As global markets navigate a mixed start to the new year, with U.S. stocks closing out a strong 2024 despite recent economic data challenges such as the Chicago PMI contraction and revised GDP forecasts, investors are keeping a close eye on high growth tech stocks that could benefit from these shifting dynamics. In this environment, identifying promising tech companies often involves looking for those with robust innovation capabilities and adaptability to market changes, which can potentially offer resilience in fluctuating conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

cBrain (CPSE:CBRAIN)

Simply Wall St Growth Rating: ★★★★★★

Overview: cBrain A/S is a software company that delivers solutions for government, private, education, and non-profit sectors both within Denmark and internationally, with a market cap of DKK3.68 billion.

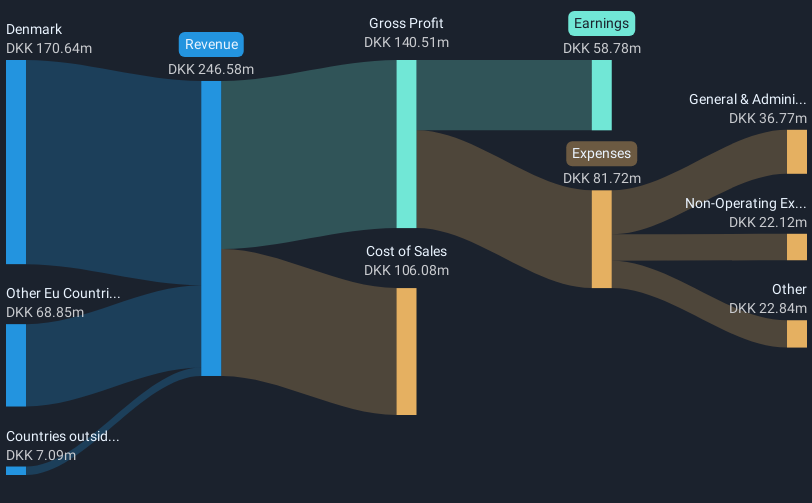

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to DKK246.58 million.

cBrain, a player in the tech sector, has demonstrated robust growth with an annual revenue increase of 26.2% and earnings expected to surge by 36.4% per year. This performance outstrips the broader Danish market's growth rates significantly, indicating a strong competitive edge. Recent corporate guidance confirms this trajectory, projecting a revenue uptick of 10%-15% for 2024 and an EBT increase of 24%-30%. At a recent conference, CFO Ejvind Jørgensen emphasized these points, underscoring cBrain's commitment to innovation and market expansion. The company's focus on R&D is evident from its strategic allocations that enhance product offerings and drive technological advancements—key factors in sustaining its rapid growth pace in the bustling software industry landscape.

- Click to explore a detailed breakdown of our findings in cBrain's health report.

Gain insights into cBrain's past trends and performance with our Past report.

Genmab (CPSE:GMAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genmab A/S is a Danish company specializing in the development of antibody therapeutics for cancer and other diseases, with a market capitalization of DKK99.67 billion.

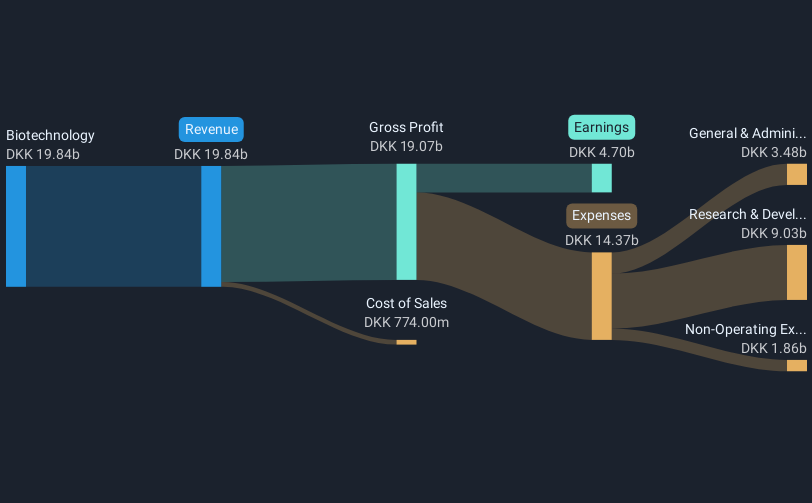

Operations: Genmab A/S generates revenue primarily from its biotechnology segment, amounting to DKK19.84 billion. The company's focus is on developing antibody therapeutics for cancer and other diseases.

Genmab A/S has recently demonstrated significant advancements in the biotech sector, particularly with its epcoritamab treatments showing promising results. In recent trials, epcoritamab combined with R-CHOP achieved a 100% overall response rate and an 87% complete response rate in high-risk DLBCL patients, with a notable 83% remaining in remission after two years. These outcomes not only underscore Genmab's innovative edge but also highlight its potential to set new standards in lymphoma treatment. Financially, the company's revenue is expected to grow by 13.7% annually, outpacing the Danish market's growth of 10.2%, while earnings are projected to increase by a robust 21.8% per year. This financial trajectory coupled with groundbreaking clinical results positions Genmab as a formidable force in transforming patient outcomes and driving sector growth.

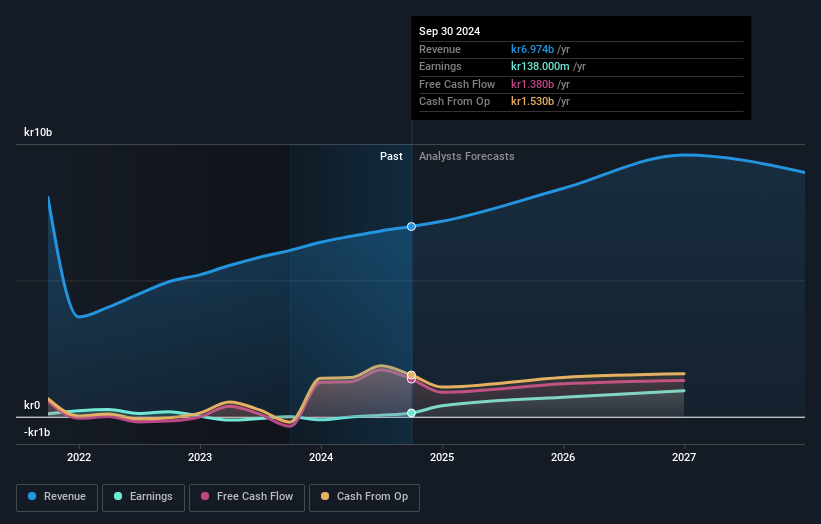

Crayon Group Holding (OB:CRAYN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Crayon Group Holding ASA, along with its subsidiaries, functions as an IT consultancy company and has a market capitalization of NOK11.42 billion.

Operations: Crayon Group Holding ASA generates revenue primarily through its Services and Software & Cloud segments, with Consulting contributing NOK 2.81 billion and Software & Cloud Direct adding NOK 2.26 billion. The company also earns from the Software & Cloud Economics and Channel segments, which contribute NOK 1.02 billion and NOK 1.16 billion, respectively.

Crayon Group Holding ASA has recently seen a notable transformation, becoming profitable this year with an earnings forecast growth of 61.4% annually, significantly outpacing the Norwegian market's average of 8.9%. This leap is underscored by its strategic merger with SoftwareOne, aiming to create a major player in the European software market with a transaction valued at NOK 11.6 billion, reflecting a premium of 36% over Crayon's undisturbed share price. Additionally, Crayon's role as an AWS Authorized Distributor across multiple European regions not only diversifies its revenue streams but also enhances its service capabilities in cloud solutions, positioning it well for sustained growth and innovation in the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Crayon Group Holding.

Evaluate Crayon Group Holding's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Investigate our full lineup of 1266 High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade cBrain, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if cBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CBRAIN

cBrain

A software company, provides software solutions for government, private, education, and non-profit sectors in Denmark, rest of the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives