Amid renewed concerns over inflated AI stock valuations and receding expectations for a U.S. interest rate cut, European markets have experienced a downturn, with major indexes such as the STOXX Europe 600 and Germany's DAX seeing notable declines. In this environment of cautious sentiment, identifying undervalued stocks can present opportunities for investors seeking value in solid fundamentals and potential for growth despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €2.988 | €5.94 | 49.7% |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €69.49 | 49.6% |

| KB Components (OM:KBC) | SEK42.30 | SEK83.54 | 49.4% |

| HMS Bergbau (XTRA:HMU) | €52.00 | €103.80 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.8% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.18 | 49.5% |

| EcoUp Oyj (HLSE:ECOUP) | €1.34 | €2.65 | 49.4% |

| cyan (XTRA:CYR) | €2.28 | €4.55 | 49.9% |

| Circle (BIT:CIRC) | €7.94 | €15.68 | 49.4% |

| Allcore (BIT:CORE) | €1.33 | €2.64 | 49.7% |

Let's explore several standout options from the results in the screener.

Cellnex Telecom (BME:CLNX)

Overview: Cellnex Telecom, S.A. operates and manages terrestrial telecommunications infrastructures across multiple European countries including Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden and Switzerland with a market cap of €17.52 billion.

Operations: Cellnex Telecom generates revenue by managing terrestrial telecommunications infrastructures across various European nations, including Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden and Switzerland.

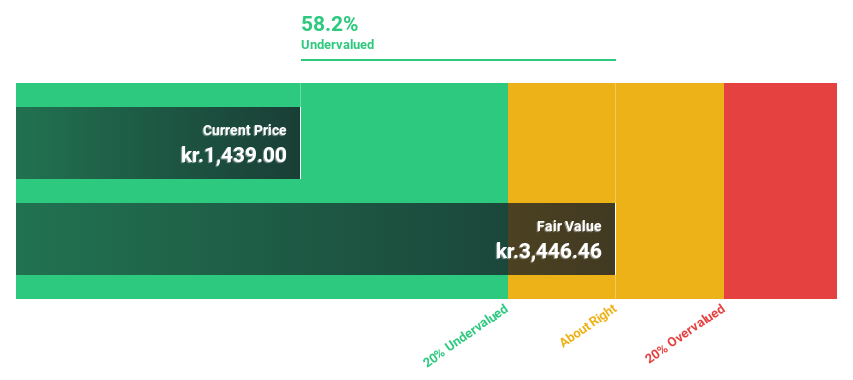

Estimated Discount To Fair Value: 33.8%

Cellnex Telecom is trading at €25.71, significantly below its estimated fair value of €38.82, reflecting a 33.8% undervaluation based on discounted cash flow analysis. Despite recent net losses of €148 million in Q3 2025, the company is forecast to achieve profitability within three years, with earnings expected to grow by over 74% annually. Revenue growth projections outpace the Spanish market slightly at 4.6%, supporting its potential as an undervalued investment opportunity based on cash flows.

- Insights from our recent growth report point to a promising forecast for Cellnex Telecom's business outlook.

- Dive into the specifics of Cellnex Telecom here with our thorough financial health report.

DSV (CPSE:DSV)

Overview: DSV A/S provides transport and logistics services across multiple regions including Europe, the Middle East, Africa, North America, South America, Asia, Australia, and the Pacific with a market cap of DKK327.72 billion.

Operations: The company's revenue segments are comprised of Road services generating DKK63.81 billion, Solutions contributing DKK35.59 billion, Air Freight bringing in DKK68.84 billion, and Sea Freight accounting for DKK59.18 billion.

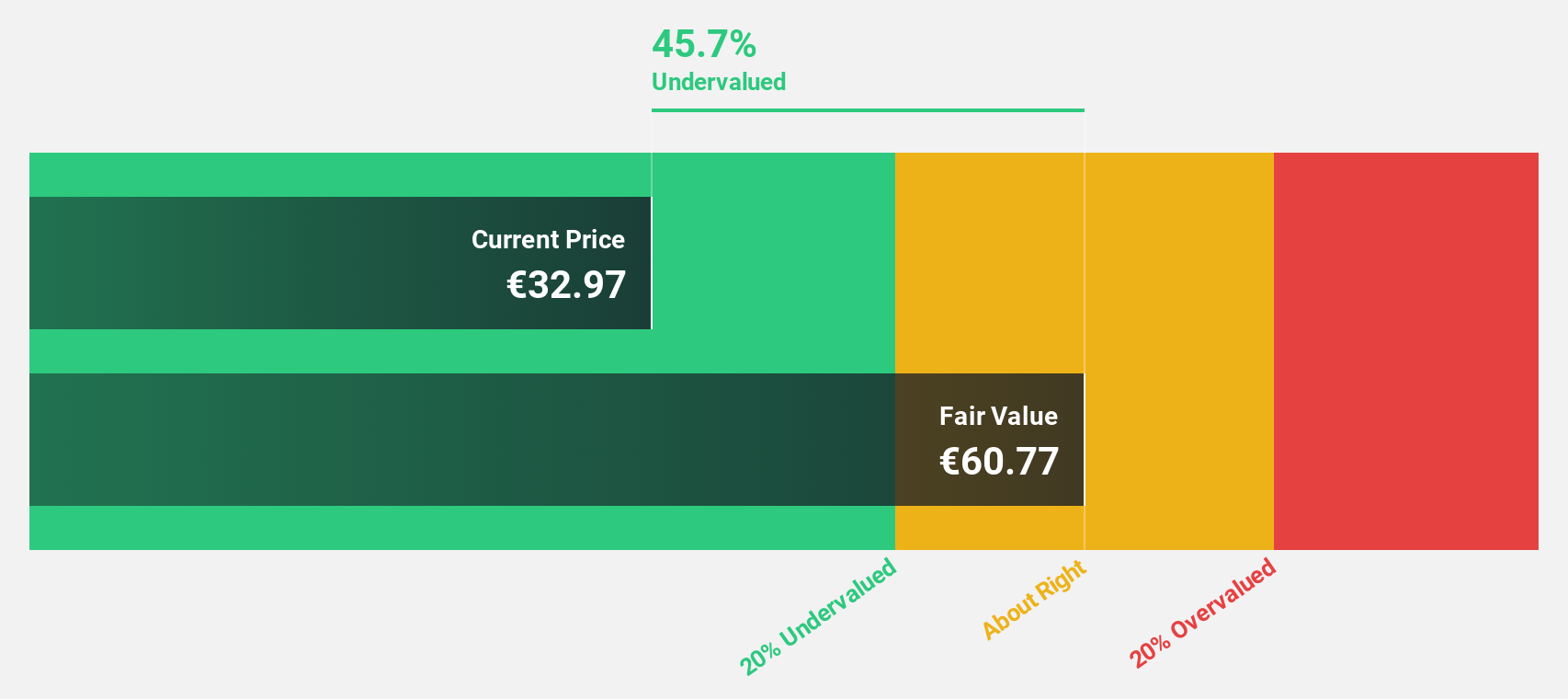

Estimated Discount To Fair Value: 45.3%

DSV is trading at DKK1388, significantly below its estimated fair value of DKK2537.42, suggesting a 45.3% undervaluation based on discounted cash flow analysis. Despite high debt levels and recent profit margin declines from 6.7% to 4.3%, earnings are expected to grow significantly over the next three years at 24.3% annually, outpacing the Danish market's growth rate of 5%. Recent strategic expansions in Virginia enhance its logistics capabilities and market reach in key U.S. regions.

- According our earnings growth report, there's an indication that DSV might be ready to expand.

- Navigate through the intricacies of DSV with our comprehensive financial health report here.

Sonova Holding (SWX:SOON)

Overview: Sonova Holding AG is a global provider of hearing care solutions for both children and adults, with operations across various regions including Switzerland, the United States, and others, and has a market cap of CHF11.83 billion.

Operations: The company's revenue is primarily derived from its Hearing Instruments segment, which generated CHF3.57 billion, and its Cochlear Implants segment, contributing CHF290.80 million.

