The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Bang & Olufsen a/s (CPH:BO) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Bang & Olufsen

How Much Debt Does Bang & Olufsen Carry?

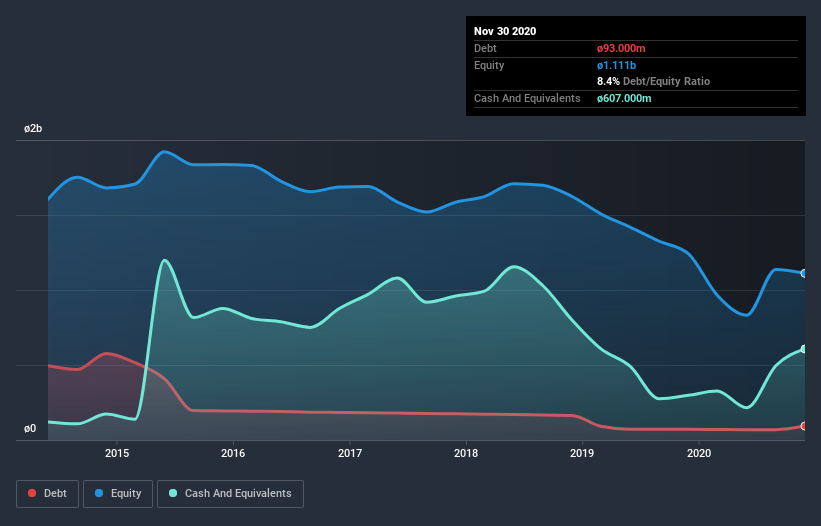

The image below, which you can click on for greater detail, shows that at November 2020 Bang & Olufsen had debt of kr.93.0m, up from kr.71.0m in one year. But on the other hand it also has kr.607.0m in cash, leading to a kr.514.0m net cash position.

How Strong Is Bang & Olufsen's Balance Sheet?

We can see from the most recent balance sheet that Bang & Olufsen had liabilities of kr.844.0m falling due within a year, and liabilities of kr.298.0m due beyond that. On the other hand, it had cash of kr.607.0m and kr.538.0m worth of receivables due within a year. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

This state of affairs indicates that Bang & Olufsen's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the kr.3.79b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, Bang & Olufsen boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Bang & Olufsen's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Bang & Olufsen had a loss before interest and tax, and actually shrunk its revenue by 9.6%, to kr.2.1b. That's not what we would hope to see.

So How Risky Is Bang & Olufsen?

While Bang & Olufsen lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow kr.3.0m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with Bang & Olufsen (including 1 which is a bit unpleasant) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Bang & Olufsen, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bang & Olufsen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:BO

Bang & Olufsen

Designs, develops, markets, manufactures, and sells audio and video products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives