Genmab (CPSE:GMAB): Evaluating Valuation After Recent Momentum in Share Price

Reviewed by Kshitija Bhandaru

See our latest analysis for Genmab.

Genmab continues to draw investor interest as its recent share price momentum extends a streak of steady gains, suggesting renewed optimism around its growth prospects. The stock’s impressive year-to-date share price return follows a solid 1-year total shareholder return, building a case for both short- and long-term strength as investors appear to re-evaluate risk and opportunity.

Looking for other companies making headlines in biotechnology? Now’s the perfect time to explore fresh possibilities with our curated healthcare stocks screener: See the full list for free.

But given Genmab’s record gains and strong financials, investors now face a key question: is the current price a springboard for further appreciation, or are expectations for future growth already fully reflected in the stock?

Most Popular Narrative: 4.8% Overvalued

Genmab’s last close of DKK2,100 stands just above the most widely followed narrative's fair value estimate of DKK2,005, with analysts split on whether current optimism is fully justified. As expectations heat up, debate is centering on how much future growth remains to be priced in.

Strong recurring royalty streams from established partnered products (such as DARZALEX) and a rising contribution from wholly owned product sales underpin stable, predictable cash flows, providing financial flexibility for pipeline investment and margin expansion.

Curious about the bold predictions driving this price? The narrative hinges on ambitious revenue expansion and a future earnings multiple that outpaces the industry. What are the hidden growth bets and margin shifts that could flip the script? See for yourself to find out what’s really powering this valuation.

Result: Fair Value of DKK2,005 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tightening drug pricing regulations and unexpected hurdles in bringing new therapies to market could quickly challenge Genmab’s optimistic growth narrative.

Find out about the key risks to this Genmab narrative.

Another View: DCF Model Suggests Deep Value

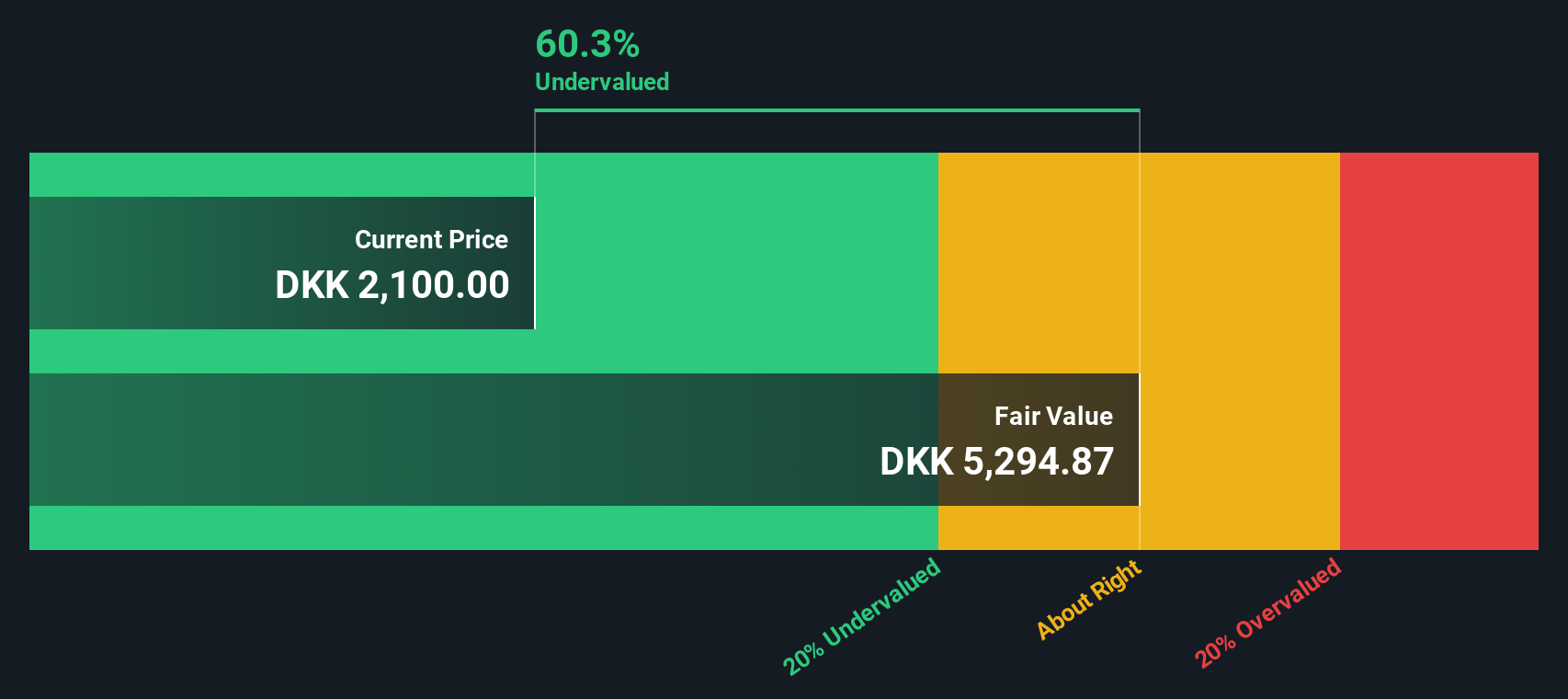

While the fair value estimate based on earnings multiples signals some overvaluation, the SWS DCF model presents a sharply different picture. According to our DCF analysis, Genmab trades at more than 60% below its estimated fair value, which implies significant upside potential if cash flows grow as projected. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Genmab Narrative

If you see things differently or want to run your own numbers, you can dive in and craft your own narrative quickly. With just a few clicks, you’re done. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Genmab.

Looking for more investment ideas?

Stop settling for the usual picks and boost your portfolio’s potential by targeting what really matters. Don’t let tomorrow’s winners pass you by.

- Accelerate your growth goals when you chase returns with these 3561 penny stocks with strong financials backed by strong financials and breakout momentum.

- Catch the next big tech trend by jumping into opportunities shaping digital healthcare with these 31 healthcare AI stocks connecting innovation and strong fundamentals.

- Power up your passive income by zeroing in on these 19 dividend stocks with yields > 3% offering yields above 3% for steady cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GMAB

Genmab

A biotechnology company, develops antibody-based products and product candidates for the treatment of cancer and other diseases in Denmark.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives