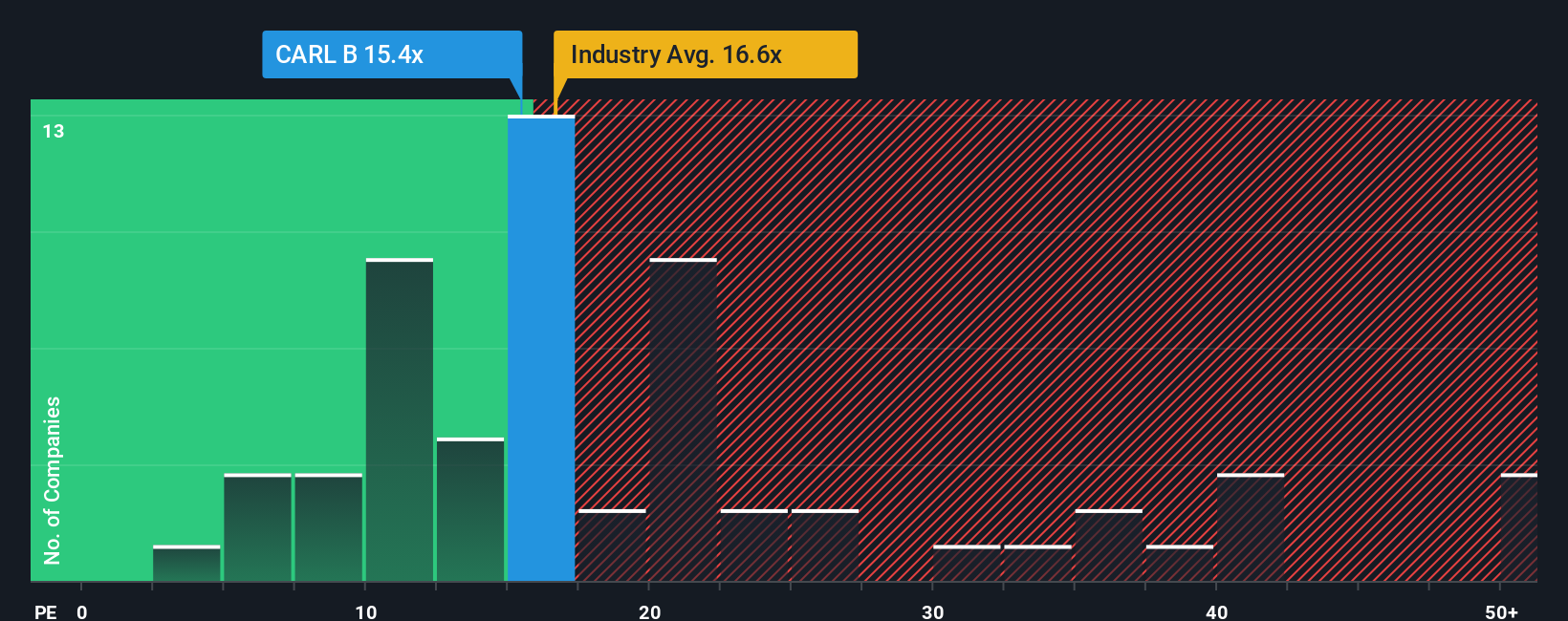

There wouldn't be many who think Carlsberg A/S' (CPH:CARL B) price-to-earnings (or "P/E") ratio of 15.4x is worth a mention when the median P/E in Denmark is similar at about 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With only a limited decrease in earnings compared to most other companies of late, Carlsberg has been doing relatively well. One possibility is that the P/E is moderate because investors think this relatively better earnings performance might be about to evaporate. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

View our latest analysis for Carlsberg

How Is Carlsberg's Growth Trending?

The only time you'd be comfortable seeing a P/E like Carlsberg's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 7.4% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 15% each year during the coming three years according to the analysts following the company. With the market only predicted to deliver 11% per annum, the company is positioned for a stronger earnings result.

In light of this, it's curious that Carlsberg's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Carlsberg's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Carlsberg currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Carlsberg that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:CARL B

Carlsberg

Produces and markets beer and other beverage products in Denmark, China, the United Kingdom, and internationally.

Very undervalued established dividend payer.

Market Insights

Community Narratives