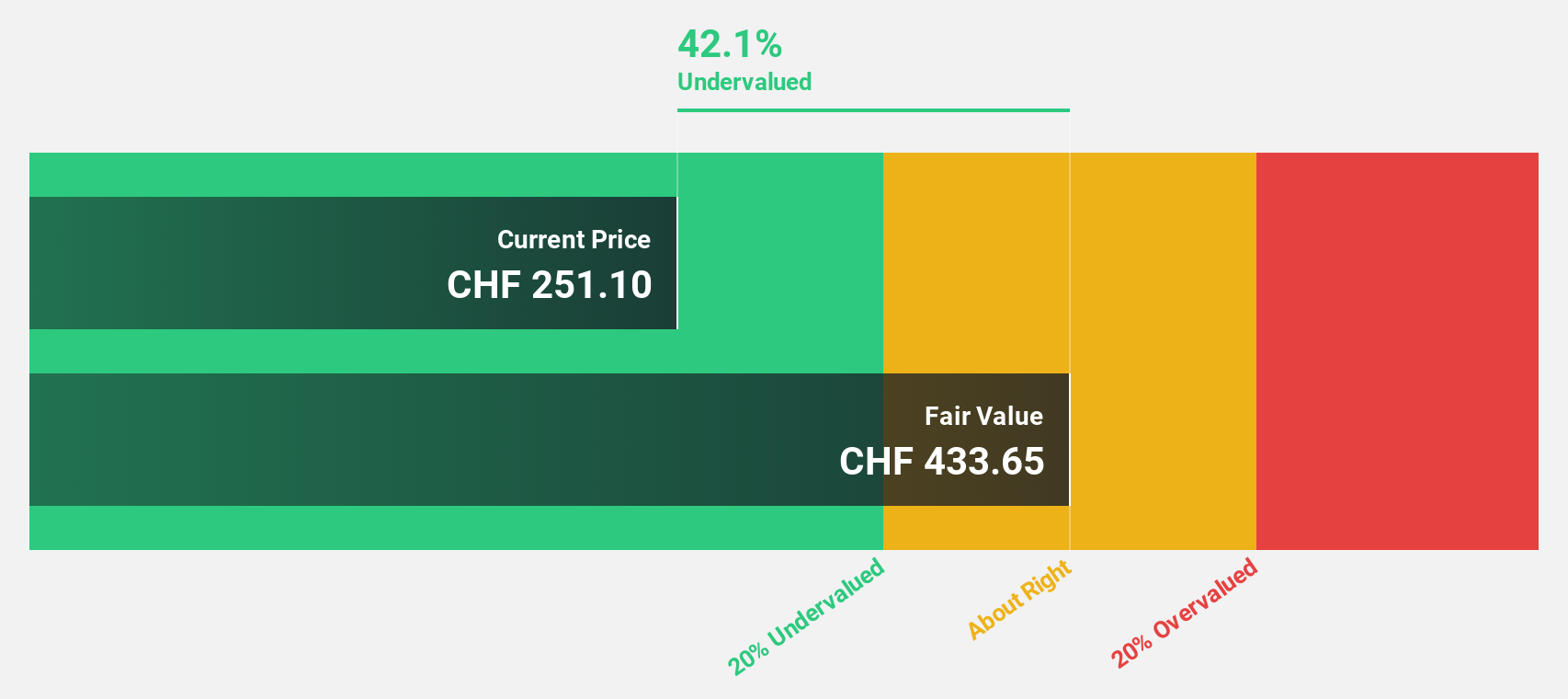

Estimated Discount To Fair Value: 46.9%

Sonova Holding is trading at CHF198.5, well below its estimated fair value of CHF374.06, indicating it is undervalued based on discounted cash flow analysis. The company's earnings are projected to grow at 11.4% annually, surpassing the Swiss market's rate of 10.4%. However, recent financial results show a decline in net income from CHF208.6 million to CHF188.5 million year-over-year, reflecting potential challenges despite robust future growth expectations and strategic organizational restructuring initiatives underway.

- Our growth report here indicates Sonova Holding may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Sonova Holding.

Key Takeaways

- Access the full spectrum of 200 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DSV

DSV

Offers transport and logistics services in Europe, the Middle East, Africa, North America, South America, Asia, Australia, and the Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success