- Denmark

- /

- Consumer Durables

- /

- CPSE:HUSCO

Investors Aren't Entirely Convinced About HusCompagniet A/S' (CPH:HUSCO) Earnings

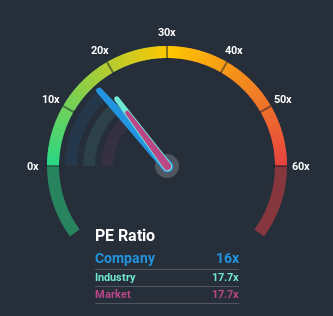

It's not a stretch to say that HusCompagniet A/S' (CPH:HUSCO) price-to-earnings (or "P/E") ratio of 16x right now seems quite "middle-of-the-road" compared to the market in Denmark, where the median P/E ratio is around 18x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

HusCompagniet has been doing a reasonable job lately as its earnings haven't declined as much as most other companies. It might be that many expect the comparatively superior earnings performance to vanish, which has kept the P/E from rising. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue outplaying the market.

Check out our latest analysis for HusCompagniet

What Are Growth Metrics Telling Us About The P/E?

HusCompagniet's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.8%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 21% per annum as estimated by the twin analysts watching the company. That's shaping up to be materially higher than the 13% per year growth forecast for the broader market.

In light of this, it's curious that HusCompagniet's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that HusCompagniet currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for HusCompagniet you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

When trading HusCompagniet or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HusCompagniet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:HUSCO

HusCompagniet

Engages in the construction of single-family detached houses in Denmark and Sweden.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives