As we enter January 2025, global markets have shown mixed performance, with the S&P 500 and Nasdaq Composite closing out a strong year despite recent fluctuations. Economic indicators such as the Chicago PMI and revised GDP forecasts highlight ongoing challenges for small-cap companies, but positive trends in jobless claims provide some optimism. In this environment, identifying high-growth tech stocks requires focusing on companies with robust innovation capabilities and adaptability to navigate economic uncertainties effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1253 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Zealand Pharma (CPSE:ZEAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zealand Pharma A/S is a biotechnology company focused on the discovery, development, and commercialization of peptide-based medicines in Denmark, with a market capitalization of DKK50.87 billion.

Operations: Zealand Pharma generates revenue primarily from its biotechnology segment, amounting to DKK76.87 million. The company focuses on peptide-based medicines, with operations centered in Denmark.

Despite facing challenges such as a recent FDA request for additional trials, Zealand Pharma continues to innovate in the biotech sector, focusing on treatments for rare diseases like short bowel syndrome. This focus is evidenced by their ambitious R&D efforts, which are crucial given their strategy to overcome regulatory hurdles and achieve market penetration. The company's inclusion in the OMX Nordic 40 Index underscores its potential and growing recognition in the industry. With revenue projected to grow at 38.4% annually, surpassing Denmark's average of 9.9%, and an anticipated shift towards profitability within three years, Zealand Pharma is navigating its path through complex regulatory environments while preparing for future growth opportunities in global markets.

Macbee Planet (TSE:7095)

Simply Wall St Growth Rating: ★★★★★☆

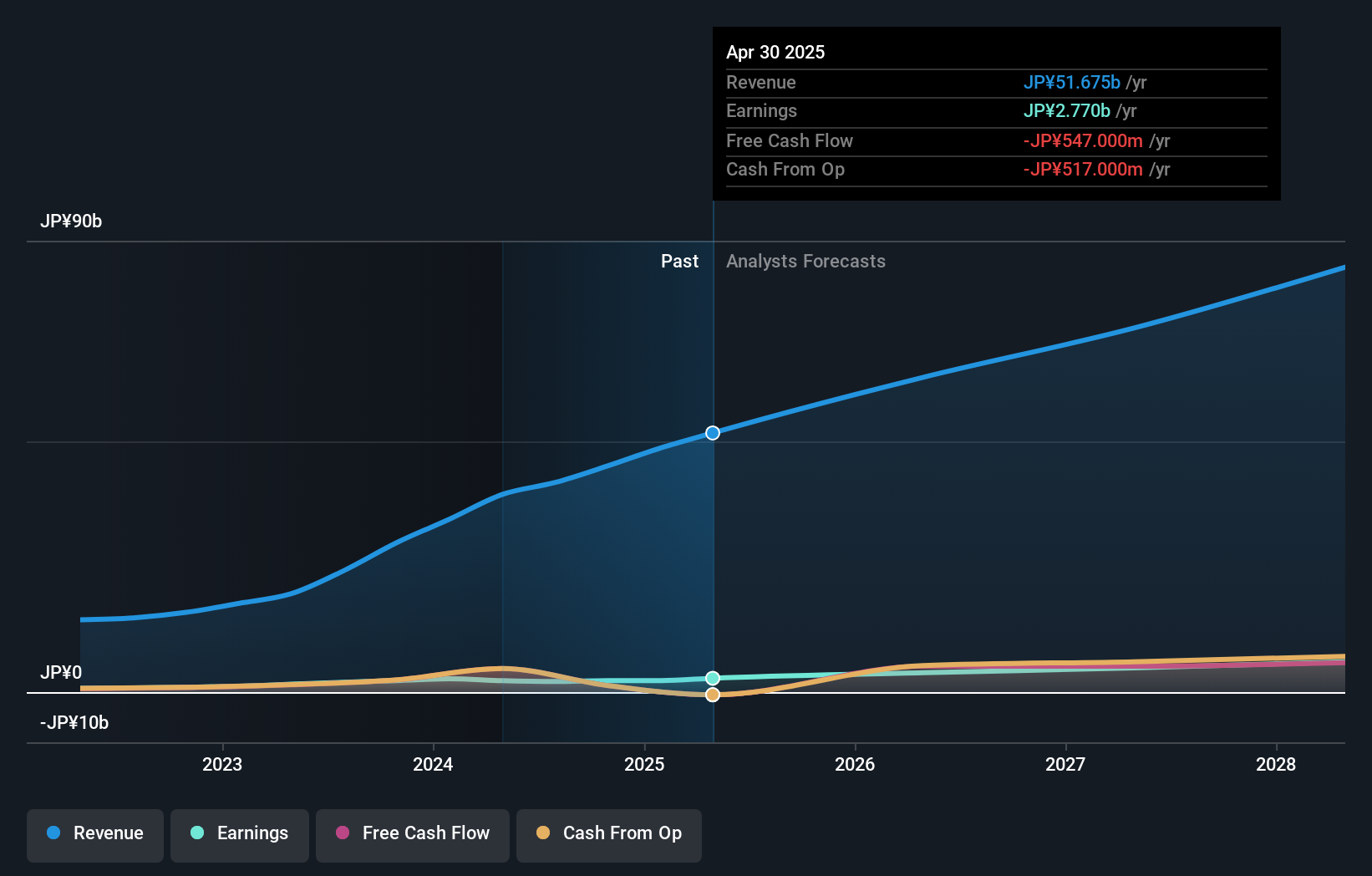

Overview: Macbee Planet, Inc. is a Japanese company specializing in analytics consulting and marketing technology, with a market capitalization of ¥41.84 billion.

Operations: Macbee Planet focuses on analytics consulting and marketing technology services within Japan. The company generates revenue through its specialized services in these sectors, contributing to its market presence.

Macbee Planet, despite its recent dividend increase to JPY 18 per share effective January 14, 2025, and a significant share buyback program completing the repurchase of shares for ¥1.62 billion, faces challenges in maintaining competitive growth rates. The company's earnings have grown by 40.3% annually over the past five years, yet recent performance shows a profit margin contraction from last year’s 7.7% to this year’s 5.1%. With an anticipated annual earnings growth of 20.9%, Macbee is striving to outpace the Japanese market's average of just under 8%. This aggressive financial strategy coupled with its R&D focus positions it for potential future gains amidst a highly volatile share price landscape.

- Navigate through the intricacies of Macbee Planet with our comprehensive health report here.

Gain insights into Macbee Planet's past trends and performance with our Past report.

General Interface Solution (GIS) Holding (TWSE:6456)

Simply Wall St Growth Rating: ★★★★☆☆

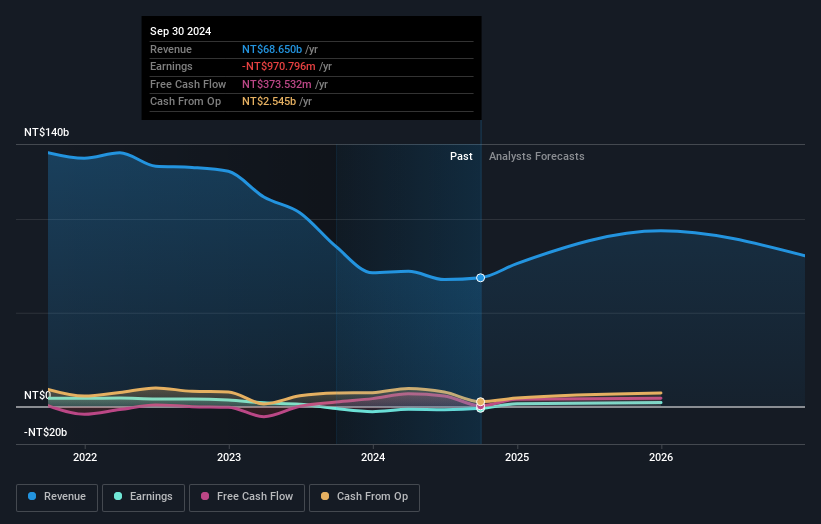

Overview: General Interface Solution (GIS) Holding Limited offers touch and display module solutions across various international markets, with a market cap of NT$18.42 billion.

Operations: GIS Holding Limited generates revenue primarily from the lamination process of various touch panels, amounting to NT$68.65 billion.

General Interface Solution (GIS) Holding has demonstrated a significant turnaround, reducing its net loss from TWD 806.54 million in the previous year to TWD 55.41 million this quarter. This improvement is mirrored in their earnings per share, which improved from a loss of TWD 2.39 to just TWD 0.17 over the same period, indicating a robust recovery strategy and operational adjustments. Despite a slight dip in nine-month sales from TWD 52.42 billion last year to TWD 49.73 billion this year, GIS's strategic focus on enhancing operational efficiencies and cost management could position it favorably for future profitability as forecasted earnings growth soars at an annual rate of approximately 128%. These figures suggest that GIS is navigating its challenges by prioritizing financial stability and growth amidst competitive pressures.

Next Steps

- Discover the full array of 1253 High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zealand Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ZEAL

Zealand Pharma

A biotechnology company, engages in the discovery, development, and commercialization of peptide-based medicines in Denmark.

High growth potential with adequate balance sheet.