Fynske Bank (CPH:FYNBK) Share Prices Have Dropped 9.8% In The Last Three Years

Fynske Bank A/S (CPH:FYNBK) shareholders should be happy to see the share price up 16% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 9.8% in the last three years, falling well short of the market return.

Check out our latest analysis for Fynske Bank

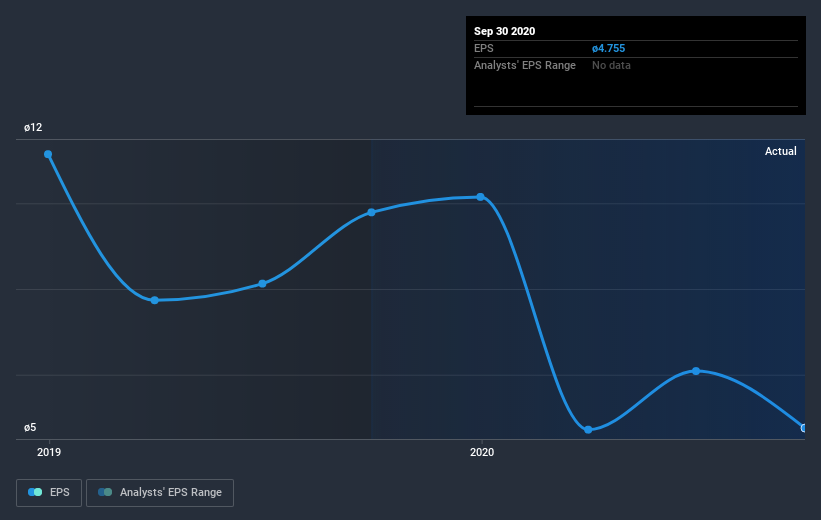

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years that the share price fell, Fynske Bank's earnings per share (EPS) dropped by 24% each year. In comparison the 3.4% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Fynske Bank's key metrics by checking this interactive graph of Fynske Bank's earnings, revenue and cash flow.

A Different Perspective

Fynske Bank provided a TSR of 2.0% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 3% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It's always interesting to track share price performance over the longer term. But to understand Fynske Bank better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Fynske Bank you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.

When trading Fynske Bank or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About CPSE:FYNBK

Fynske Bank

Provides banking products and services for private customers, and small and medium-sized businesses in Denmark.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives