Is Alm. Brand's (CPSE:ALMB) 2025 Profit Guidance Altering the Investment Case?

Reviewed by Sasha Jovanovic

- Alm. Brand A/S has issued earnings guidance for 2025, projecting group profit before tax and excluding special costs and run-off gains in the range of DKK 1.93 billion to DKK 2.03 billion for the fourth quarter of 2025.

- This new guidance provides investors with updated expectations for the company’s financial performance, which may prompt a reassessment of Alm. Brand’s business outlook for the year ahead.

- To explore the impact of Alm. Brand’s recently published profit outlook, we’ll consider how this update could shape its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Alm. Brand Investment Narrative Recap

To be a shareholder in Alm. Brand, you need to believe in the company’s ability to drive steady profit growth and maintain market share despite fierce competition, high payout ratios, and recent one-off impacts on results. The latest earnings guidance for 2025 communicates management’s confidence in operational resilience, but does not materially reduce the primary short-term risk, the doubt over whether recent improvements in motor claims frequency and repricing effects will hold up in the new fiscal year.

Among recent developments, Alm. Brand’s completion of a buyback initiative for DKK 400 million in Tier 2 Capital Notes could be the most relevant, as it signals ongoing refinement of capital management practices at a time when capital adequacy and solvency remain in focus due to regulatory transitions. This capital action sits alongside efficiency and profitability efforts, shaping the most important catalysts for the company as it looks ahead to 2025.

Yet, in contrast to the business outlook, investors should not ignore the risk that the repricing actions in motor insurance may not...

Read the full narrative on Alm. Brand (it's free!)

Alm. Brand's outlook anticipates revenues of DKK 12.9 billion and earnings of DKK 1.5 billion by 2028. This is based on a yearly revenue decline of 1.2% and a DKK 544 million increase in earnings from the current level of DKK 956 million.

Uncover how Alm. Brand's forecasts yield a DKK20.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

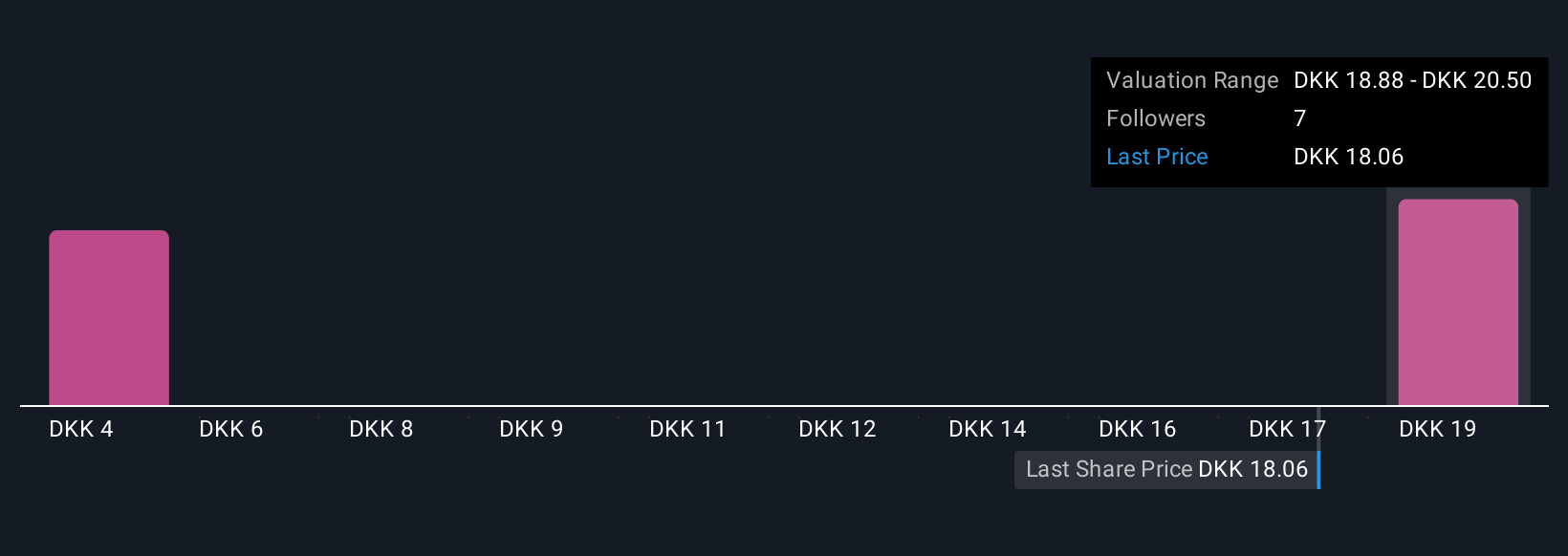

Community investors have published fair value estimates ranging from DKK 4.34 to DKK 20.50 based on two separate analyses. With ongoing questions around Alm. Brand’s ability to sustain recent improvements in motor claims and pricing, it’s clear there are several perspectives for you to consider.

Explore 2 other fair value estimates on Alm. Brand - why the stock might be worth less than half the current price!

Build Your Own Alm. Brand Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alm. Brand research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alm. Brand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alm. Brand's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ALMB

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives