Exploring None's High Growth Tech Stocks With Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have shown a mixed performance, with major U.S. indexes such as the S&P 500 and Nasdaq Composite reaching record highs, while the Russell 2000 Index for small-cap stocks experienced a decline following its previous outperformance. This divergence highlights the ongoing rally in growth stocks, particularly within sectors like information technology and consumer discretionary, which have gained over 3% amid broader economic indicators such as job growth rebounding in November. In this context of fluctuating market dynamics and sector-specific gains, identifying high-growth tech stocks requires careful consideration of factors like innovation potential and financial health to navigate current conditions effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Genmab (CPSE:GMAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genmab A/S is a biotechnology company based in Denmark that focuses on developing antibody therapeutics for cancer and other diseases, with a market cap of approximately DKK102.52 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to DKK19.84 billion. Its focus on antibody therapeutics positions it as a key player in the treatment of cancer and other diseases.

Genmab's recent strides in biotechnology, particularly through its EPCORE® NHL-2 trial, underscore a robust approach to R&D that is yielding compelling clinical results. With a 96% overall response rate and an 87% complete response rate in its latest study, the company not only demonstrates strong potential in lymphoma treatment but also showcases the effectiveness of its proprietary DuoBody® technology. Financially, Genmab has shown resilience and growth with third-quarter sales rising to DKK 5.54 billion from DKK 4.71 billion year-over-year, alongside an upward revision of its full-year revenue forecast to between DKK 21.1 billion and DKK 21.7 billion. This financial trajectory complements their scientific achievements and positions them well for sustained impact in healthcare innovation.

- Take a closer look at Genmab's potential here in our health report.

Assess Genmab's past performance with our detailed historical performance reports.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

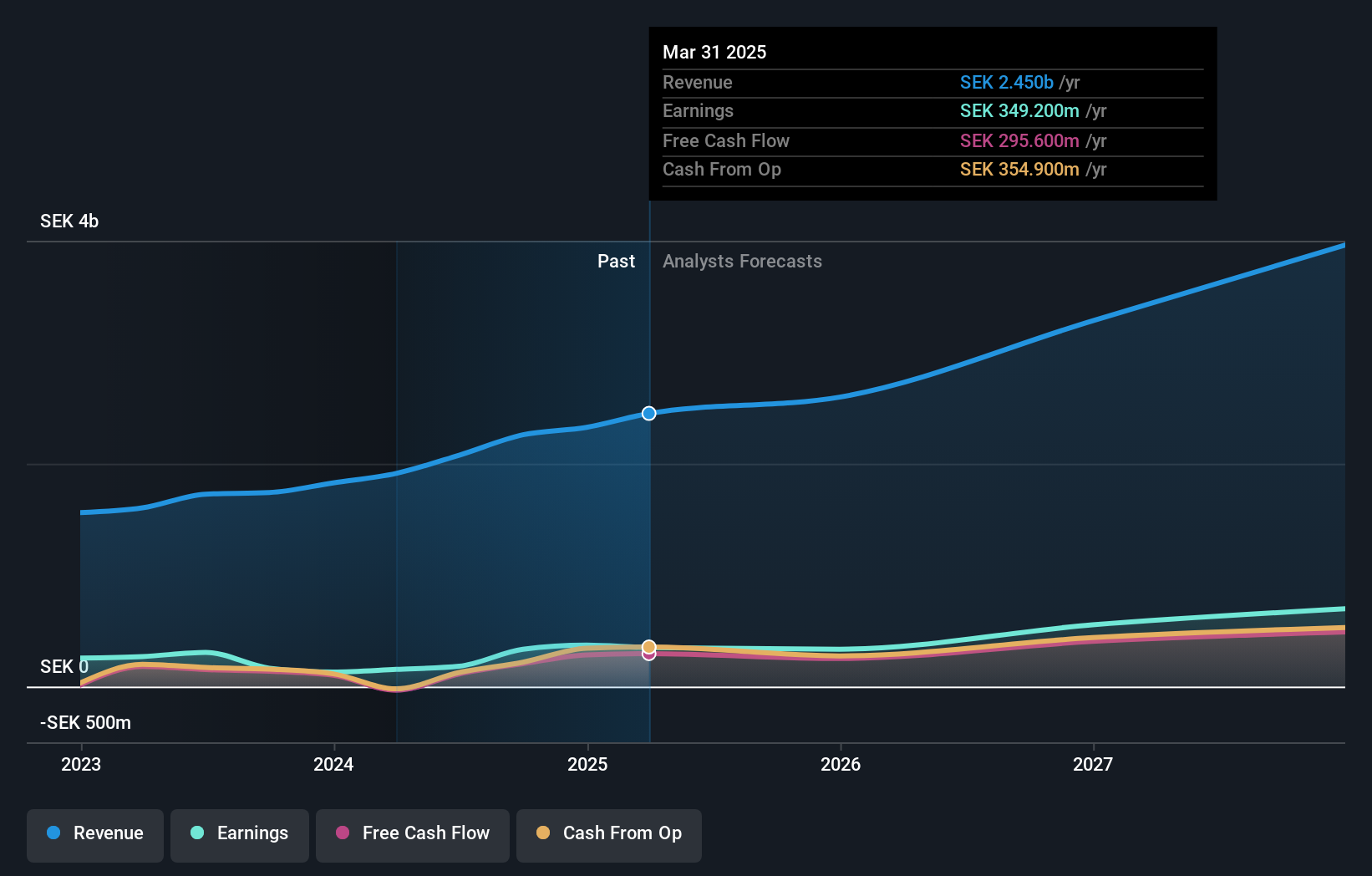

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of approximately SEK25.06 billion.

Operations: With a market cap of approximately SEK25.06 billion, Yubico AB generates revenue primarily from its Security Software & Services segment, amounting to SEK2.28 billion.

Yubico's recent inclusion in the OMX Nordic All-Share Index and its innovative Yubico Enrollment Suite for Microsoft users mark significant strides in cybersecurity. This suite, part of a broader initiative with Microsoft, enhances phishing-resistant multi-factor authentication, pivotal in today’s digital security landscape. Financially, Yubico has turned around impressively; from a net loss last year to posting SEK 81.2 million in net income this quarter with sales jumping to SEK 589.9 million from SEK 407.3 million previously. These developments not only boost Yubico's market position but also underscore its growth trajectory in revenue and earnings, expected at an annual rate of 21.2% and 28.8% respectively, outpacing broader market projections significantly.

- Click here and access our complete health analysis report to understand the dynamics of Yubico.

Evaluate Yubico's historical performance by accessing our past performance report.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sharetronic Data Technology Co., Ltd. is a global solution provider specializing in wireless network and smart terminal technologies, with a market cap of CN¥25.50 billion.

Operations: The company provides solutions in wireless network and smart terminal technologies on a global scale. It focuses on developing advanced technological solutions, which are integral to its business operations.

Sharetronic Data Technology has demonstrated robust growth, with revenue soaring to CNY 5.39 billion, up from CNY 3.23 billion year-over-year, and net income escalating impressively to CNY 557 million from CNY 196 million. This surge reflects a strategic expansion in their business scope and amendments to operational policies discussed in recent shareholder meetings. The company’s commitment to innovation is evident in its R&D spending, which supports its projected annual earnings growth of 29.1% and revenue increase of 22.8%, outstripping broader market averages significantly. These figures underscore Sharetronic's potential in navigating the competitive tech landscape effectively while adapting swiftly to market demands and opportunities.

- Click here to discover the nuances of Sharetronic Data Technology with our detailed analytical health report.

Understand Sharetronic Data Technology's track record by examining our Past report.

Next Steps

- Explore the 1280 names from our High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GMAB

Genmab

A biotechnology company, develops antibody-based products and product candidates for the treatment of cancer and other diseases in Denmark.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives