- Germany

- /

- Electric Utilities

- /

- DB:LEC

The Lechwerke (FRA:LEC) Share Price Has Gained 43% And Shareholders Are Hoping For More

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, Lechwerke AG (FRA:LEC) shareholders have seen the share price rise 43% over three years, well in excess of the market return (-0.2%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 1.7% in the last year, including dividends.

Check out our latest analysis for Lechwerke

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

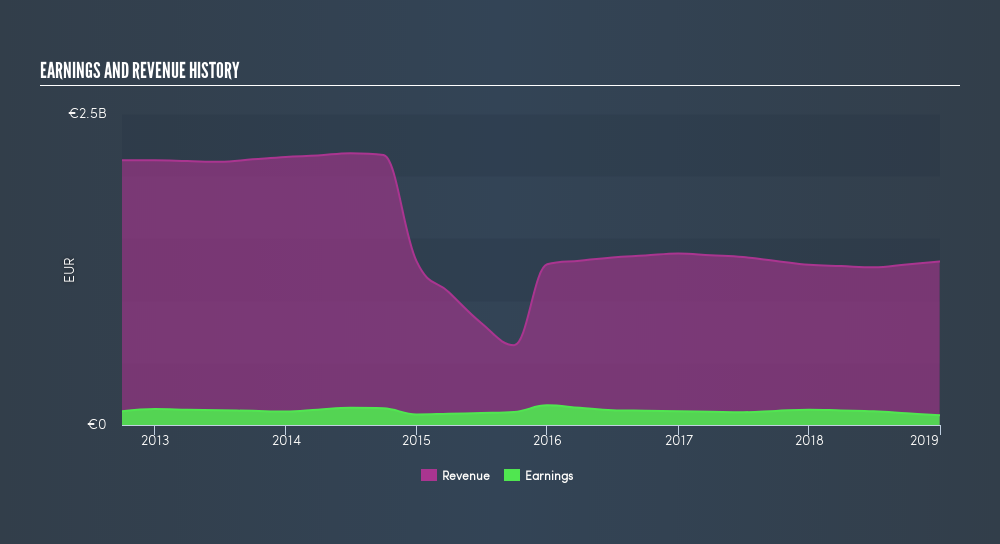

Over the last three years, Lechwerke failed to grow earnings per share, which fell 5.0% (annualized). Given the share price resilience, we don't think the (declining) EPS numbers are a good measure of how the business is moving forward, right now. Therefore, it makes sense to look into other metrics.

The revenue drop of 1.3% is as underwhelming as some politicians. The only thing that's clear is there is low correlation between Lechwerke's share price and its historic fundamental data. Further research may be required!

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Lechwerke the TSR over the last 3 years was 57%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Lechwerke shareholders have received a total shareholder return of 1.7% over the last year. That's including the dividend. However, the TSR over five years, coming in at 11% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Is Lechwerke cheap compared to other companies? These 3 valuation measures might help you decide.

Of course Lechwerke may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:LEC

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives