Is Bavarian Nordic Attractively Priced After Strong Vaccine Pipeline Partnerships in 2025?

Reviewed by Bailey Pemberton

- Wondering if Bavarian Nordic is a hidden gem or simply riding the latest biotech wave? Let's dig in and see if the stock is living up to its reputation.

- Bavarian Nordic shares have seen a solid 18.2% jump year-to-date and are up 13.6% over the past year, but there was a slight dip of 0.6% just last week.

- Recent headlines highlight the company's expanding role in vaccine development, with positive investor sentiment driven by new partnerships and regulatory milestones. These developments have helped fuel recent price action and stirred fresh interest in the stock's future potential.

- On the valuation front, Bavarian Nordic scores a 4 out of 6 on our undervaluation checks. This suggests there are multiple angles worth exploring. Stay tuned as we break down exactly how we look at fair value and why there is an even more insightful approach waiting for you at the end.

Approach 1: Bavarian Nordic Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation works by estimating a company's future cash flows, then projecting those numbers over several years and discounting them back to today’s value. This method provides a detailed view of what a business is truly worth based on how much cash it is expected to generate.

For Bavarian Nordic, the current Free Cash Flow (FCF) is DKK 44.3 Million. Analysts provide cash flow forecasts for the next five years, followed by further projections extrapolated by Simply Wall St. According to this model, Bavarian Nordic's FCF is projected to grow substantially, reaching around DKK 1.28 Billion by 2029. These longer-term projections suggest a robust increase in cash generation over the coming decade.

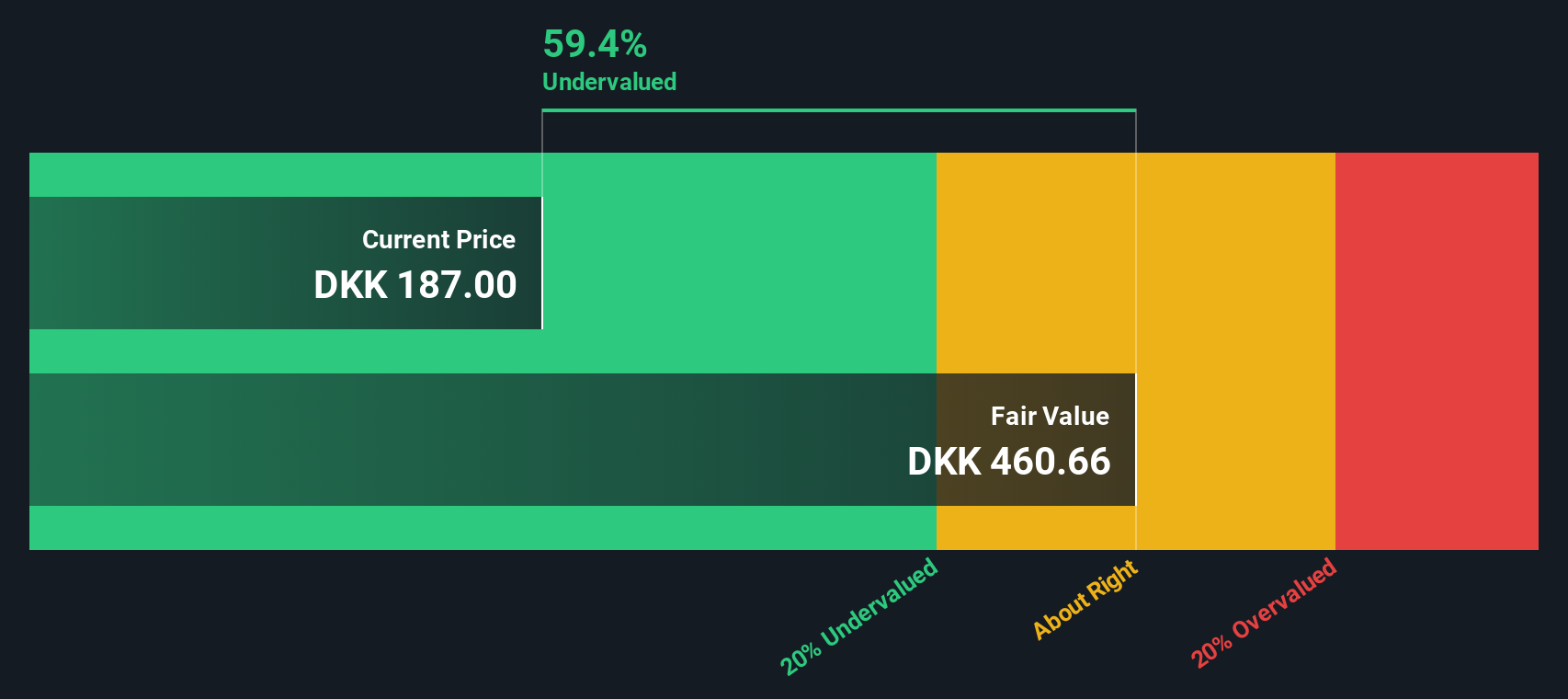

Based on these estimates and using a 2 Stage Free Cash Flow to Equity model, the intrinsic value of Bavarian Nordic is calculated to be DKK 460.86 per share. The stock is currently trading at a 49.0% discount relative to this value. The DCF analysis indicates that Bavarian Nordic is significantly undervalued based on its projected cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bavarian Nordic is undervalued by 49.0%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Bavarian Nordic Price vs Earnings (PE)

For profitable companies, the Price-to-Earnings (PE) ratio is a widely used and reliable valuation metric, as it directly relates a company's share price to its per-share earnings. Investors often look to the PE ratio to quickly gauge whether a stock is trading at an attractive multiple of its profits compared to others in the same sector.

The "right" PE ratio for any company typically depends on several factors, most notably growth prospects and risk profile. Companies with higher earnings growth or lower risk generally justify higher PE multiples. In contrast, slower-growing or riskier businesses often trade at lower multiples.

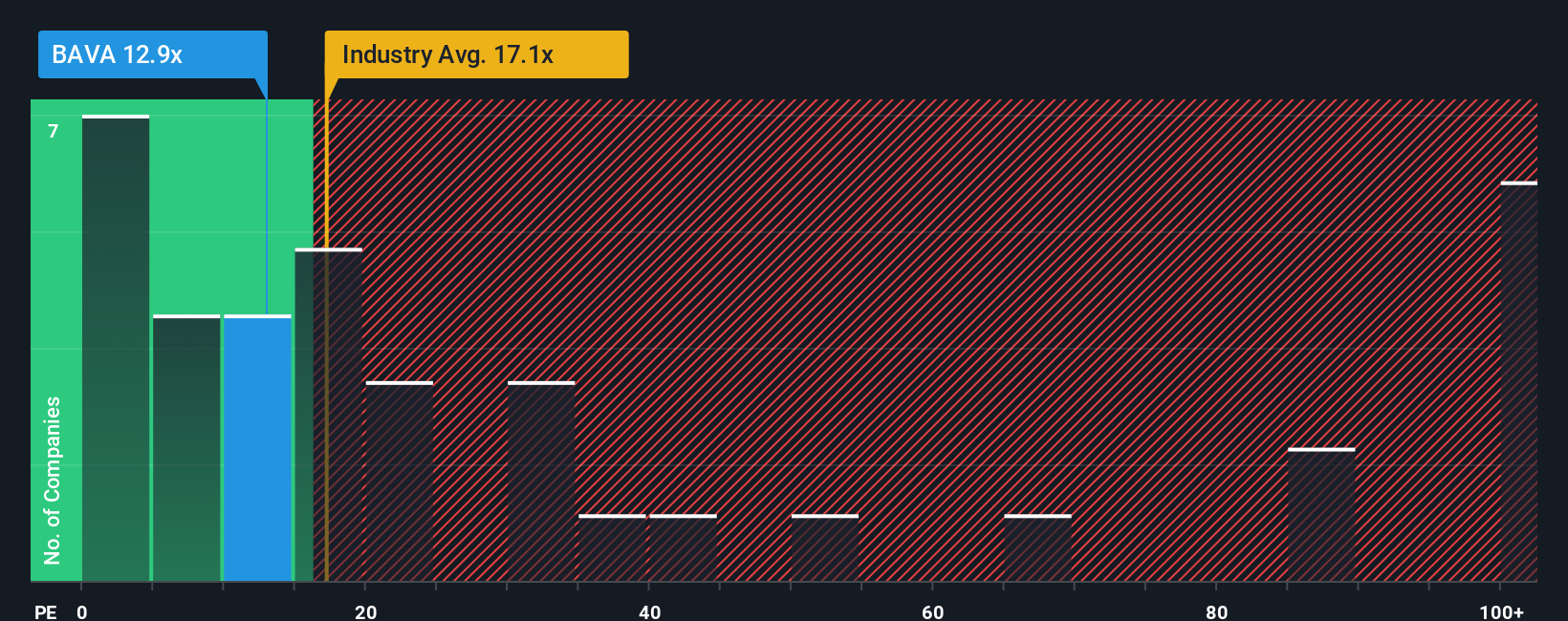

At present, Bavarian Nordic trades on a PE of 12.9x. This is well below the biotech industry average of 29.7x and also lower than the peer group average of 25.9x. On the surface, this suggests the market is pricing Bavarian Nordic much more conservatively than its industry and peer group.

Simply Wall St’s proprietary “Fair Ratio” model calculates that a PE of 12.7x would be appropriate for Bavarian Nordic, taking into account its specific earnings growth, profitability, industry dynamics, market cap, and risks. Unlike standard benchmarks, the Fair Ratio offers a more personalized and holistic view by considering these critical company-specific factors.

When compared directly, the company’s current PE of 12.9x is nearly identical to its Fair Ratio of 12.7x. This means Bavarian Nordic’s valuation is right in line with fair value based on its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bavarian Nordic Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple and intuitive way to capture your perspective on a company, combining your view of its story, such as what will drive its growth or risks, with your expectations for future revenue, earnings, and profit margins to generate a personalized fair value.

Unlike traditional valuation metrics, Narratives link the business context to real financial forecasts, so you can clearly see how your underlying beliefs about Bavarian Nordic’s products, opportunities, or industry challenges translate into estimated share price outcomes. On Simply Wall St’s Community page, Narratives make this process accessible to everyone by letting you create, adjust, and compare differing perspectives in just a few clicks. This all uses actual models and is used by millions of investors globally.

Narratives empower you to act more confidently. When your fair value (based on your story and forecasts) is above the current market price, it may be time to consider buying, while a lower fair value suggests caution or even selling. Furthermore, Narratives are dynamically updated whenever new events or data appear, so your analysis stays fresh and relevant.

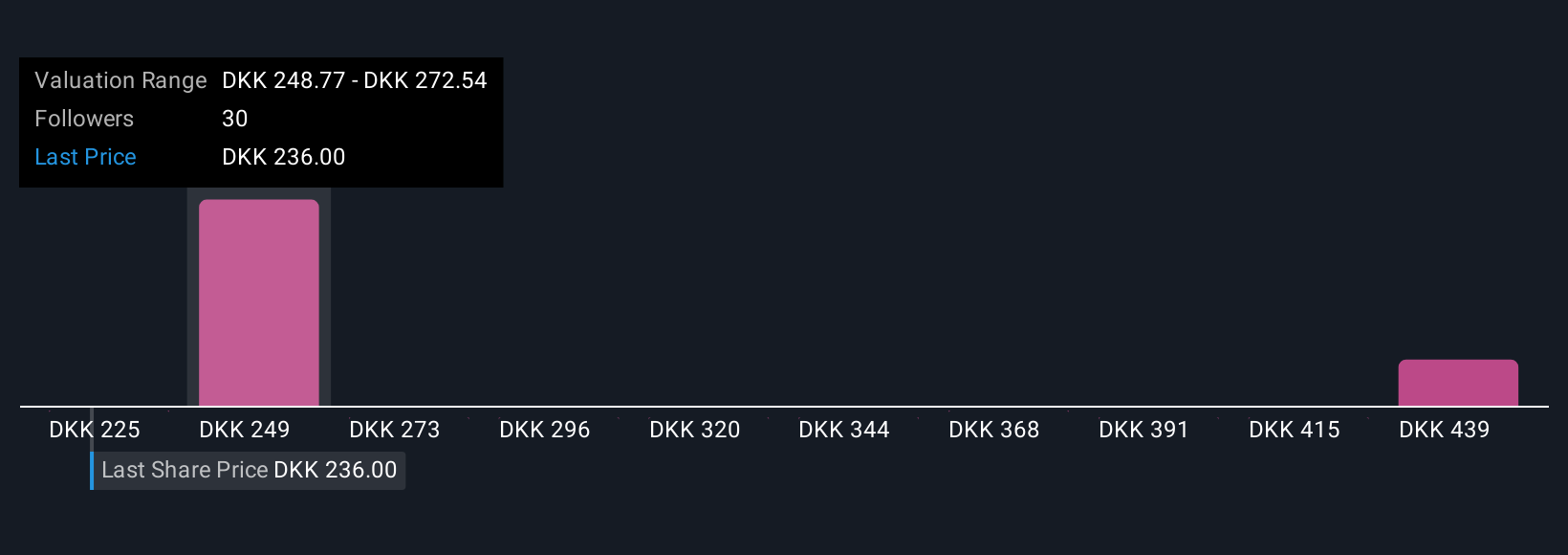

For instance, one investor might see Bavarian Nordic as at risk from shrinking vaccine demand and expect revenues to fall, putting fair value near DKK 244. Another might expect growth from new product launches and global health trends, which could justify a higher fair value closer to DKK 250. This helps you easily understand and debate both sides.

Do you think there's more to the story for Bavarian Nordic? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bavarian Nordic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:BAVA

Bavarian Nordic

Develops, manufactures, and supplies life-saving vaccines.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives