North Media A/S' (CPH:NORTHM) Earnings Haven't Escaped The Attention Of Investors

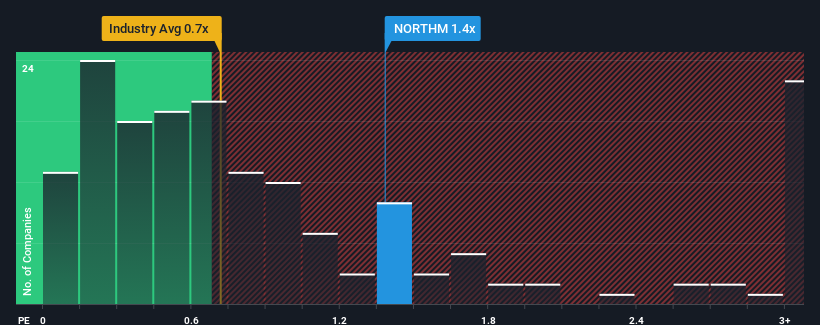

When you see that almost half of the companies in the Media industry in Denmark have price-to-sales ratios (or "P/S") below 0.7x, North Media A/S (CPH:NORTHM) looks to be giving off some sell signals with its 1.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for North Media

What Does North Media's Recent Performance Look Like?

North Media could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on North Media.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as North Media's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 6.1% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 9.7% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the lone analyst watching the company. With the industry only predicted to deliver 3.5% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why North Media's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into North Media shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for North Media (2 are concerning!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if North Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:NORTHM

North Media

Develops and operates platforms for transactions between businesses and consumers in Denmark, Sweden, and Norway.

Excellent balance sheet and good value.

Market Insights

Community Narratives