3 European Dividend Stocks To Consider With At Least 3.7% Yield

Reviewed by Simply Wall St

As European markets experience an upswing, with major indices like the STOXX Europe 600 and Germany's DAX showing notable gains, investors are increasingly exploring dividend stocks as a means to generate steady income amidst fluctuating economic forecasts. In this environment, selecting dividend stocks with robust yields and stable financial health can offer a reliable income stream while potentially benefiting from market resilience.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.88% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.42% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.61% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.42% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.02% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.22% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.93% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.27% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.11% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.34% | ★★★★★★ |

Click here to see the full list of 239 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

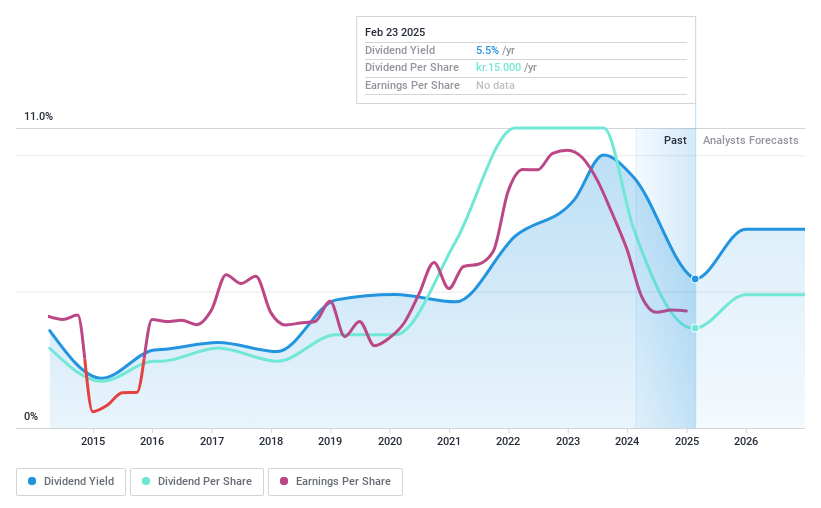

Solar (CPSE:SOLAR B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Solar A/S is a sourcing and services company that operates in the electrical, heating and plumbing, ventilation, and climate and energy solutions sectors across Denmark, Sweden, Norway, and the Netherlands with a market cap of DKK1.88 billion.

Operations: Solar A/S generates its revenue through three main segments: Trade (DKK1.17 billion), Industry (DKK4.34 billion), and Installation (DKK6.72 billion).

Dividend Yield: 5.8%

Solar A/S has faced volatility in dividend payments over the past decade, with recent decreases to DKK 15 per share for 2024. Despite this, dividends are well-covered by earnings (payout ratio of 72.5%) and cash flows (cash payout ratio of 49.3%). The company announced a special dividend of up to DKK 50 per share, indicating potential shareholder returns despite declining profit margins and earnings forecasts. Its current dividend yield is competitive within the Danish market.

- Unlock comprehensive insights into our analysis of Solar stock in this dividend report.

- The analysis detailed in our Solar valuation report hints at an inflated share price compared to its estimated value.

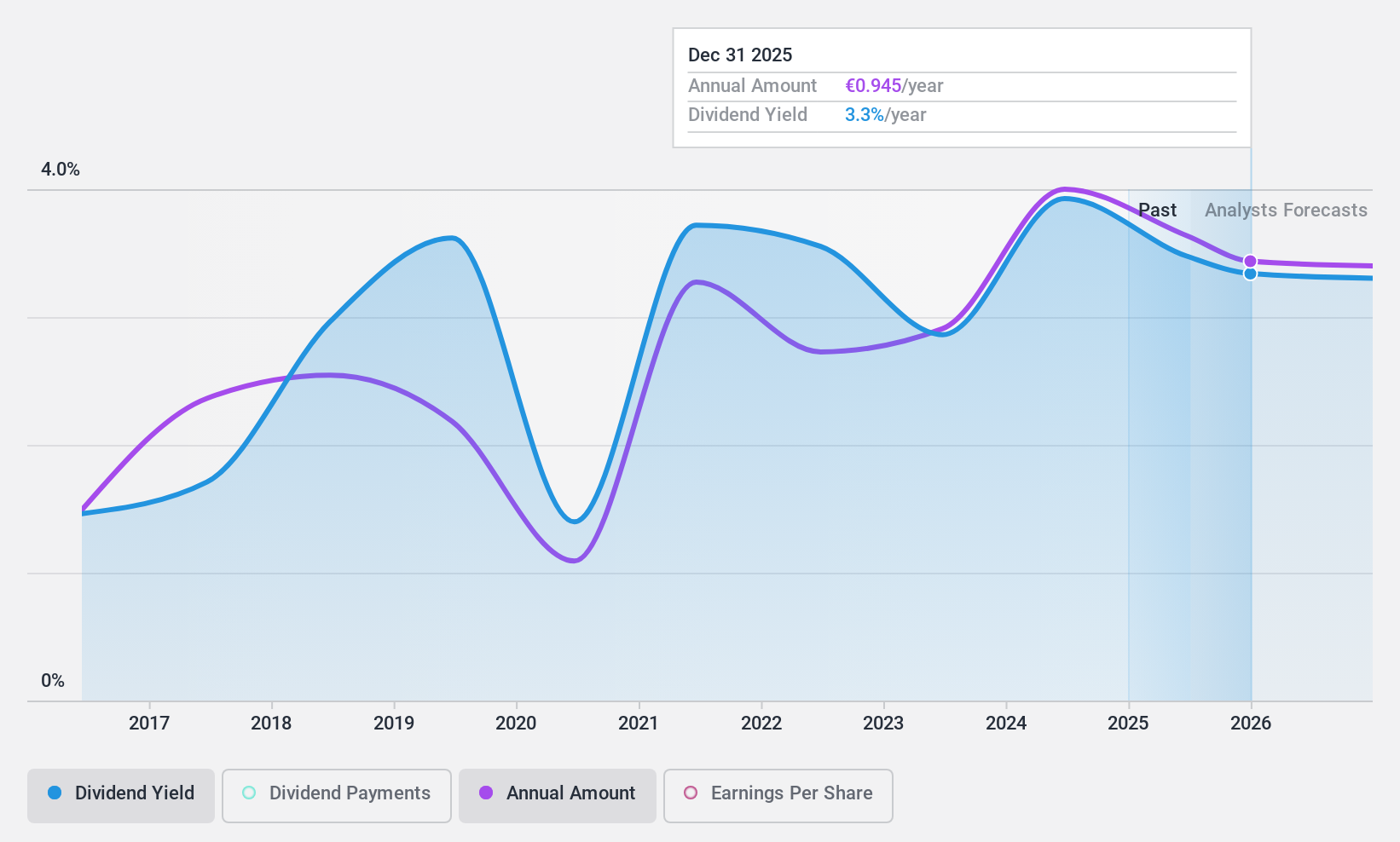

Groupe Guillin (ENXTPA:ALGIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Guillin S.A. is engaged in the production and sale of food packaging products both in France and internationally, with a market capitalization of €509.74 million.

Operations: Groupe Guillin S.A. generates revenue through the production and sale of food packaging products across various markets.

Dividend Yield: 4%

Groupe Guillin's dividend history shows volatility, with the latest annual dividend set at €1.00 per share. Despite a lower net income of €59.74 million for 2024, dividends remain covered by earnings (payout ratio of 29.2%) and cash flows (cash payout ratio of 69.5%). Trading below its estimated fair value by 70.2%, the stock offers good relative value but provides a lower yield than top French market payers, reflecting its inconsistent dividend track record over the past decade.

- Click to explore a detailed breakdown of our findings in Groupe Guillin's dividend report.

- Our expertly prepared valuation report Groupe Guillin implies its share price may be lower than expected.

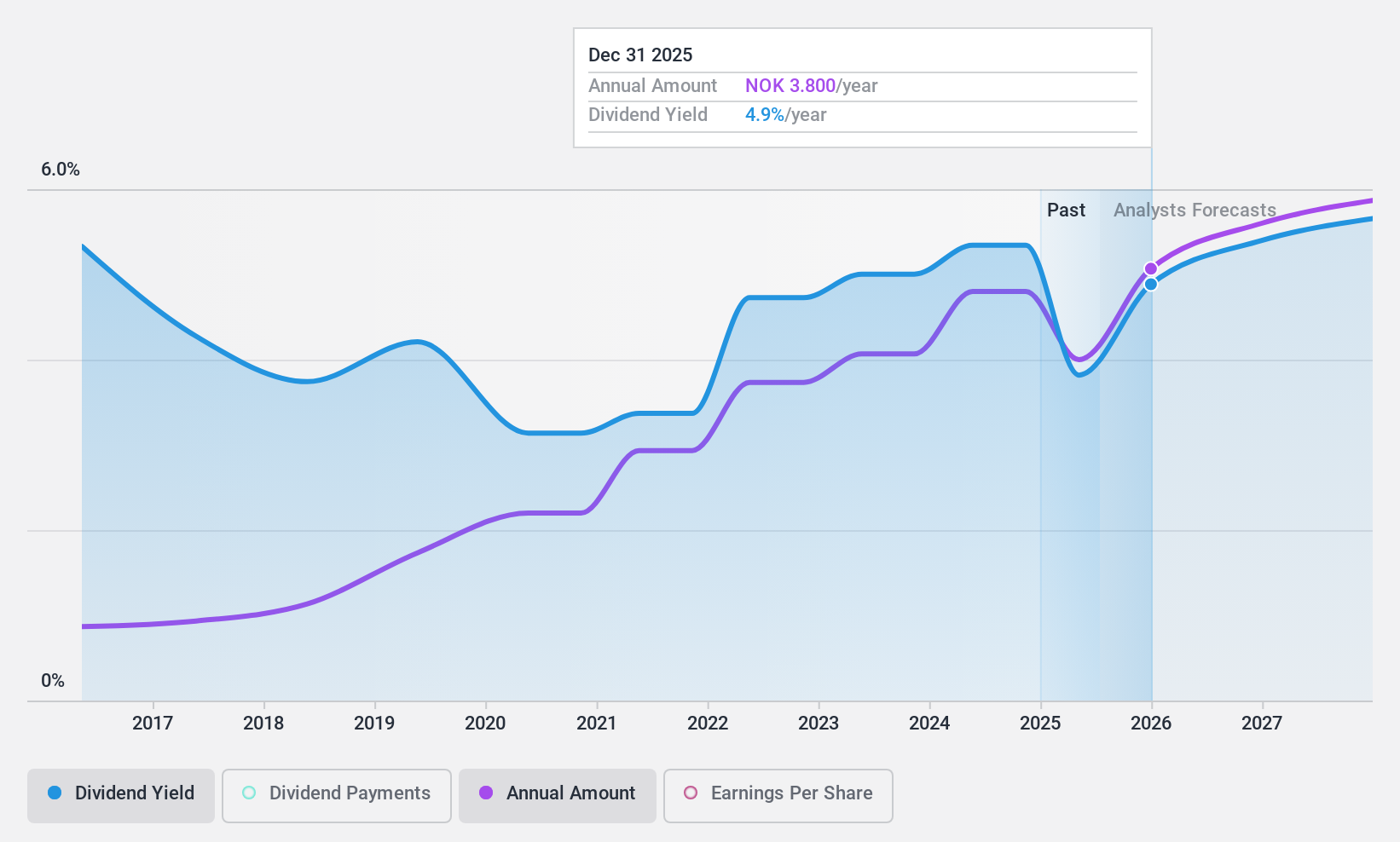

Bouvet (OB:BOUV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bouvet ASA is an IT and digital communication consultancy firm serving public and private sectors in Norway, Sweden, and internationally, with a market cap of NOK8.21 billion.

Operations: Bouvet ASA generates revenue from its IT consultancy services, amounting to NOK3.92 billion.

Dividend Yield: 3.8%

Bouvet ASA's dividend has shown consistent growth over the past decade, with the latest proposed payment set at NOK 3.00 per share for 2024. The payout ratio of 80.7% indicates dividends are covered by earnings, while a cash payout ratio of 38.3% suggests strong coverage by free cash flow. Despite a relatively modest yield of 3.75%, Bouvet's reliability in dividend payments and robust financial performance support its position as a stable choice for income-focused investors in Europe.

- Navigate through the intricacies of Bouvet with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Bouvet's current price could be inflated.

Summing It All Up

- Click here to access our complete index of 239 Top European Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bouvet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BOUV

Bouvet

Provides IT and digital communication consultancy services for public and private sectors in Norway, Sweden, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives