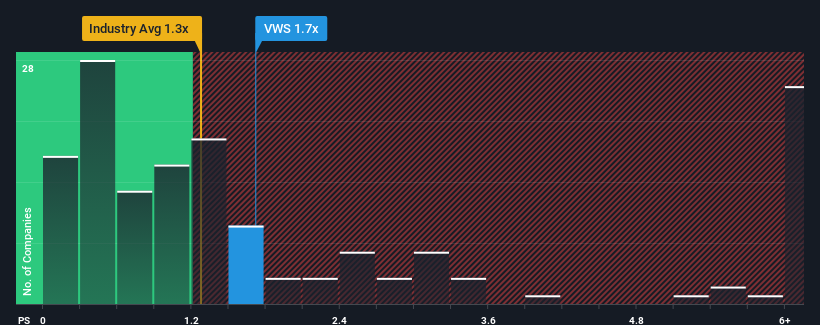

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Electrical industry in Denmark, you could be forgiven for feeling indifferent about Vestas Wind Systems A/S' (CPH:VWS) P/S ratio of 1.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Vestas Wind Systems

What Does Vestas Wind Systems' Recent Performance Look Like?

Vestas Wind Systems could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vestas Wind Systems.How Is Vestas Wind Systems' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Vestas Wind Systems' to be considered reasonable.

Retrospectively, the last year delivered a decent 8.0% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 11% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 8.2% each year growth forecast for the broader industry.

In light of this, it's curious that Vestas Wind Systems' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Vestas Wind Systems' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Vestas Wind Systems' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You always need to take note of risks, for example - Vestas Wind Systems has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:VWS

Vestas Wind Systems

Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

Excellent balance sheet and good value.