Should Rockwool's (CPSE:ROCK B) Lowered EBIT Margin Guidance Prompt Investor Reassessment?

Reviewed by Sasha Jovanovic

- On November 11, 2025, Rockwool A/S updated its full-year 2025 guidance, lowering its expected EBIT margin to a range of 14% to 15%, compared to the previous outlook of below 16%, while maintaining its revenue forecast at last year's level.

- This adjustment highlights a more measured profit outlook even as the company anticipates steady sales, reflecting current operating cost pressures.

- We'll explore how Rockwool's revised EBIT margin outlook may influence the company's longer-term investment case and margin resilience.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Rockwool Investment Narrative Recap

Being a Rockwool shareholder typically rests on long-term confidence in resilient demand for stone wool insulation, the company’s ability to pass on costs, and benefits from growth investments. The recent EBIT margin downgrade for 2025 signals ongoing cost headwinds, but with steady revenue guidance intact, the update mostly affects short-term earnings visibility without fundamentally shifting the most important catalyst, a rebound in delayed North American and European projects. The most immediate risk now is further margin pressure if elevated costs persist or market demand softens.

Among Rockwool’s recent announcements, the August 2025 revision of earnings guidance, which first signaled a lower full-year EBIT margin and flat revenue outlook, is especially relevant. This update foreshadowed November’s reduced profitability guidance, reinforcing concerns about persistent operating cost escalation and muted demand, key factors investors should weigh in the context of the delayed project recovery catalyst.

By contrast, investors should be aware that persistent cost inflation and slower demand trends could drive another margin reset if...

Read the full narrative on Rockwool (it's free!)

Rockwool's narrative projects €4.4 billion revenue and €607.3 million earnings by 2028. This requires 4.6% yearly revenue growth and a €77.3 million earnings increase from €530.0 million currently.

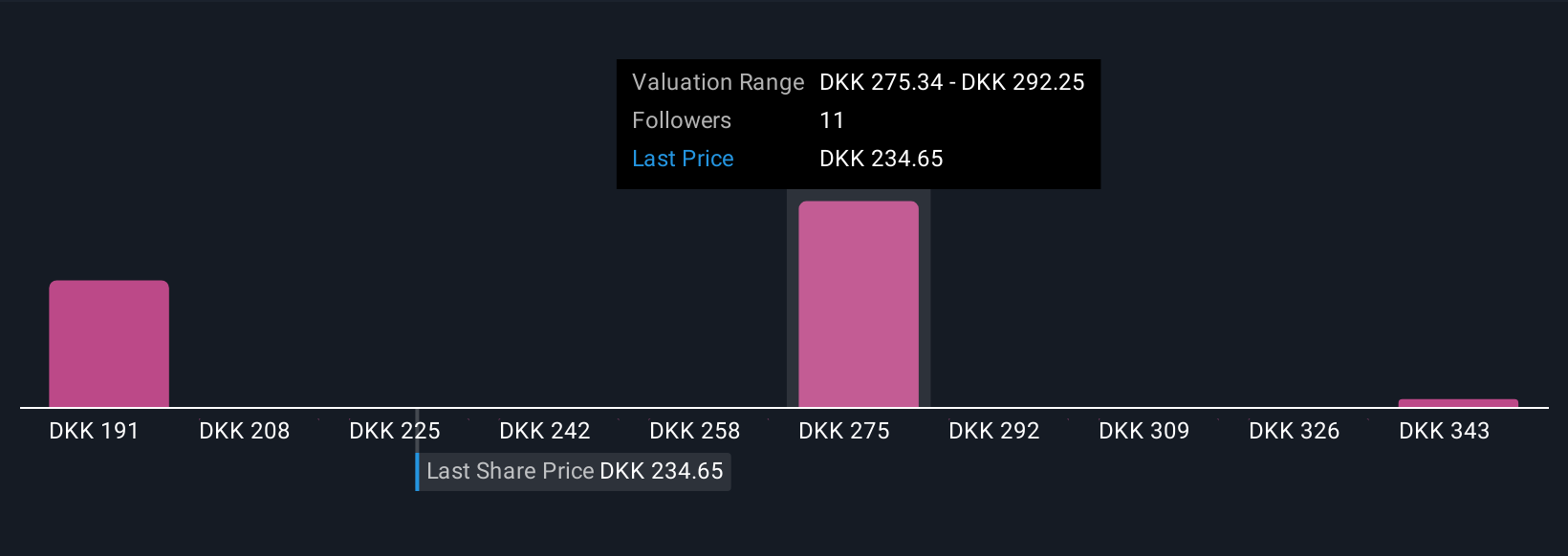

Uncover how Rockwool's forecasts yield a DKK286.23 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three members of the Simply Wall St Community ranged from DKK 189.60 to DKK 359.88 per share. Many participants remain focused on ongoing cost pressures and their effect on Rockwool’s near-term profitability, highlighting why opinions across the market can differ and are worth comparing.

Explore 3 other fair value estimates on Rockwool - why the stock might be worth 10% less than the current price!

Build Your Own Rockwool Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rockwool research is our analysis highlighting 6 key rewards that could impact your investment decision.

- Our free Rockwool research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rockwool's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ROCK B

Rockwool

Produces and sells stone wool insulation products in Western Europe, Eastern Europe, Russia, North America, Asia, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives