- Japan

- /

- Auto Components

- /

- TSE:5970

3 Reliable Dividend Stocks Yielding Up To 4.7%

Reviewed by Simply Wall St

In a week marked by volatility due to AI competition fears and mixed corporate earnings, global markets have shown varied performances across regions. With the Federal Reserve holding rates steady amidst persistent inflation concerns, investors are increasingly turning to dividend stocks for stability and income in uncertain times. A good dividend stock offers a reliable yield and resilience against market fluctuations, making them an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.91% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

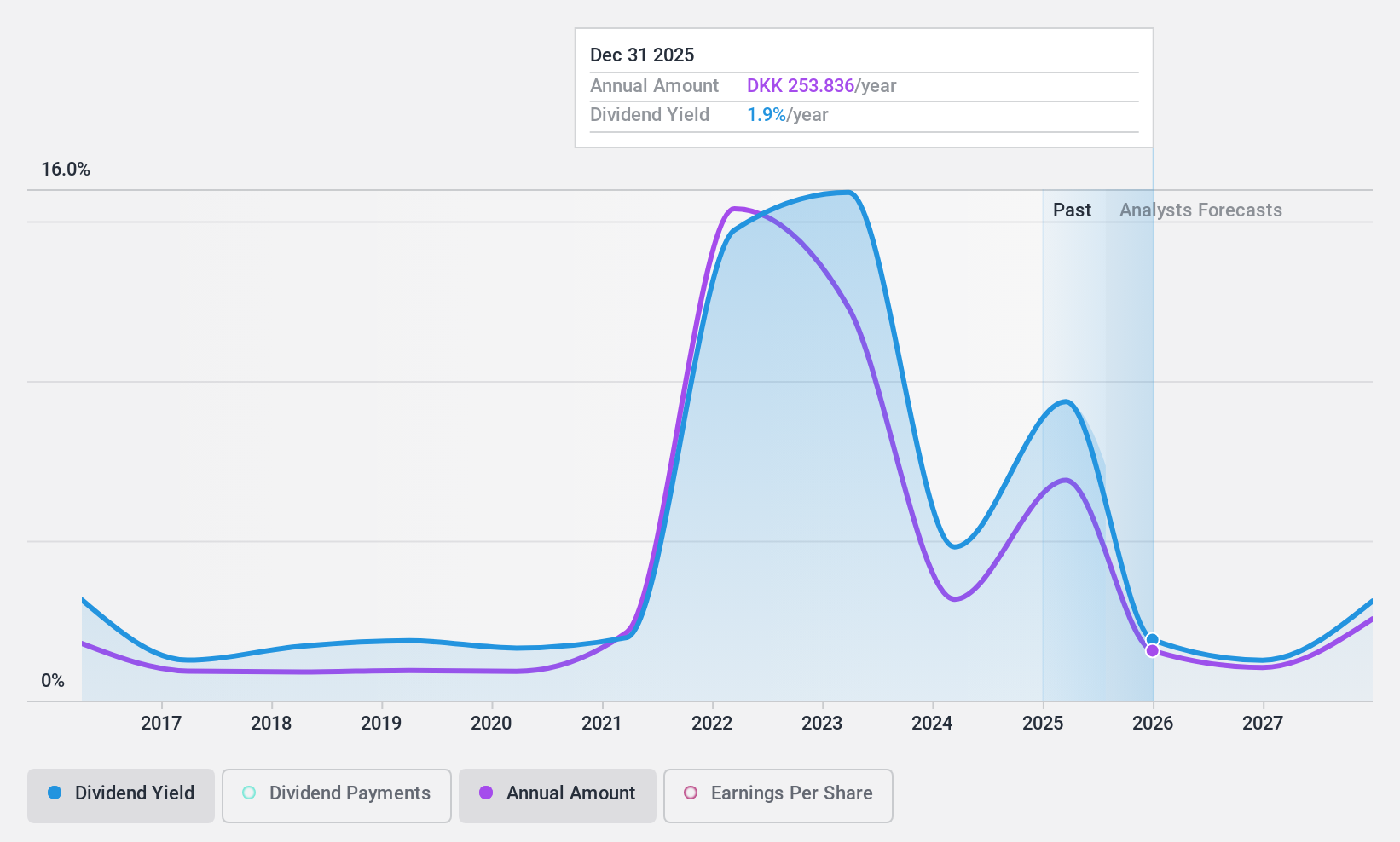

A.P. Møller - Mærsk (CPSE:MAERSK B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: A.P. Møller - Mærsk A/S, along with its subsidiaries, operates in the ocean transport and logistics sector both in Denmark and globally, with a market capitalization of DKK165.42 billion.

Operations: A.P. Møller - Mærsk's revenue is derived from its Ocean segment at $34.67 billion, Terminals at $4.29 billion, and Logistics & Services at $14.57 billion.

Dividend Yield: 4.8%

A.P. Møller - Mærsk's dividend is well-covered by earnings and cash flows, with a payout ratio of 33.9% and a cash payout ratio of 33.1%. Despite this, the dividend yield of 4.75% is lower than the top quartile in Denmark, and its track record shows volatility over the past decade. Recent earnings growth—sales at US$15.76 billion for Q3—suggests strong short-term financial health, but profit margins have decreased significantly from last year’s levels.

- Get an in-depth perspective on A.P. Møller - Mærsk's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, A.P. Møller - Mærsk's share price might be too optimistic.

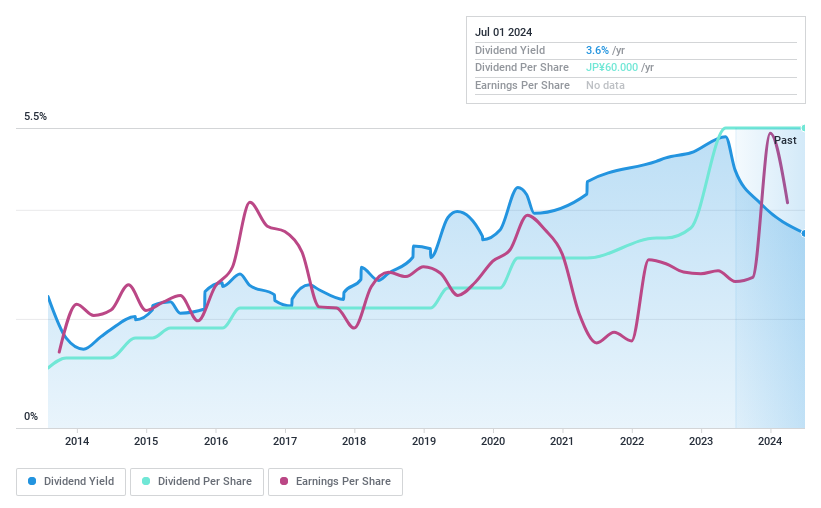

Yahagi ConstructionLtd (TSE:1870)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yahagi Construction Co., Ltd. is involved in the construction of buildings in Japan and has a market capitalization of ¥66.69 billion.

Operations: Yahagi Construction Co., Ltd. generates its revenue primarily through the construction of buildings in Japan.

Dividend Yield: 3.9%

Yahagi Construction Ltd. offers a dividend yield of 3.87%, placing it in the top 25% of Japanese dividend payers. The company has consistently increased dividends over the past decade, recently raising its quarterly payout from ¥30 to ¥40 per share. With a payout ratio of 60.4% and cash payout ratio of 50.5%, dividends are well-covered by earnings and cash flows, supported by recent earnings growth of 48.5%.

- Click to explore a detailed breakdown of our findings in Yahagi ConstructionLtd's dividend report.

- In light of our recent valuation report, it seems possible that Yahagi ConstructionLtd is trading beyond its estimated value.

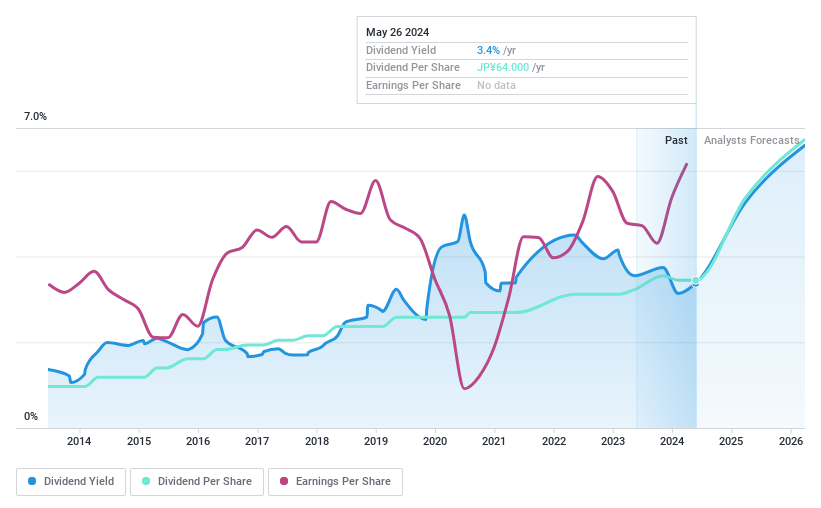

G-Tekt (TSE:5970)

Simply Wall St Dividend Rating: ★★★★★★

Overview: G-Tekt Corporation manufactures and sells auto body components and transmission parts both in Japan and internationally, with a market cap of ¥74.00 billion.

Operations: G-Tekt Corporation's revenue segments are comprised of ¥45.41 billion from Asia, ¥64.36 billion from China, ¥66.13 billion from Japan, ¥37.02 billion from Europe, ¥125.34 billion from North America, and ¥16.88 billion from South America.

Dividend Yield: 4.3%

G-Tekt's dividend yield of 4.31% is among the top 25% in Japan, with stable and growing payments over the past decade. The payout ratio of 27.7% and cash payout ratio of 58.5% indicate dividends are well-covered by earnings and cash flows. Trading below its estimated fair value, G-Tekt offers good relative value compared to peers, supported by a recent earnings growth rate of 20.7%.

- Click here and access our complete dividend analysis report to understand the dynamics of G-Tekt.

- Our comprehensive valuation report raises the possibility that G-Tekt is priced lower than what may be justified by its financials.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 1940 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5970

G-Tekt

Manufactures and sells auto body components and transmission parts in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives