- Germany

- /

- Electric Utilities

- /

- DB:LEC

If You Had Bought Lechwerke (FRA:LEC) Shares Three Years Ago You'd Have Made 51%

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, the Lechwerke AG (FRA:LEC) share price is up 51% in the last three years, clearly besting than the market return of around 7.0% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 21%, including dividends.

View our latest analysis for Lechwerke

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, Lechwerke actually saw its earnings per share (EPS) drop 5.0% per year. Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. Therefore, it makes sense to look into other metrics.

The revenue drop of 1.3% is as underwhelming as some politicians. The only thing that's clear is there is low correlation between Lechwerke's share price and its historic fundamental data. Further research may be required!

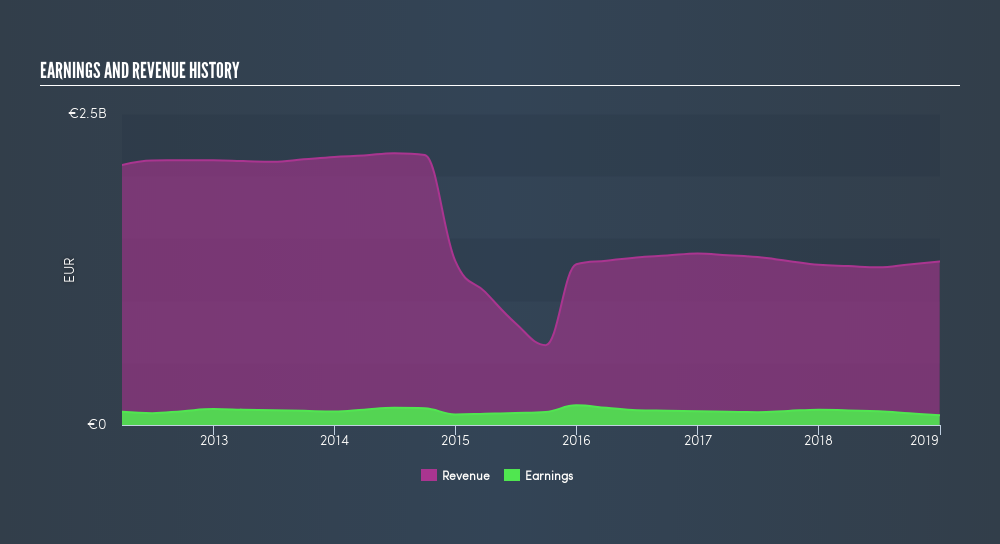

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Lechwerke, it has a TSR of 68% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Lechwerke has rewarded shareholders with a total shareholder return of 21% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before deciding if you like the current share price, check how Lechwerke scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:LEC

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives