Is There Now an Opportunity in Novo Nordisk After the 44% Drop in 2025?

Reviewed by Bailey Pemberton

If you’ve been watching Novo Nordisk stock and wondering whether it’s time to buy, sell, or simply hold steady, you’re definitely not alone. Over the past year, shares have tumbled by more than 50%, with a 44.4% decline so far this year alone. Even so, those longer-term investors who got in five years ago are still sitting on impressive gains of nearly 80%. That sharp reversal of fortune understandably has many folks scratching their heads and asking what’s driving the story right now, and is this a compelling entry point?

The recent slide in Novo Nordisk’s share price comes amid shifting investor sentiment. While some see risk in the company’s heavy research and development spending, others are focused on Novo’s ambitious push into new therapies for diabetes and obesity. There has also been a steady drumbeat of positive headlines about drug approvals and partnerships, which suggest that skies may clear for growth-minded investors.

Given all the characters in play, it’s no surprise that conversations about valuation have taken center stage. According to our quantitative checks, Novo Nordisk earns a valuation score of 5 out of 6, signaling the stock is potentially undervalued in most major categories. That’s a solid showing, but understanding the real story takes a bit more nuance than numbers alone can provide. Let’s walk through how the company stacks up using standard valuation measures, before I share the one perspective I think matters most for long-term investors.

Why Novo Nordisk is lagging behind its peers

Approach 1: Novo Nordisk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation approach that estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to their present value using appropriate rates. This method is widely regarded as a cornerstone for evaluating whether a stock is trading above or below its true worth.

For Novo Nordisk, the latest twelve months' Free Cash Flow stands at DKK 68.4 billion. According to analyst projections, this cash flow is expected to grow significantly over the next decade, reaching approximately DKK 136 billion by 2029. While analysts typically provide five years of guidance, further estimates beyond that are extrapolated to provide a broader picture of the company’s long-term earning potential.

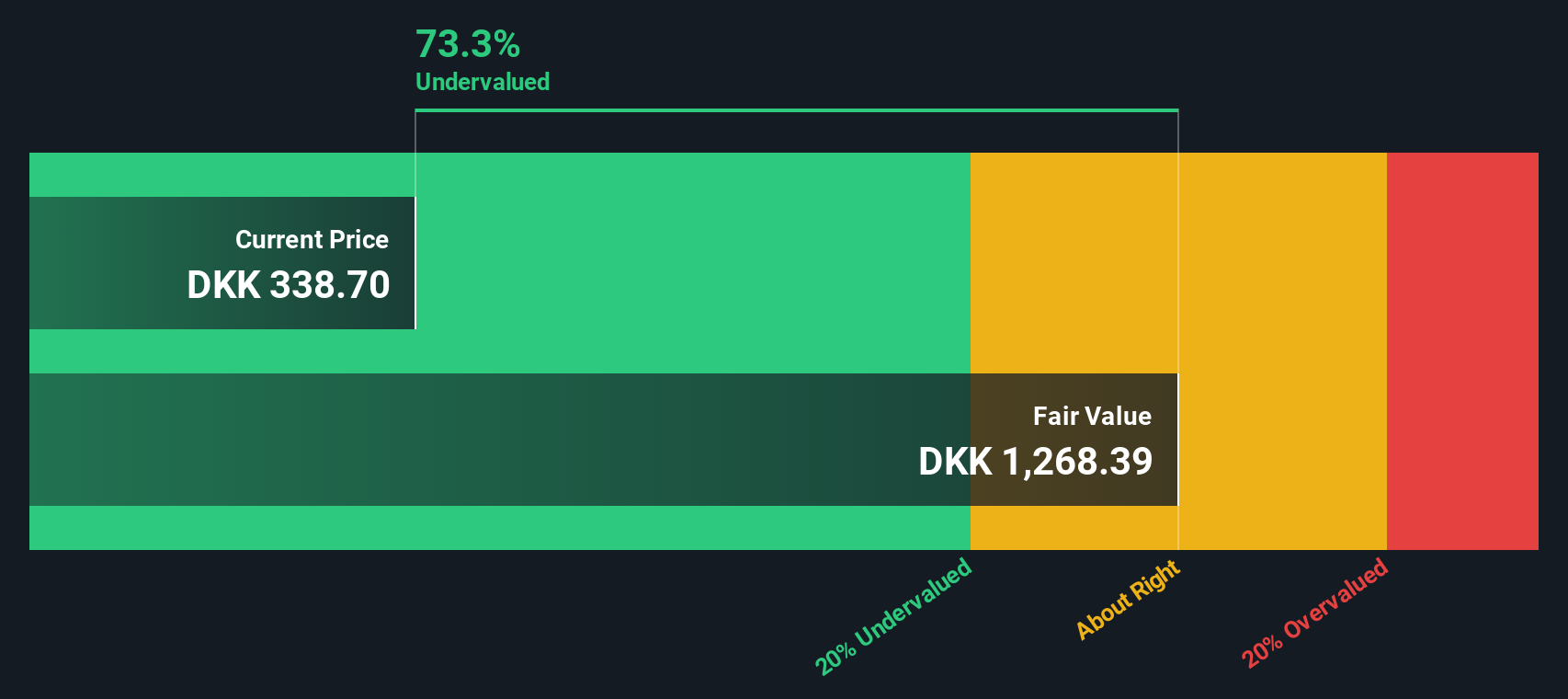

Applying the 2 Stage Free Cash Flow to Equity model and discounting all future flows, the DCF analysis estimates Novo Nordisk's value at DKK 1,125.58 per share. This figure implies the stock is currently trading at a 68.5% discount to its intrinsic value. This may indicate the market is undervaluing Novo's growth prospects and cash-generating abilities.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novo Nordisk is undervalued by 68.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Novo Nordisk Price vs Earnings (PE)

For profitable companies like Novo Nordisk, the Price-to-Earnings (PE) ratio is a widely used and meaningful valuation metric. This ratio tells us how much the market is willing to pay for each Danish krone of the company’s earnings. It provides a quick gauge of whether a stock appears expensive or cheap relative to its profits.

The “right” PE ratio for a business often depends on factors such as growth prospects and risk. Companies with strong expected earnings growth or lower risk profiles tend to trade at higher PE multiples, since investors are willing to pay a premium for future profitability and stability. Slower growth or higher risk typically results in a lower, more modest PE ratio being justified.

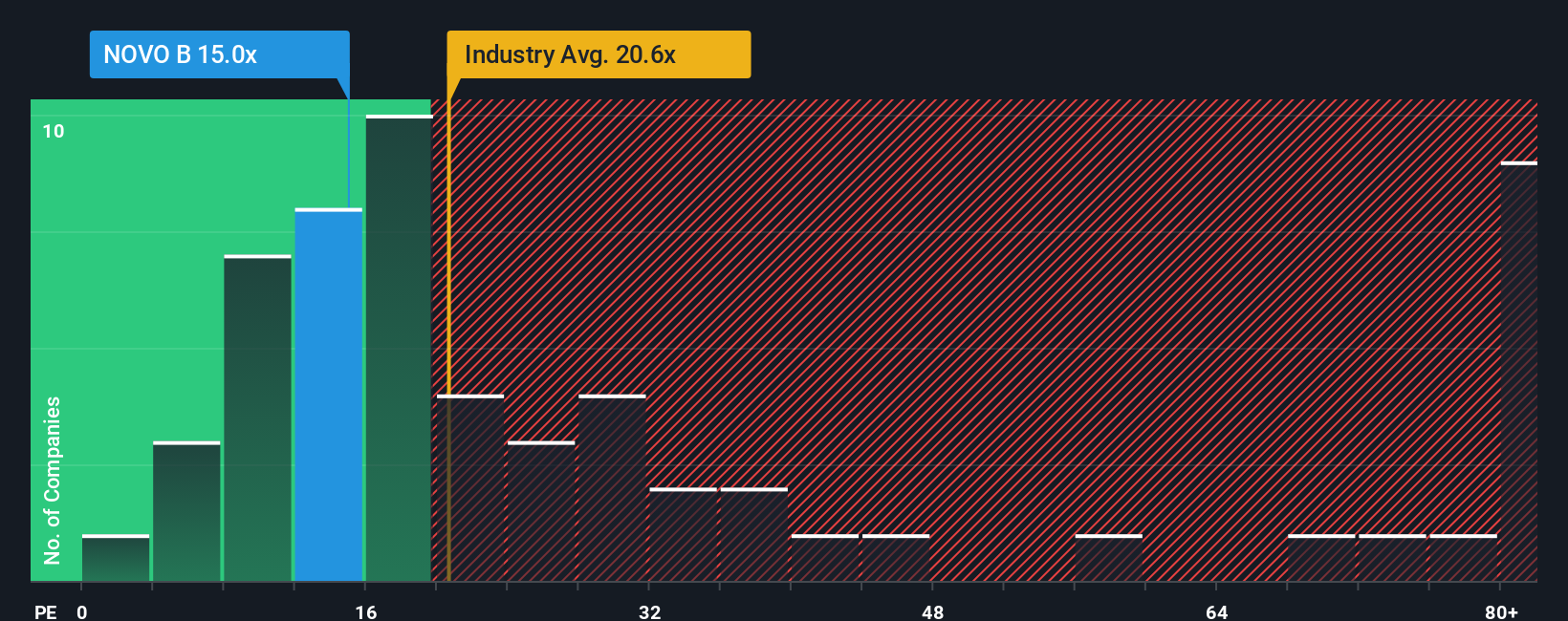

Currently, Novo Nordisk has a PE ratio of 14.2x. This is well below both the Pharmaceutical industry average of 24.7x and the average of its direct peers at 27.5x. At first glance, that makes Novo Nordisk appear attractively valued based on earnings alone.

However, Simply Wall St’s proprietary “Fair Ratio” estimates that, accounting for Novo’s unique growth outlook, risk profile, profit margins, industry position, and market capitalization, a PE of 28.3x is appropriate. This Fair Ratio is considered more reliable than a simple comparison with peers or the overall industry because it reflects the company’s specific characteristics rather than broad averages that may overlook important details.

With Novo Nordisk’s actual PE (14.2x) falling significantly below its Fair Ratio (28.3x), the numbers indicate that the stock is undervalued by the market when considering its true potential and strengths.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novo Nordisk Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company, connecting the numbers (like fair value, revenue growth, or profit margins) to your unique perspective about Novo Nordisk’s future and its role in the world.

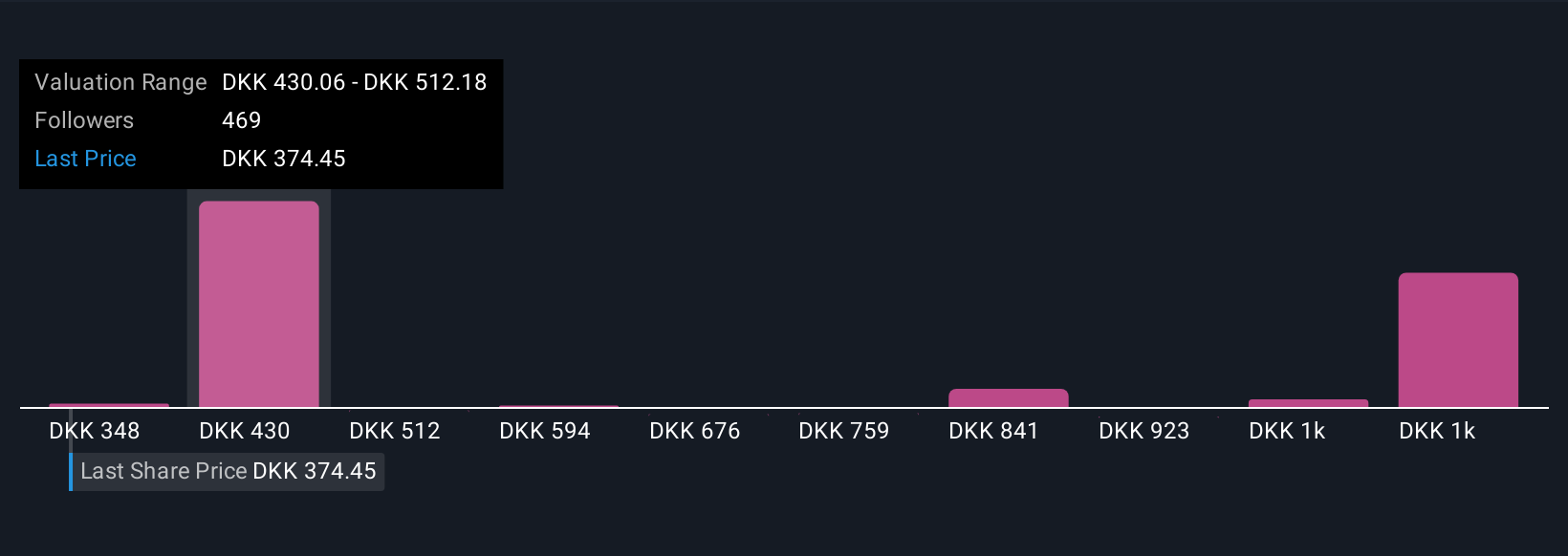

Instead of just relying on standard models, Narratives let you combine your outlook and assumptions with financial forecasts to produce a fair value tailored for you. On Simply Wall St’s Community page, millions of investors use Narratives to clarify their thinking and see how their views compare to others, all with just a few clicks.

Narratives empower you to confidently decide when to buy or sell by clearly showing the gap between what you think Novo Nordisk is worth and its current market price. Best of all, your Narrative updates automatically when new information such as company news or fresh earnings comes in, so your fair value stays relevant and up to date.

For example, some investors see Novo Nordisk’s fair value as high as DKK 1,036 per share based on bullish outlooks for obesity drugs and profit margins, while others are more cautious, estimating a fair value near DKK 444 if future growth underwhelms, making it easy to spot where your own story fits in.

Do you think there's more to the story for Novo Nordisk? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives