Is Genmab Still an Opportunity After 22% Surge and Antibody Pipeline Progress in 2025?

Reviewed by Bailey Pemberton

If you’re considering what your next move should be with Genmab stock, you’re not alone. The company has grabbed a lot of attention this year, and for good reason. After a period of underperformance, Genmab’s share price has not just rebounded but surged, climbing 9.3% over the last week and 22.6% in the past month. Year to date, holders are looking at a gain of 32.3%, while over the last twelve months, it has achieved a solid 27.6% return.

That recent momentum stands in stark contrast to the longer trend. Over three years, Genmab is still down 26.9%, and it has lost 13.8% across five years. But the market seems to be waking up to Genmab’s story again. Investors seem to be reassessing risk as positive market developments breathe new life into biotech, and Genmab’s progress in antibody therapeutics and strategic partnerships is coming into sharper focus. The result is renewed optimism and the kind of price action that has both long-term holders and newcomers rethinking their approach.

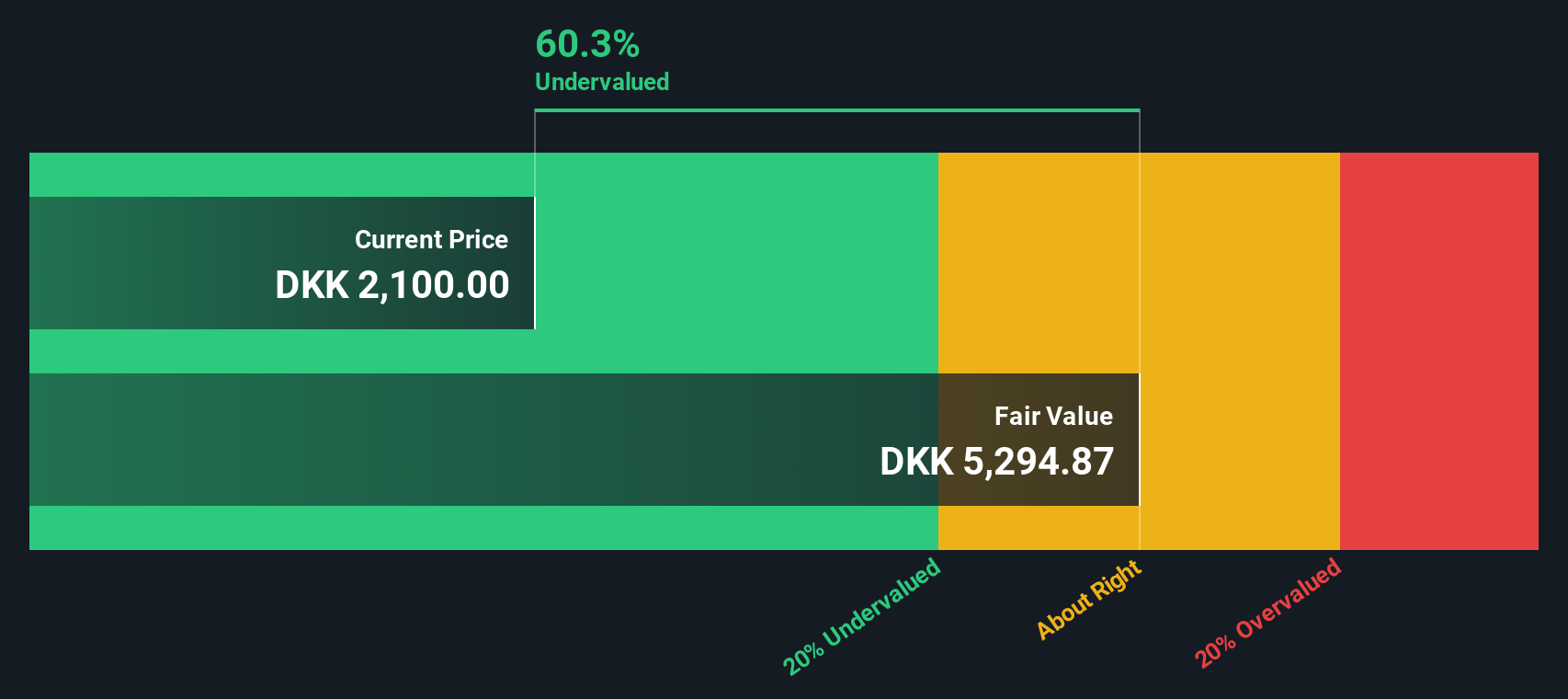

So, the big question: does Genmab still offer value, or has this surge left the stock looking expensive? According to our latest metric, Genmab scores 5 out of 6 on the undervaluation checklist. That is strong by almost any measure.

In the next section, we will break down the key approaches to valuing Genmab and see how each one stacks up in today’s environment. If you stick with us until the end, we will also reveal an even more insightful lens for understanding what Genmab’s true value could be.

Approach 1: Genmab Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those amounts back to today's dollars. This approach helps investors answer a straightforward question: given Genmab's expected growth, is the current share price justified?

Genmab's most recent Free Cash Flow (FCF) stands at $1.06 Billion, which represents the cash generated by the business after expenses, interest, and taxes. According to analyst estimates, FCF is expected to climb steadily over the next five years, reaching close to $2.05 Billion by the end of 2029. For years beyond the analyst horizon, further projections are calculated using established financial models to extend the forecast another five years, though these should be viewed as indicative rather than precise.

Based on these projections, the DCF model returns an intrinsic value of $4,544 per share. This implies that Genmab shares are currently trading at a 55.4% discount compared to their fair value, which suggests that the stock is deeply undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Genmab is undervalued by 55.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Genmab Price vs Earnings (P/E Ratio)

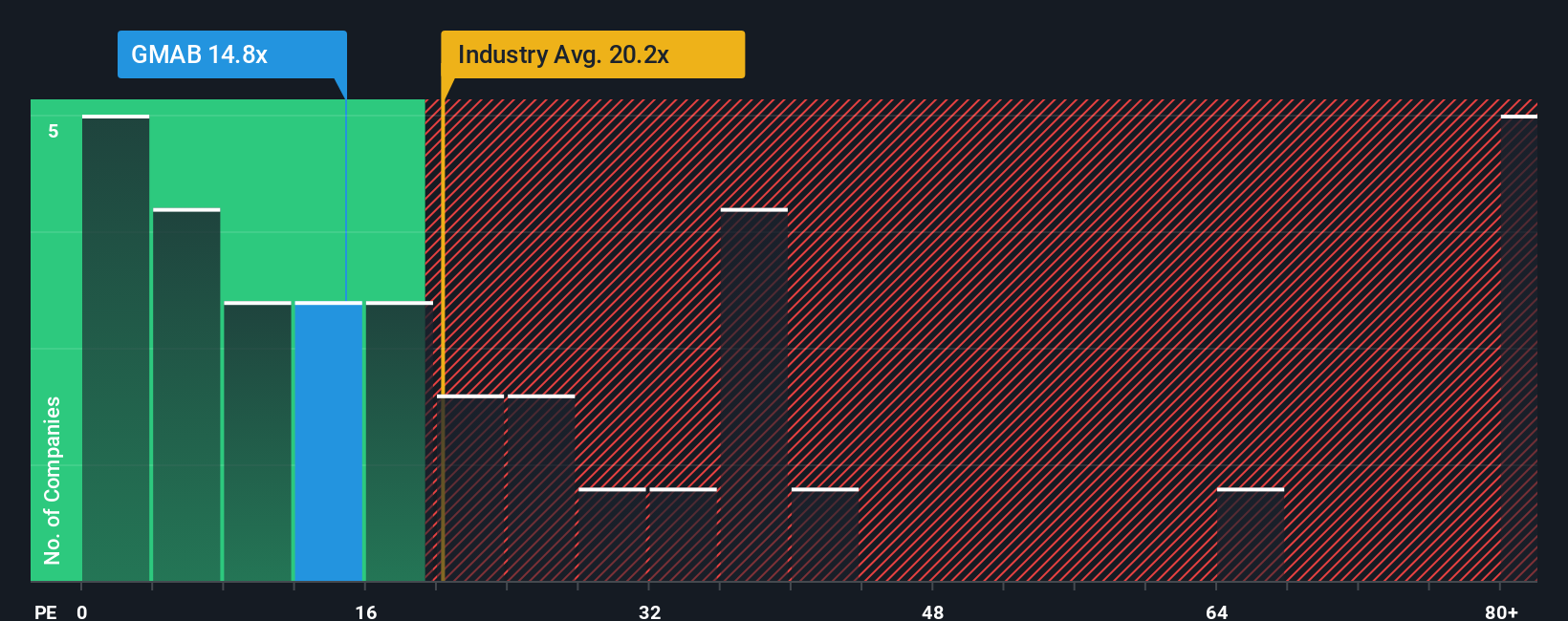

For profitable companies like Genmab, the Price-to-Earnings (P/E) ratio is often the go-to valuation metric. It tells investors how much they are paying today for each unit of earnings the company generates. The P/E is widely used because it quickly shows if the market is optimistic or skeptical about a firm's future growth prospects.

Not all P/E ratios are created equal. Faster-growing companies usually command higher P/E ratios, while additional risk, economic uncertainty, or lower expected growth typically lead to lower "normal" or "fair" P/E multiples. Evaluating a P/E in context helps determine if the market's optimism or caution is warranted for a particular stock.

Genmab currently trades at 14.3x earnings. This is noticeably lower than both the biotech industry average of 29.4x and the listed peer group average of 19.1x. However, to get a more accurate picture, it is worth considering Simply Wall St’s "Fair Ratio," which factors in unique elements such as Genmab’s earnings growth outlook, its profit margin, risk profile, industry, and market cap. Genmab’s Fair Ratio comes in at 18.5x, reflecting what would be a justified valuation given these conditions. Unlike a straight comparison with sector averages or competitors, the Fair Ratio provides a tailored benchmark specific to Genmab’s situation.

With Genmab’s current P/E sitting moderately below its Fair Ratio, the stock appears undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Genmab Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a new, more powerful way to make investment decisions because they connect your personal story and expectations for a company (like your assumptions for Genmab’s future revenue growth, earnings, and margins) directly to a fair value and financial forecast. In simple terms, a Narrative lets you clearly spell out what you believe will drive Genmab’s future and see how those beliefs translate into a potential price.

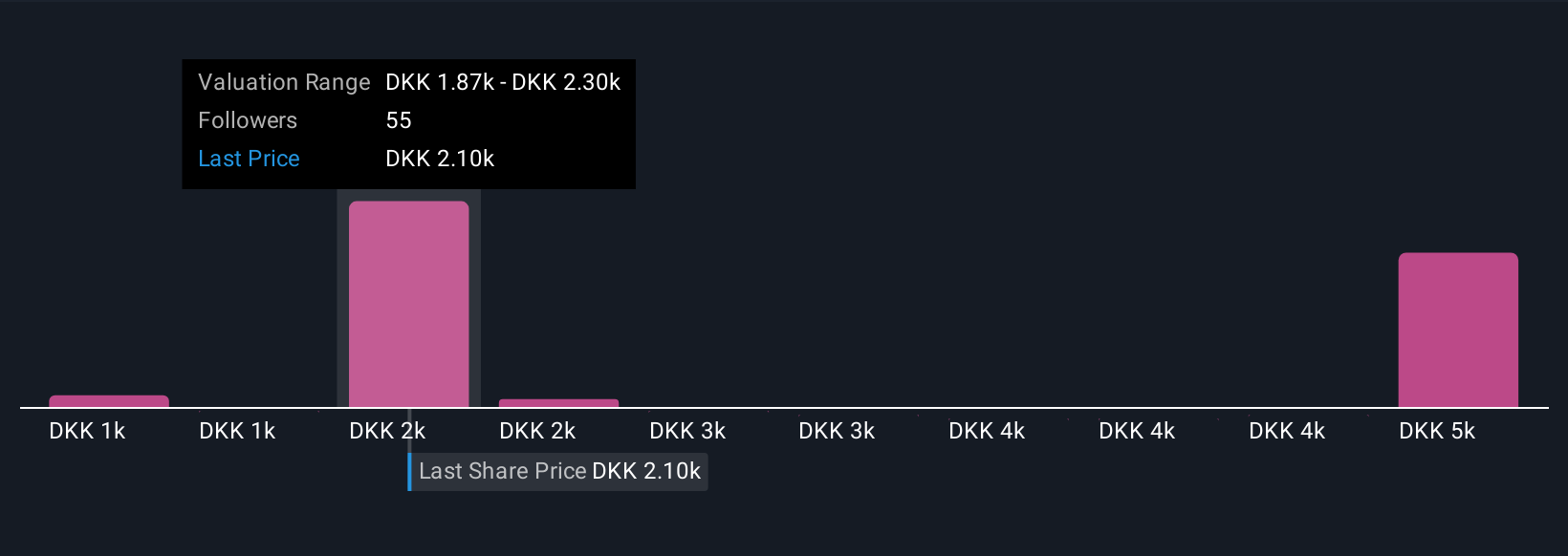

Narratives on Simply Wall St’s Community page make this process easy and accessible. They are dynamic and automatically update whenever new news or earnings are released, keeping your view of fair value current. Narratives empower you to explore a range of perspectives. For example, some investors currently see Genmab as worth as much as DKK2,650 per share given pipeline success and international expansion, while others are more cautious and peg fair value closer to DKK1,000, emphasizing competition and pricing pressures. By comparing your Narrative’s fair value with the current price, you will have a clearer signal on when to buy or sell, making your investment decision-making process truly smarter and more personal.

Do you think there's more to the story for Genmab? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GMAB

Genmab

A biotechnology company, develops antibody-based products and product candidates for the treatment of cancer and other diseases in Denmark.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives