- Denmark

- /

- Healthtech

- /

- CPSE:NNIT

Exploring High Growth Tech Stocks In Europe April 2025

Reviewed by Simply Wall St

Amid escalating trade tensions and volatile market conditions, the European stock markets have experienced a downturn, with key indices such as the STOXX Europe 600 Index ending lower. Despite these challenges, investors continue to seek opportunities in high-growth tech stocks that demonstrate resilience and potential for innovation-driven expansion.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.54% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Skolon | 29.76% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

NNIT (CPSE:NNIT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NNIT A/S offers IT solutions across life sciences, public, and private sectors in Denmark, Europe, the United States, and Asia with a market cap of DKK1.66 billion.

Operations: NNIT A/S generates revenue from IT solutions, with significant contributions from Denmark (DKK844 million) and Europe (DKK512 million), followed by the United States and Asia.

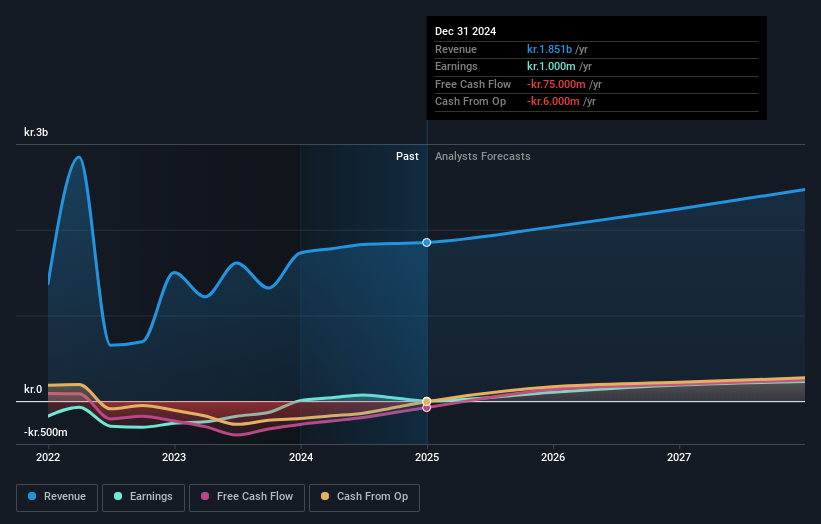

NNIT, a player in Europe's tech scene, recently navigated significant changes and challenges. Despite a one-off loss of DKK 69 million impacting its financials for the year ended December 31, 2024, the company is poised for recovery with an earnings forecast showing substantial growth at 61.1% annually over the next three years. This growth trajectory is notably faster than Denmark's market average of 8.4%. Additionally, NNIT aims to boost its revenue by 9.3% annually through expanding client engagements and onboarding new customers—outpacing the Danish market forecast of 8.7%. However, it’s crucial to note that NNIT’s profit margins have dipped from last year's 0.3% to just 0.05%, reflecting broader challenges despite optimistic revenue and earnings projections.

- Delve into the full analysis health report here for a deeper understanding of NNIT.

Gain insights into NNIT's past trends and performance with our Past report.

Nordhealth (OB:NORDH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordhealth AS is a company that offers healthcare software solutions across Norway, Finland, Sweden, Denmark, Germany, and other international markets with a market capitalization of NOK2.75 billion.

Operations: Nordhealth AS generates revenue primarily from its Therapy and Veterinary segments, with the Veterinary segment contributing €28.43 million and the Therapy segment contributing €15.44 million.

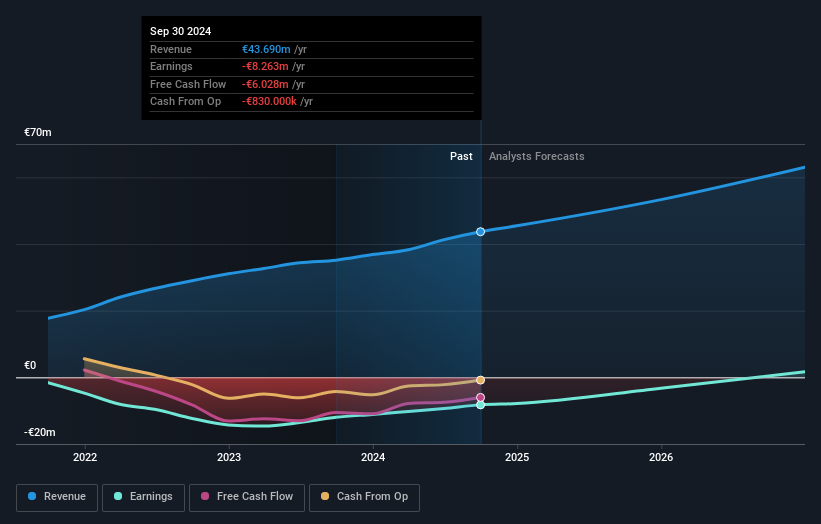

Nordhealth, navigating through a transformative phase, reported a significant reduction in net loss to EUR 2.81 million from EUR 3.4 million year-over-year as per Q4 2024 results, reflecting tighter operational controls and strategic shifts under new CFO Alexander Cram's guidance. With annualized revenue growth projected at 16.1%, surpassing Norway's market average of 2.2%, and an impressive forecast of earnings growth at 111.1% annually, the firm is setting a robust foundation for profitability. Despite current unprofitability and high share price volatility, these financial indicators coupled with strategic executive changes suggest potential for future stability and growth in the competitive tech landscape.

- Navigate through the intricacies of Nordhealth with our comprehensive health report here.

Evaluate Nordhealth's historical performance by accessing our past performance report.

Ependion (OM:EPEN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ependion AB, with a market cap of SEK3.78 billion, offers digital solutions focused on secure control, management, visualization, and data communication for industrial applications through its subsidiaries.

Operations: Ependion AB generates revenue by providing digital solutions tailored for industrial applications, emphasizing secure control and data communication. The company operates through its subsidiaries to deliver these specialized services.

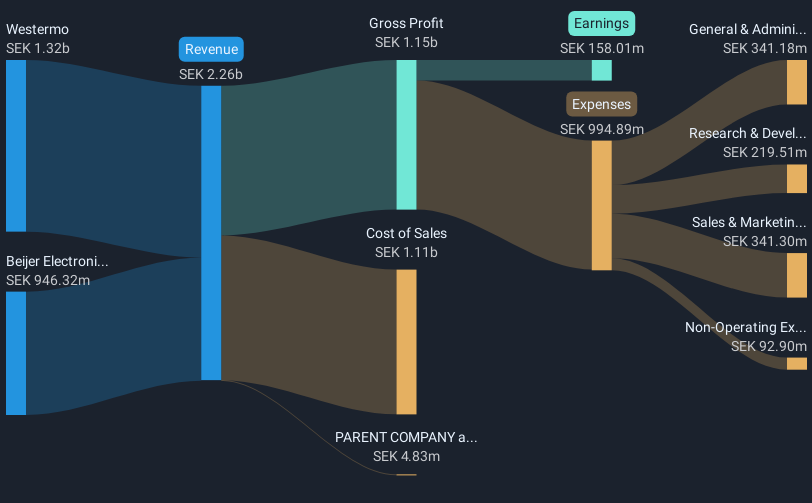

Ependion is navigating a complex landscape with its recent decision to acquire Welotec, aiming to bolster its market position amid challenging conditions indicated by a slight dip in annual sales from SEK 2.47 billion to SEK 2.26 billion. Despite this, the company's earnings growth forecast remains robust at 25% annually, outpacing the Swedish market's average of 13.4%. This growth trajectory is supported by Ependion’s strategic moves in mergers and acquisitions and its ability to maintain a positive free cash flow, which stands as a testament to its operational efficiency and potential for sustained profitability in the tech sector.

- Click here to discover the nuances of Ependion with our detailed analytical health report.

Understand Ependion's track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 229 European High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NNIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NNIT

NNIT

Provides information technology solutions for life sciences, public, and private sectors in Denmark, Europe, the United States, and Asia.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives