Genmab’s Valuation in Focus After Recent Pipeline Collaboration and Price Swings

Reviewed by Bailey Pemberton

If you are eyeing Genmab’s stock right now, you are certainly not alone. After a sharp 6.2% rally over the past month, the stock has given up some of those gains with a -9.2% slip in the last week. But don’t let short-term swings distract you from the surprising longer-term resilience here. Genmab is still up 26.6% since January and has gained 22.8% over the past year, even as the wider biotech sector has had its share of shake-ups.

What is driving all this movement? It has been a mix of renewed optimism about Genmab’s antibody pipeline and some cautious excitement about recent collaboration announcements, particularly those extending the company’s reach in immuno-oncology. While management is tight-lipped about the impact of these deals, investors seem to view them as strengthening Genmab’s future growth prospects, which could explain some of the positive pressure on the share price in recent months. At the same time, the stock is not immune to shifts in risk appetite and overall market volatility, which likely contributed to the pullback this week.

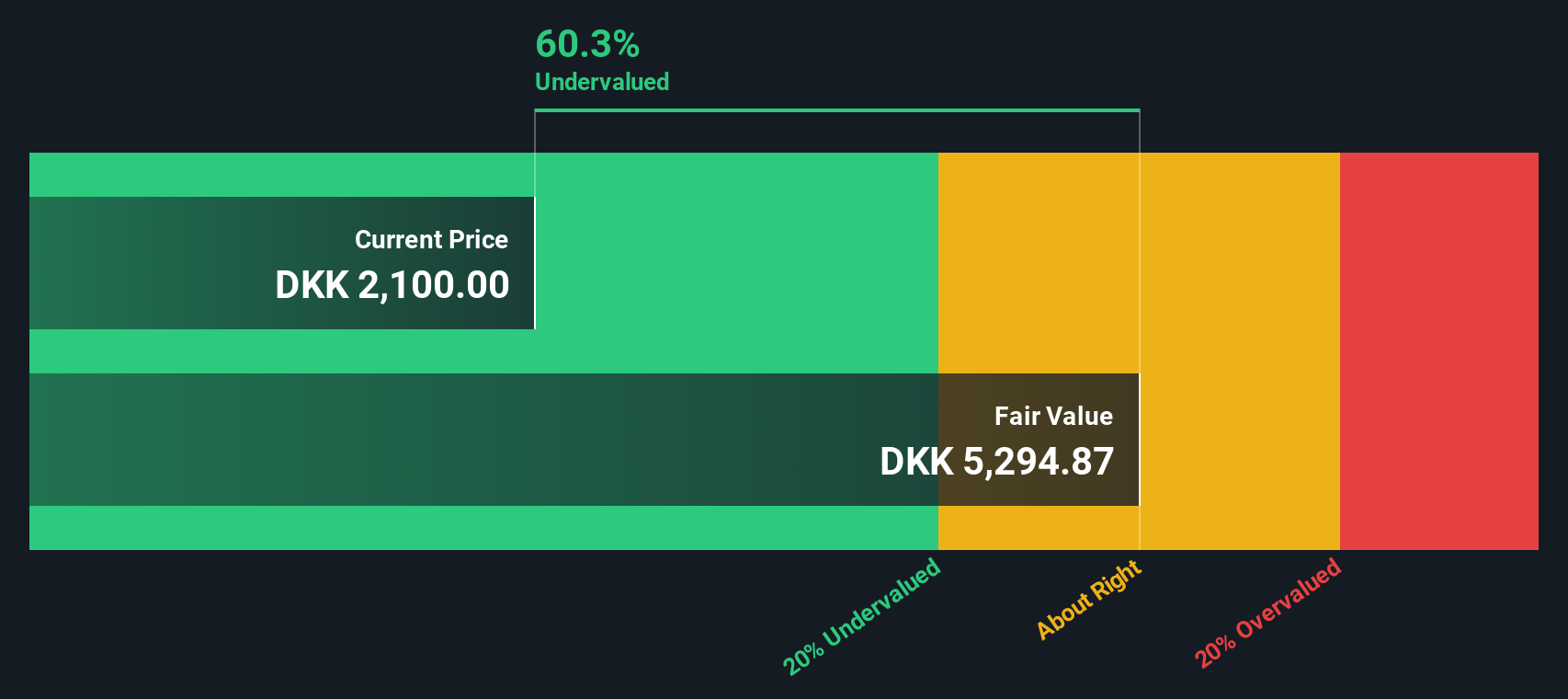

For anyone weighing whether Genmab is currently a bargain or fairly priced, valuation is clearly in focus. According to a composite score that checks six different valuation criteria, Genmab is undervalued on five out of six metrics, giving it a robust value score of 5. But what do these scores really mean for your investment decision? Let’s break down each valuation method in detail and then look at an even more powerful way to assess what Genmab’s share price could do next.

Approach 1: Genmab Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to the present. This method is widely used because it attempts to capture what the business is really worth, based on its ability to generate cash in the years ahead.

Currently, Genmab’s Free Cash Flow stands at $1.06 Billion, serving as a healthy foundation for the forecast. Analysts provide direct estimates through 2029, projecting robust growth with Free Cash Flow expected to climb to about $2.52 Billion by then. Beyond those years, Simply Wall St extrapolates future figures, with projections showing stable amounts into the next decade. All these projections are modeled in U.S. dollars for consistency.

The outcome of this DCF analysis is an estimated intrinsic value of $5,711 per share. This figure points to Genmab stock being roughly 66.1% undervalued compared to its current trading price, a significant margin. For long-term investors, this suggests the market may be pricing in much more risk or uncertainty than the fundamentals justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Genmab is undervalued by 66.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Genmab Price vs Earnings

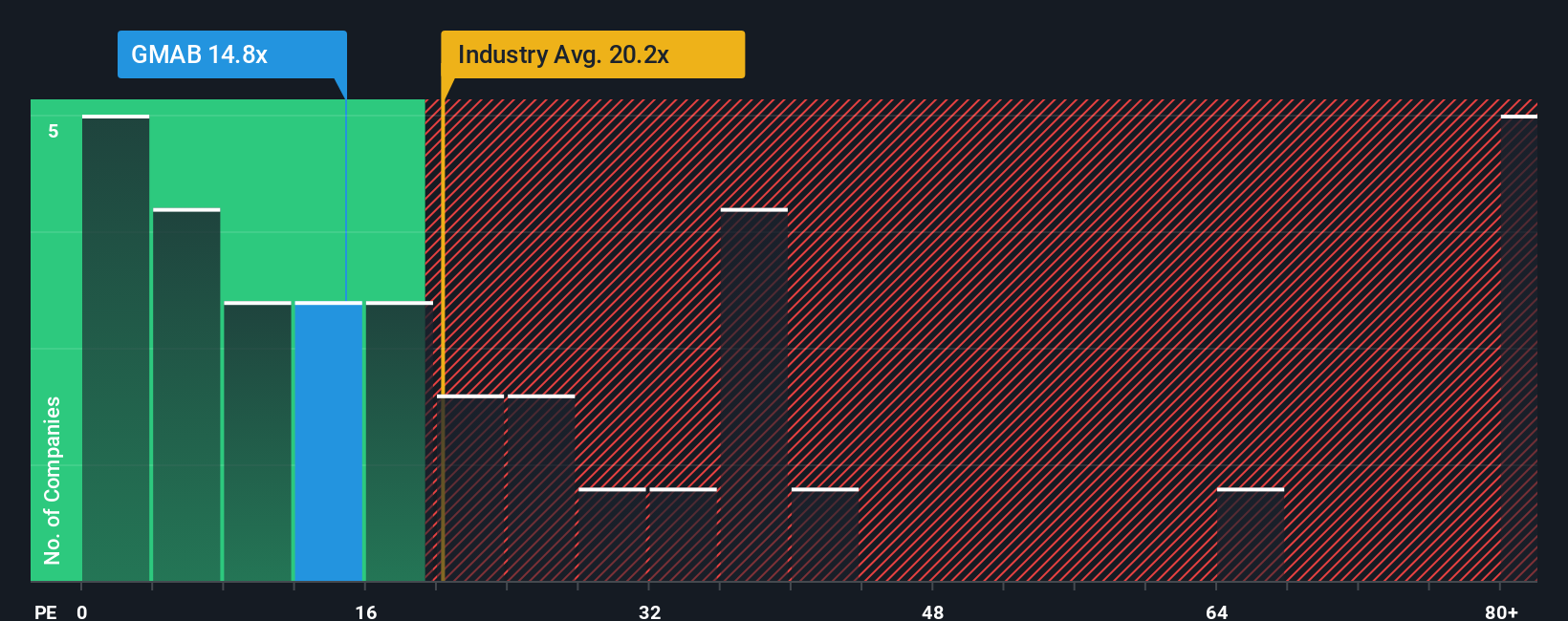

The Price-to-Earnings (PE) ratio is a staple valuation tool for profitable companies like Genmab. It compares a company's share price to its per-share earnings and serves as a quick gauge for how much investors are willing to pay today for a unit of future profit. This makes the PE ratio particularly relevant when the business has consistent earnings, as is the case here.

What counts as a "fair" or "normal" PE ratio varies between companies and sectors. Faster earnings growth, higher profitability, and lower risk tend to justify higher PE ratios, while slower growth or higher uncertainty reduces that number. Essentially, investors may pay more for promising companies and discount those facing challenges.

Genmab currently trades at 13.5x earnings. For context, the average PE for the Biotechs industry is 30.7x and the peer group sits at 19.8x. At first glance, Genmab looks much cheaper than its industry and peers. Rather than relying only on simple averages, Simply Wall St’s “Fair Ratio” offers a tailored benchmark. The Fair Ratio for Genmab is 18.6x, reflecting factors such as earnings growth, profit margins, industry trends, company size, and business risks. This approach provides a more realistic picture, since it weighs what actually matters for Genmab instead of applying a one-size-fits-all standard.

With Genmab’s actual PE ratio of 13.5x sitting below its Fair Ratio of 18.6x, the stock appears undervalued based on the earnings multiple approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Genmab Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future, built not just on numbers like fair value, revenue, and earnings forecasts, but also on your expectations around business risks, opportunities, and key milestones. Narratives connect the “why” of your investment idea, such as your view on Genmab’s potential to launch new drugs, expand globally, or overcome competitive threats, with a financial forecast and ultimately a fair value for the stock.

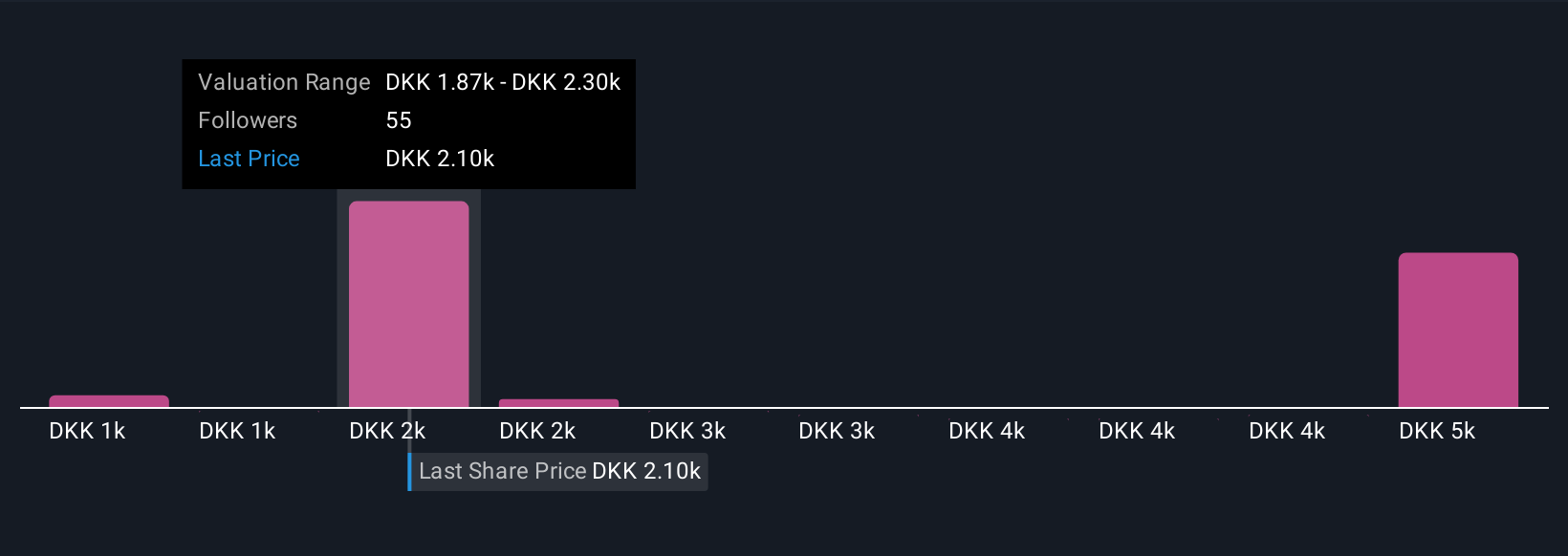

Narratives are easy to create and explore within the Simply Wall St platform’s Community page, giving you access to millions of investors’ stories. Because every investor’s assumptions and risk tolerances differ, you can see a range of Genmab Narratives side by side. For example, some investors expect strong pipeline launches and international expansion to push Genmab’s fair value as high as DKK2,650, while others see risks limiting upside to just DKK1,000.

The real power of Narratives is how they update dynamically as new events, earnings results, or news are released. This shows you instantly how recent developments shift the investment outlook. By comparing each Narrative’s fair value with Genmab’s current price, you get a dynamic, story-driven signal for when to buy, hold, or sell, tuned to your own beliefs about the company’s future.

Do you think there's more to the story for Genmab? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GMAB

Genmab

A biotechnology company, develops antibody-based products and product candidates for the treatment of cancer and other diseases in Denmark.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives