This Is Why P/F BankNordik's (CPH:BNORDIK CSE) CEO Compensation Looks Appropriate

CEO Arni Ellefsen has done a decent job of delivering relatively good performance at P/F BankNordik (CPH:BNORDIK CSE) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 25 March 2022. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for P/F BankNordik

Comparing P/F BankNordik's CEO Compensation With the industry

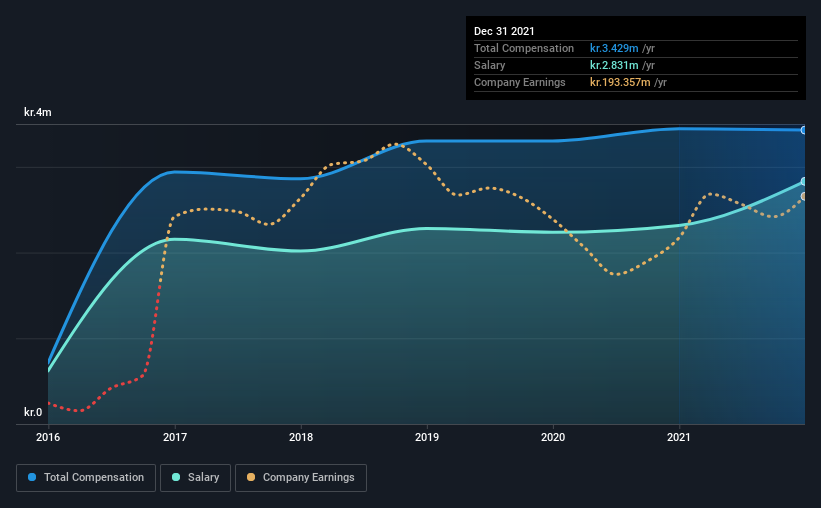

At the time of writing, our data shows that P/F BankNordik has a market capitalization of kr.1.7b, and reported total annual CEO compensation of kr.3.4m for the year to December 2021. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is kr.2.83m, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from kr.673m to kr.2.7b, we found that the median CEO total compensation was kr.3.6m. This suggests that P/F BankNordik remunerates its CEO largely in line with the industry average. What's more, Arni Ellefsen holds kr.2.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | kr.2.8m | kr.2.3m | 83% |

| Other | kr.598k | kr.1.1m | 17% |

| Total Compensation | kr.3.4m | kr.3.4m | 100% |

On an industry level, roughly 83% of total compensation represents salary and 17% is other remuneration. There isn't a significant difference between P/F BankNordik and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

P/F BankNordik's Growth

P/F BankNordik has reduced its earnings per share by 9.3% a year over the last three years. It achieved revenue growth of 25% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has P/F BankNordik Been A Good Investment?

Most shareholders would probably be pleased with P/F BankNordik for providing a total return of 128% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The overall company performance has been commendable, however there are still areas for improvement. Despite robust revenue growth, until EPS growth improves, shareholders may be hesitant to increase CEO pay by too much.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 2 warning signs (and 1 which makes us a bit uncomfortable) in P/F BankNordik we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:FOBANK

Føroya Banki

Provides personal and corporate banking services in the Faroe Islands and Greenland.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion