Could Novo Nordisk’s (CPSE:NOVO B) Rare Disease Bet Shift Its Portfolio Beyond Diabetes?

Reviewed by Sasha Jovanovic

- Omeros Corporation recently announced a definitive asset purchase and license agreement granting Novo Nordisk exclusive global rights to develop and commercialize zaltenibart, an experimental antibody targeting rare blood and kidney disorders, in exchange for US$340 million upfront and potential total payments of up to US$2.1 billion plus tiered royalties.

- This deal marks Novo Nordisk's significant move to diversify its portfolio beyond diabetes and obesity by investing in promising therapies for rare diseases.

- We will assess how Novo Nordisk’s acquisition of zaltenibart shifts its investment narrative and focus on rare disease innovation.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Novo Nordisk Investment Narrative Recap

For Novo Nordisk shareholders, the big picture centers on widespread adoption of GLP-1 therapies for diabetes and obesity, which underpins long-term growth despite current volume and pricing headwinds. The Omeros deal for zaltenibart may help diversify Novo Nordisk's portfolio but does not immediately affect the key near-term catalyst, U.S. pricing dynamics for Wegovy and Ozempic, nor does it materially reduce the main risk of shrinking net margins due to price erosion and generic threats.

Among recent announcements, the September 18 results from the REACH real-world study, showing Ozempic’s 23% reduction in major cardiovascular events, are particularly relevant. These reinforce the clinical strength of Novo Nordisk’s core products and could support further label expansions, directly impacting the volume growth catalyst that remains crucial for offsetting external pressures on pricing and market share.

Yet, on the flip side, investors should not lose sight of ongoing risks regarding brand erosion and price compression if...

Read the full narrative on Novo Nordisk (it's free!)

Novo Nordisk's narrative projects DKK396.7 billion revenue and DKK142.5 billion earnings by 2028. This requires 8.3% yearly revenue growth and a DKK31.4 billion earnings increase from DKK111.1 billion.

Uncover how Novo Nordisk's forecasts yield a DKK444.05 fair value, a 30% upside to its current price.

Exploring Other Perspectives

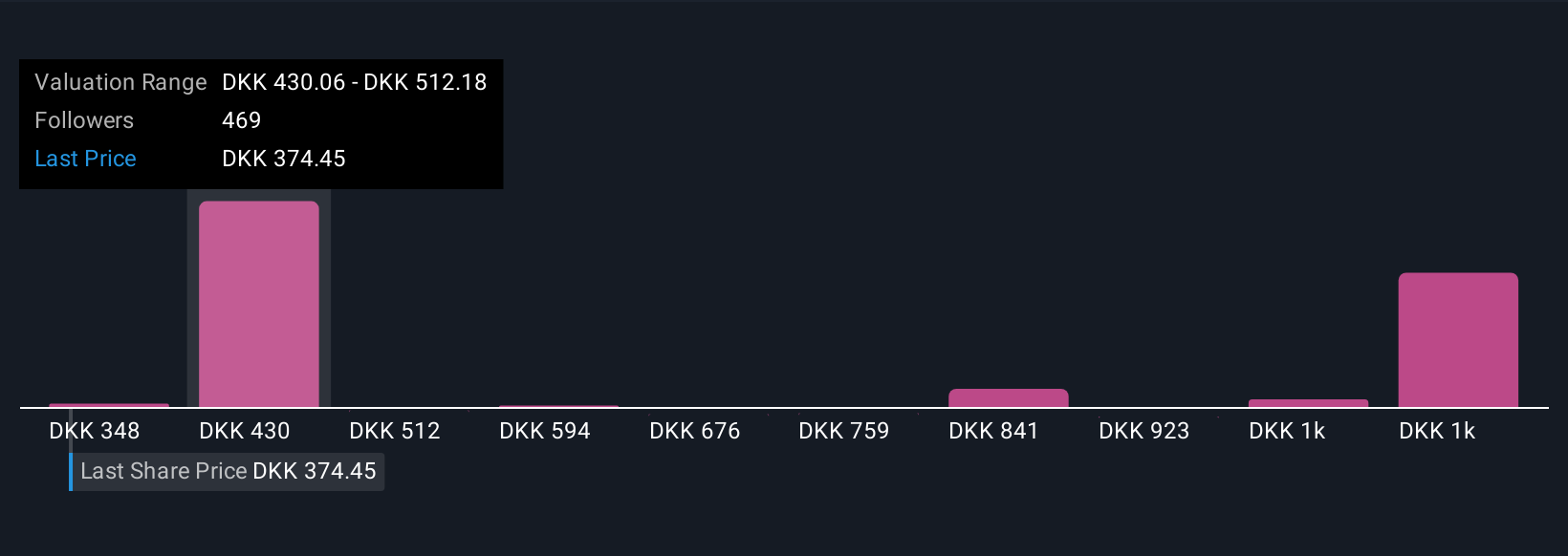

Simply Wall St Community members contributed 130 fair value estimates for Novo Nordisk, spanning DKK340 to DKK1,133, showing wide-ranging views on potential outcomes. Competing assessments highlight just how much ongoing pricing and margin risks can shape the outlook for Novo Nordisk’s future performance.

Explore 130 other fair value estimates on Novo Nordisk - why the stock might be worth just DKK340.00!

Build Your Own Novo Nordisk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novo Nordisk research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Novo Nordisk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novo Nordisk's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives