- Denmark

- /

- Electrical

- /

- CPSE:VWS

How Investors May Respond To Vestas Wind Systems (CPSE:VWS) Surge in Global Wind Turbine Orders

Reviewed by Sasha Jovanovic

- Vestas Wind Systems announced a series of significant wind turbine orders in the past week, including over 239 MW across eight projects in Germany, additional capacity in Italy and the USA, and projects across Europe, the Americas, and Asia as part of its third quarter 2025 order intake.

- These project wins highlight Vestas’ ability to secure large-scale orders with tailored turbine solutions and long-term service agreements, reinforcing its global presence in diverse markets.

- We’ll now explore how this surge in global project wins and order intake may influence Vestas’ investment narrative and growth outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Vestas Wind Systems Investment Narrative Recap

To invest in Vestas Wind Systems, you need to believe in the long-term global shift towards renewable energy and Vestas’ ability to secure substantial wind turbine orders across key markets. The latest surge in new orders strengthens order intake, a key short-term catalyst, but does not materially change the biggest risk: ongoing margin pressure from steep ramp-up costs and intense price competition, especially in Europe’s onshore and offshore wind segments.

Among recent announcements, the firm orders for eight wind projects totaling 239 MW in Germany stand out. These projects use Vestas’ newest EnVentus platform turbines and include long-term service agreements, emphasizing the company’s capacity to win sizable deals while deploying flexible, high-performance technology, a relevant point, as sustained order momentum can help offset margin headwinds if executed efficiently.

However, it’s important to note that, despite this positive momentum, investors should be aware of how ongoing price competition from Chinese manufacturers could...

Read the full narrative on Vestas Wind Systems (it's free!)

Vestas Wind Systems' outlook anticipates €23.1 billion in revenue and €1.3 billion in earnings by 2028. This scenario is based on a 7.6% annual revenue growth rate and an earnings increase of €538 million from the current €762.0 million.

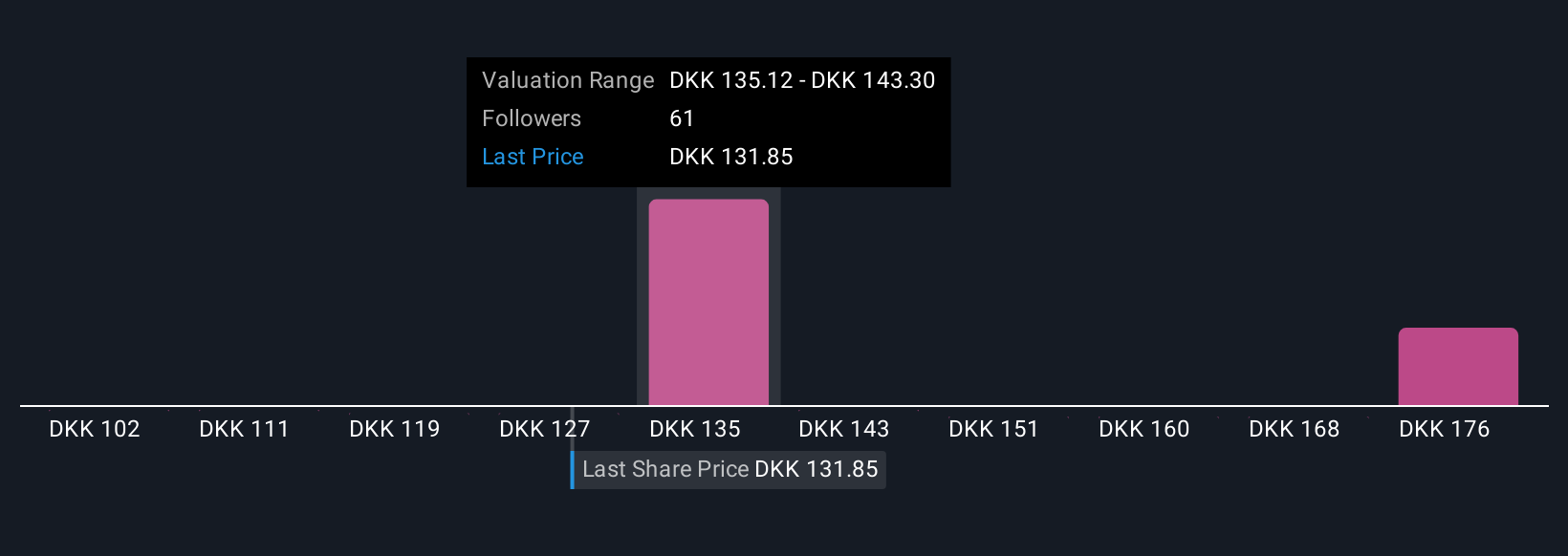

Uncover how Vestas Wind Systems' forecasts yield a DKK140.61 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put Vestas’ fair value between DKK102.43 and DKK183.11 across 11 separate analyses. While several see deep undervaluation, persistent margin risks from rising costs and price competition remain a key consideration for anyone weighing these diverse viewpoints.

Explore 11 other fair value estimates on Vestas Wind Systems - why the stock might be worth as much as 46% more than the current price!

Build Your Own Vestas Wind Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vestas Wind Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vestas Wind Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vestas Wind Systems' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:VWS

Vestas Wind Systems

Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives