- Denmark

- /

- Construction

- /

- CPSE:PAAL B

Per Aarsleff (CPSE:PAAL B) Margin Slippage Tests Bullish Undervaluation Narrative After Q3 FY 2025

Reviewed by Simply Wall St

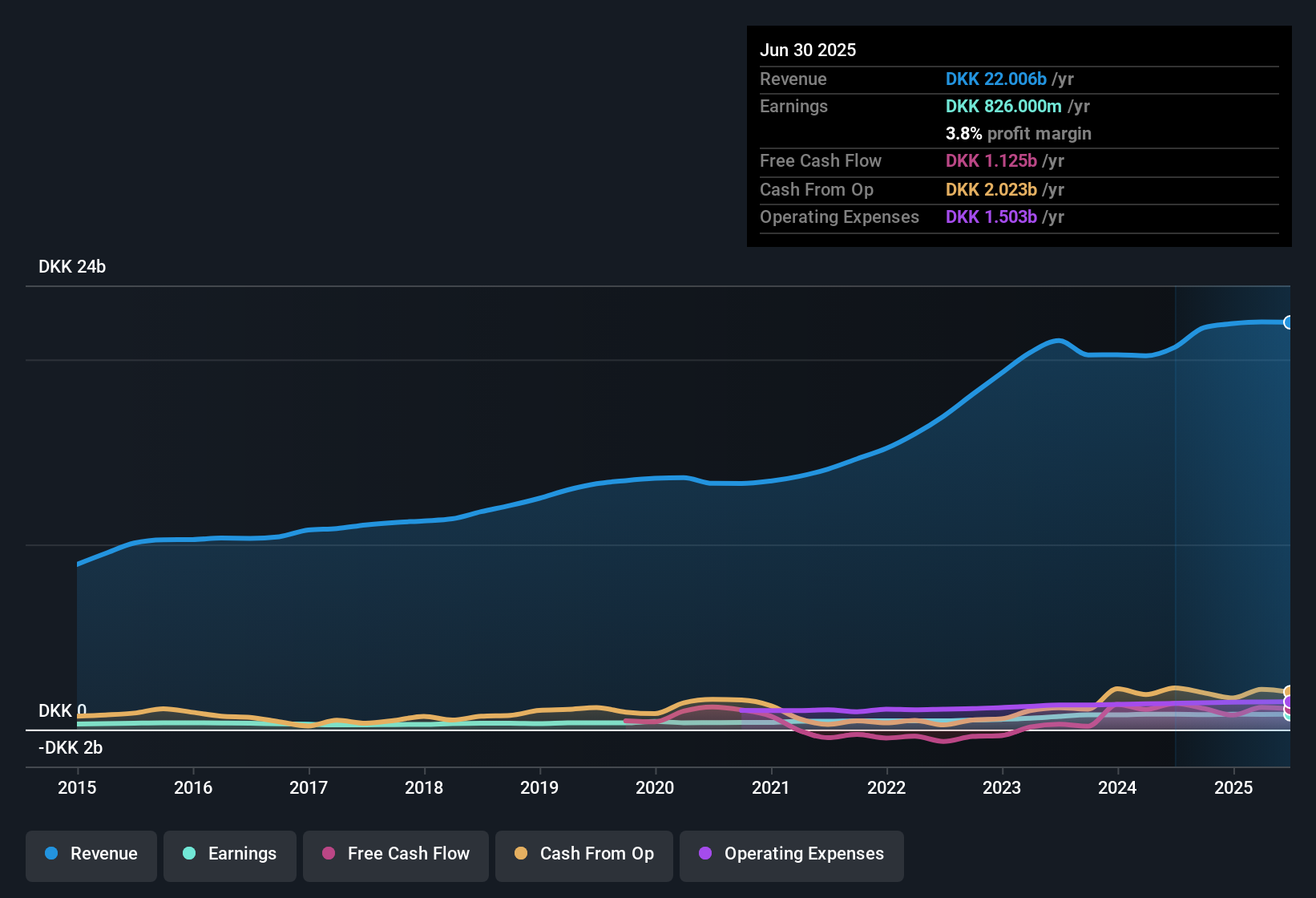

Per Aarsleff Holding (CPSE:PAAL B) has posted another solid update for FY 2025, with third quarter revenue of DKK 5.8 billion and EPS of DKK 12.37, setting the tone for a year that is tracking steadily against last year’s performance. The company has seen quarterly revenue move between DKK 5.2 billion and DKK 5.8 billion over the last three quarters, while EPS has ranged from DKK 8.84 to DKK 12.37. This gives investors a clear view of how earnings are holding up as margins ease slightly from last year’s levels.

See our full analysis for Per Aarsleff Holding.With the latest numbers on the table, the next step is to set them against the dominant bull and bear narratives around Per Aarsleff Holding and see which stories the margins, growth rates and forecasts really support.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM earnings steady at DKK 826 million

- Over the last twelve months Per Aarsleff Holding generated net income of DKK 826 million on revenue of about DKK 22.0 billion, with trailing EPS around DKK 43.6.

- What stands out for the bullish view is that this TTM profit line is broadly stable quarter to quarter, even though one year earnings growth is only 0.2 percent versus a five year average of 18.5 percent. This means:

- The long stretch of 18.5 percent annual earnings growth helps frame the current stability in net income as a pause rather than a break in the story.

- At the same time, the flat 0.2 percent recent growth figure is a concrete check on overly optimistic expectations that past high growth will automatically continue.

Margins soften from 4.0 percent to 3.8 percent

- Net profit margin in the latest trailing period is 3.8 percent, compared with 4.0 percent a year earlier, even as TTM revenue has risen from about DKK 20.2 billion to roughly DKK 22.0 billion.

- Critics highlight this modest margin compression as a bearish data point, and the numbers give that argument some backing because:

- Revenue growth near 5 percent per year pairs with only 0.2 percent earnings growth, so more top line is not yet translating into proportionate profit.

- The slippage from a 4.0 percent margin to 3.8 percent shows that even with higher sales, the business is absorbing slightly more cost pressure than it did a year ago.

Valuation premium versus peers despite 31.8 percent DCF discount

- The shares trade at DKK 850 against a DCF fair value of about DKK 1,246.60, implying a 31.8 percent discount, yet the current P E of 19.3 times is still above the European construction industry at 14.4 times and peers at 16.1 times.

- From a bullish angle, supporters point to the DCF fair value gap and forecast earnings growth of about 8.1 percent per year, but the valuation data injects useful tension into that case because:

- Paying a 19.3 times multiple for forecast earnings growth only modestly above the Danish market at 5.1 percent leaves less room if growth stays near the recent 0.2 percent pace.

- The combination of a peer premium multiple and a 31.8 percent DCF discount means investors need to decide whether the five year 18.5 percent earnings growth record is more relevant than the slower most recent year.

Investors weighing this mix of steady trailing profits, slightly lower margins, and a discounted DCF fair value versus peer rich multiples may want a deeper dive into how different scenarios could play out for the stock over time. 📊 Read the full Per Aarsleff Holding Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Per Aarsleff Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Per Aarsleff Holding combines only marginal earnings growth with softening profit margins, which raises questions about how reliably future profits can compound from here.

If you want businesses already proving they can grow more smoothly through cycles, use our CTA_SCREENER_STABLE_GROWTH to quickly focus on companies with steadier earnings momentum and fewer question marks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:PAAL B

Per Aarsleff Holding

Provides infrastructure and construction services for societies in Denmark and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)