Genmab (CPSE:GMAB): Reassessing Valuation After Promising New EPKINLY Phase 3 Lymphoma Data

Reviewed by Simply Wall St

Genmab (CPSE:GMAB) is back in focus after new clinical data on EPKINLY showed strong efficacy signals in both follicular lymphoma and diffuse large B cell lymphoma, prompting investors to reassess the stock’s risk reward profile.

See our latest analysis for Genmab.

Those trial wins come on top of Genmab’s recent multi billion dollar debt raise to help fund its planned Merus acquisition. Investors seem to be warming up again, with a roughly 34 percent year to date share price return, but a still negative three year total shareholder return shows how early this momentum shift might be.

If EPKINLY’s data has you rethinking biotech, it could be worth scanning healthcare stocks to spot other treatment focused names where clinical catalysts and sentiment are starting to line up.

With the shares up strongly this year but still lagging badly over five years, and trading only slightly below consensus targets despite hefty implied intrinsic upside, is Genmab still a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 10% Overvalued

Compared with Genmab’s last close at DKK 2,056, the most followed narrative points to a slightly lower fair value, suggesting the recent rally may be running ahead of fundamentals.

Strong late stage pipeline progress including positive Phase III results for epcoritamab (EPKINLY) and expansion of Rina S programs positions Genmab to benefit from the growing global burden of cancer and rising demand for innovative biologic therapies, supporting significant future revenue and earnings growth.

Want to see the full playbook behind that growth story, from mid teens expansion to a richer earnings multiple on 2028 profits, and the bold assumptions tying it all together? Read on to uncover the projections driving this valuation call.

Result: Fair Value of $2054.66 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory delays for key late stage assets or mounting pricing pressure in major markets could quickly undermine today’s bullish growth assumptions.

Find out about the key risks to this Genmab narrative.

Another Lens On Value

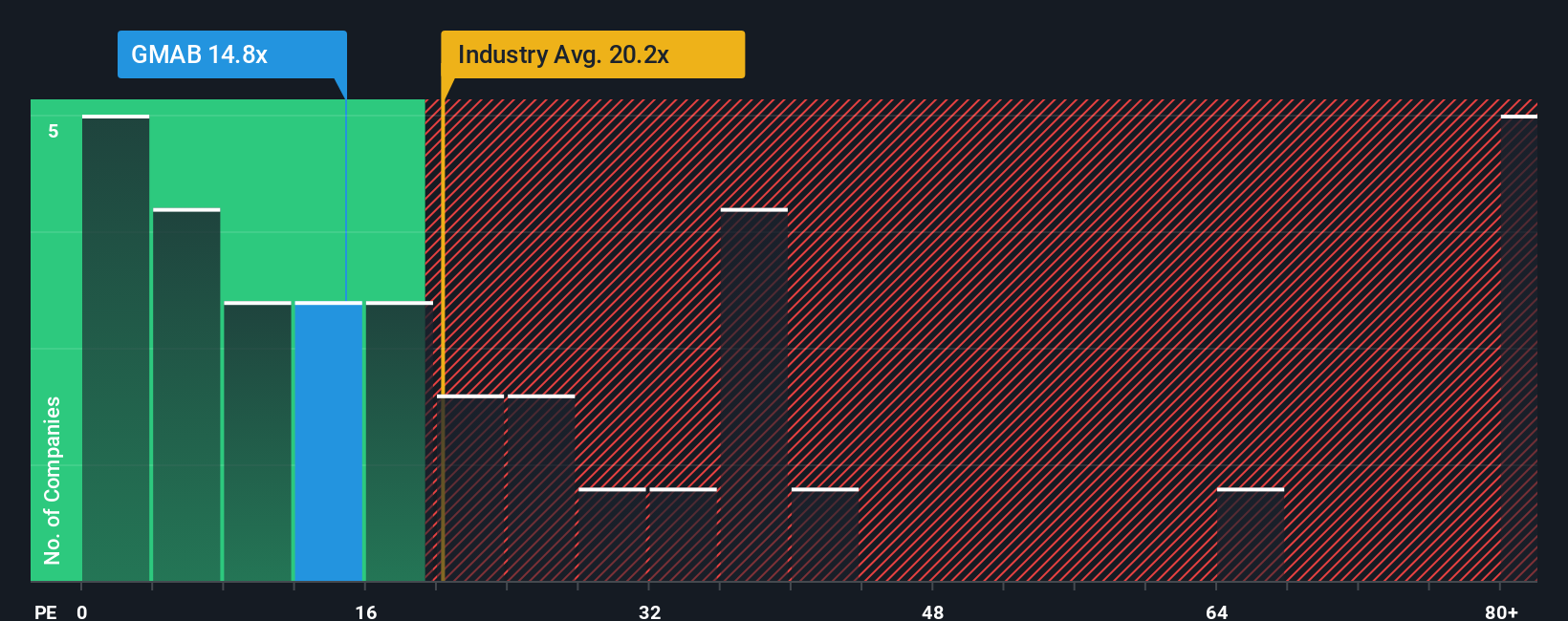

While the narrative based fair value suggests Genmab is slightly overvalued, its current price to earnings ratio of 12.5 times looks far cheaper than both peers at 17.2 times and a 18.8 times fair ratio, which hints at upside if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Genmab Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Genmab.

Ready for more investment ideas?

Smart investors never stop refining their watchlists, so use the Simply Wall Street Screener to uncover fresh opportunities before the crowd catches on.

- Explore early stage potential by targeting these 3581 penny stocks with strong financials that already show disciplined financial strength and credible growth paths.

- Look at the next technology wave by focusing on these 27 AI penny stocks involved in automation, data intelligence, and next generation software.

- Screen for these 15 dividend stocks with yields > 3% that may provide income and stability while still leaving room for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GMAB

Genmab

A biotechnology company, develops antibody-based products and product candidates for the treatment of cancer and other diseases in Denmark.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026