Sydbank (CPSE:SYDB) Valuation: Assessing Premium Pricing After a Strong Year for Shareholders

Reviewed by Simply Wall St

Sydbank (CPSE:SYDB) shares have delivered solid returns over the past year, rising 63% and outpacing many peers in the Danish banking sector. Investors watching for value might be curious about what is driving the momentum.

See our latest analysis for Sydbank.

After a year of strong total shareholder returns, Sydbank’s recent upward momentum has continued, with a 3.2% share price return over the past month. The longer-term total shareholder return of 62.5% for the year suggests sustained investor confidence in the bank’s growth outlook and risk profile, even as enthusiasm may cool after such significant gains.

If you’re looking to spot more rising opportunities in the market, it could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With Sydbank still trading below analyst targets but not far off its recent highs, investors are left to wonder whether there is more value to unlock or if expectations for future growth are already fully reflected in the price.

Price-to-Earnings of 11x: Is it justified?

Sydbank currently trades at a price-to-earnings (P/E) ratio of 11, a figure that sits above the average P/E of its European banking peers. With a recent close at DKK518, this valuation signals the market is putting a premium on Sydbank’s earnings compared to other banks in the region.

The price-to-earnings ratio is a classic metric for banks, showing how much investors are willing to pay for each krone of profit. For Sydbank, a higher P/E reflects elevated expectations, either for consistent earnings delivery or some unique strength not found in competitors.

However, compared to the European banks industry average (9.7x) and peer average (9x), Sydbank does appear expensive. That premium could narrow if earnings do not outpace rivals soon. Regression analysis suggests the fair P/E is closer to 11.1x, indicating that the current valuation might not be far off a justified level assuming all else is equal.

Explore the SWS fair ratio for Sydbank

Result: Price-to-Earnings of 11x (OVERVALUED)

However, any slowdown in Sydbank’s revenue or profit growth could cool investor sentiment and challenge the current premium valuation.

Find out about the key risks to this Sydbank narrative.

Another Perspective: Deep Value Revealed?

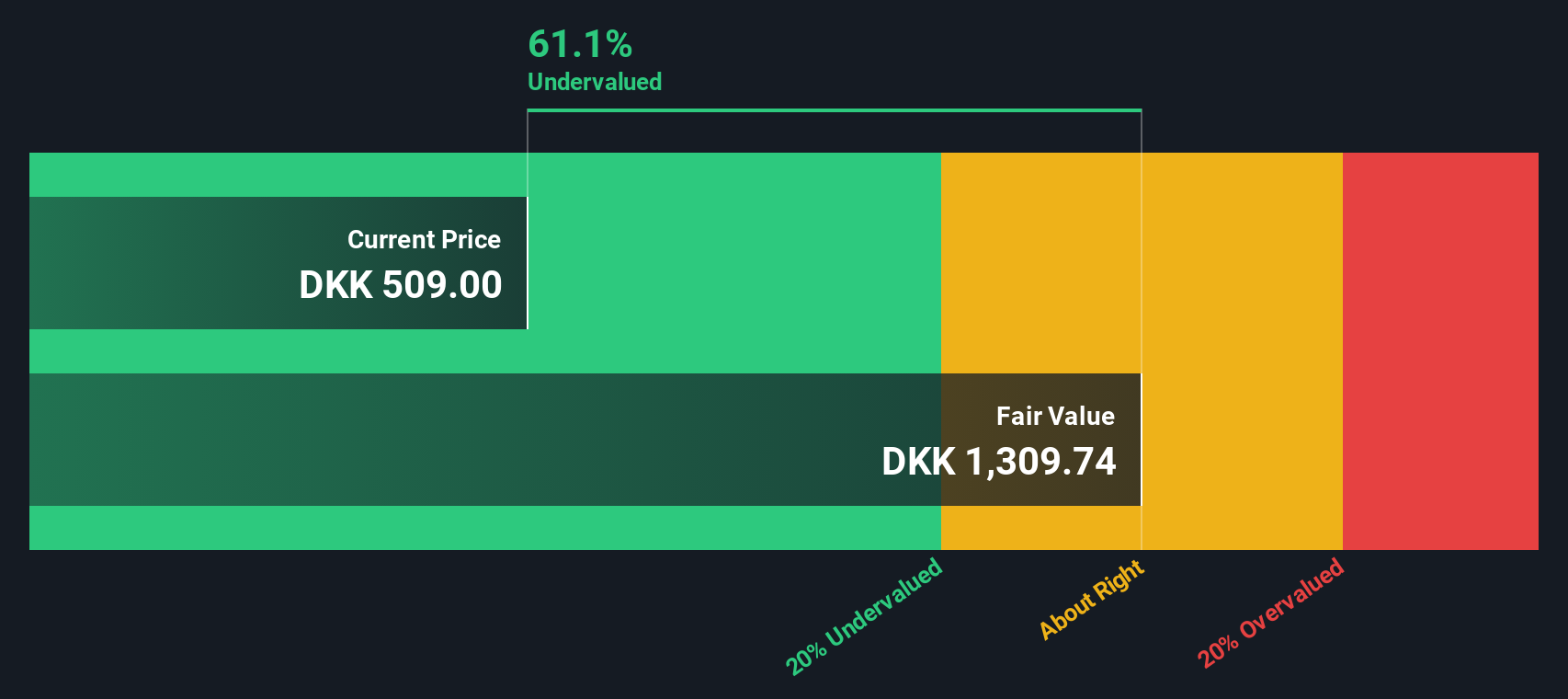

While Sydbank’s price-to-earnings ratio appears high, our DCF model paints a much different picture. According to this approach, Sydbank is trading at a steep discount, estimated to be 60% below its fair value. Could the market be overlooking a bigger opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sydbank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sydbank Narrative

If you have a different perspective or want to dive into the numbers yourself, you can build your own analysis in just a few minutes, Do it your way.

A great starting point for your Sydbank research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t stop with just one bank. Expand your horizons and access new sectors, future trends, and hidden value by using the Simply Wall Street Screener today.

- Catch industry leaders tapping into the next tech wave by reviewing these 24 AI penny stocks with advanced machine learning and AI-powered growth stories.

- Tap into income potential by targeting these 17 dividend stocks with yields > 3% that offer robust dividend yields and stable cash flows for long-term rewards.

- Stay ahead of the curve by checking out these 874 undervalued stocks based on cash flows where current prices don’t reflect the underlying value. This may set the stage for tomorrow’s success stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:SYDB

Sydbank

Provides various banking products and services to corporate, private, retail, and institutional clients in Denmark and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives