- Germany

- /

- Renewable Energy

- /

- XTRA:UN0

Uniper (XTRA:UN0): Assessing Whether Current Valuation Reflects Recent Investor Sentiment Shift

Reviewed by Simply Wall St

Price-To-Sales Ratio of 0.2x: Is it justified?

Based on Uniper's current valuation, the stock trades at a price-to-sales (P/S) ratio of 0.2x, significantly below both the peer average of 0.7x and the European Renewable Energy industry average of 2.6x. This suggests that, relative to its sales, Uniper is valued much more cheaply than comparable companies in its sector.

The price-to-sales ratio compares a company's market capitalization to its total sales, providing a quick measure of how much investors are willing to pay for each euro of revenue generated. For sectors where profitability may fluctuate, such as utilities or renewable energy, the P/S ratio can give useful insight into relative valuation when earnings are volatile or negative.

Given Uniper’s low multiple relative to peers and the industry, investors appear to be pricing in ongoing challenges or uncertainty about future growth. However, this low valuation could also signal the potential for outsized returns if the company manages to outperform expectations or improve its fundamentals.

Result: Fair Value of €33.75 (ABOUT RIGHT)

See our latest analysis for Uniper.However, ongoing revenue declines and persistent net losses continue to cast doubt on Uniper’s recovery. As a result, any turnaround remains far from guaranteed.

Find out about the key risks to this Uniper narrative.Another View: A DCF Model Tells a Different Story

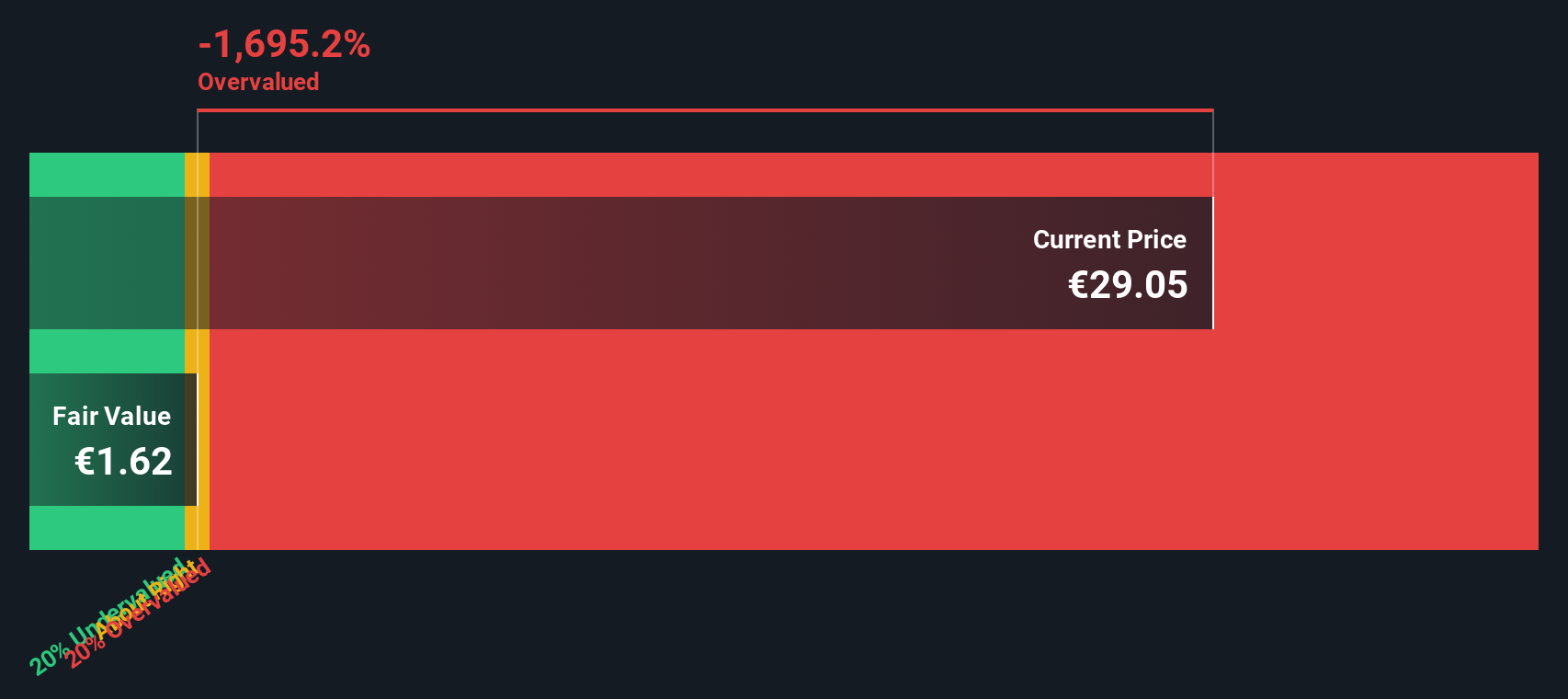

Looking beyond sales-based comparisons, the SWS DCF model values Uniper quite differently and suggests the shares are actually overvalued. It challenges the idea that a low price relative to sales always means good value. Which side will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Uniper Narrative

If our conclusions do not entirely align with your perspective, or if you prefer to examine the details on your own, you can assemble your version of the story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Uniper.

Looking for more investment ideas?

Stay ahead by searching beyond the usual picks. The Simply Wall Street Screener helps you discover hidden opportunities across the market. You could be missing out on standout performers that fit your strategy perfectly.

- Supercharge your portfolio with companies harnessing artificial intelligence to shape tomorrow. Start your search with AI penny stocks.

- Uncover high-potential companies that the market may have overlooked by using the power of undervalued stocks based on cash flows.

- Step into the future of finance by filtering for pioneers at the forefront of digital currencies with cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About XTRA:UN0

Uniper

Operates as an energy company in Germany, the United Kingdom, Sweden, the rest of Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives