- Denmark

- /

- Hospitality

- /

- CPSE:PARKEN

If EPS Growth Is Important To You, PARKEN Sport & Entertainment (CPH:PARKEN) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like PARKEN Sport & Entertainment (CPH:PARKEN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide PARKEN Sport & Entertainment with the means to add long-term value to shareholders.

Check out our latest analysis for PARKEN Sport & Entertainment

How Fast Is PARKEN Sport & Entertainment Growing?

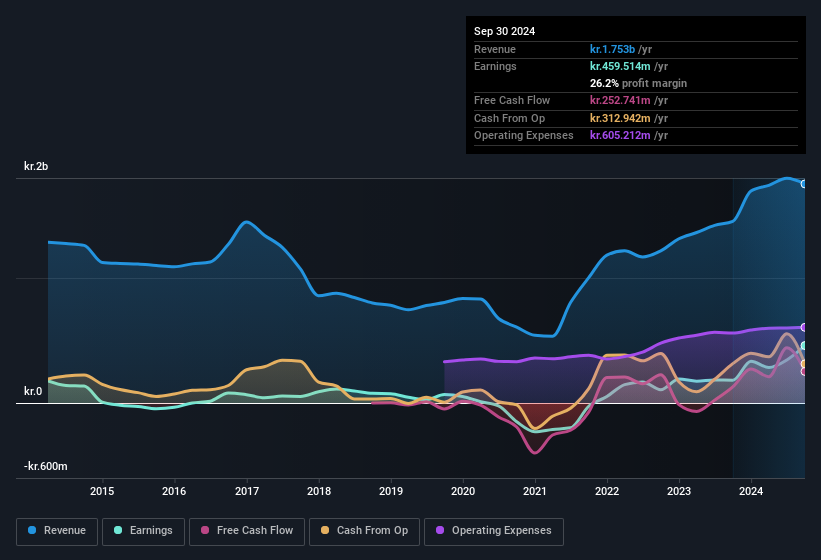

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that PARKEN Sport & Entertainment has grown EPS by 60% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that PARKEN Sport & Entertainment is growing revenues, and EBIT margins improved by 11.7 percentage points to 35%, over the last year. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since PARKEN Sport & Entertainment is no giant, with a market capitalisation of kr.1.4b, you should definitely check its cash and debt before getting too excited about its prospects.

Are PARKEN Sport & Entertainment Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. PARKEN Sport & Entertainment followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. To be specific, they have kr.142m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 10% of the shares on issue for the business, an appreciable amount considering the market cap.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to PARKEN Sport & Entertainment, with market caps between kr.724m and kr.2.9b, is around kr.7.9m.

PARKEN Sport & Entertainment's CEO took home a total compensation package of kr.3.8m in the year prior to December 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add PARKEN Sport & Entertainment To Your Watchlist?

PARKEN Sport & Entertainment's earnings have taken off in quite an impressive fashion. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. PARKEN Sport & Entertainment is certainly doing some things right and is well worth investigating. However, before you get too excited we've discovered 3 warning signs for PARKEN Sport & Entertainment that you should be aware of.

Although PARKEN Sport & Entertainment certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Danish companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:PARKEN

PARKEN Sport & Entertainment

Operates in the sports and entertainment industry in Denmark.

Outstanding track record average dividend payer.