- Germany

- /

- Renewable Energy

- /

- XTRA:RWE

RWE (XTRA:RWE): Examining Valuation After a 6% Share Price Gain This Month

Reviewed by Simply Wall St

RWE (XTRA:RWE) has seen some interesting movement in its share price over the past month, gaining nearly 6%. For investors, this raises questions about what is driving the recent momentum and how sustainable it might be.

See our latest analysis for RWE.

RWE's steady climb is drawing attention, especially with a year-to-date share price return of almost 47% and a total shareholder return of 41% over the past 12 months. While there have been small swings in recent days, this overall momentum reflects growing confidence in RWE’s positioning for both growth and stability.

If strong momentum like RWE's has you wondering what else could be trending, this could be the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

With RWE's impressive rally and analyst targets suggesting only modest further upside, the key question is whether the stock remains undervalued or if the market has already taken the company's future growth prospects into account.

Most Popular Narrative: 7.9% Undervalued

The most widely followed narrative values RWE shares at €47.16, which is above the latest close of €43.44. This signals room for upside if the narrative’s financial projections play out.

Major policy tailwinds in core markets, the U.K. retention of a single price zone, extension of CfD periods to 20 years, higher auction price caps, and the new U.S. "Big Beautiful Bill" with tax incentives, are expected to provide greater revenue visibility and de-risk project cash flows. This may support higher recurring revenues and improved earnings quality over time.

Curious what drives a valuation above today’s price despite muted earnings growth expectations? The narrative leans heavily on stable margins and bold sector forecasts. That is just the tip of the iceberg. Dive into the full breakdown to uncover the specific projections and financial levers powering this valuation call.

Result: Fair Value of €47.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently weak wind conditions or tighter government policies could quickly undermine these optimistic projections. This adds unpredictability to RWE’s growth story.

Find out about the key risks to this RWE narrative.

Another View: Market Multiples Tell a Different Story

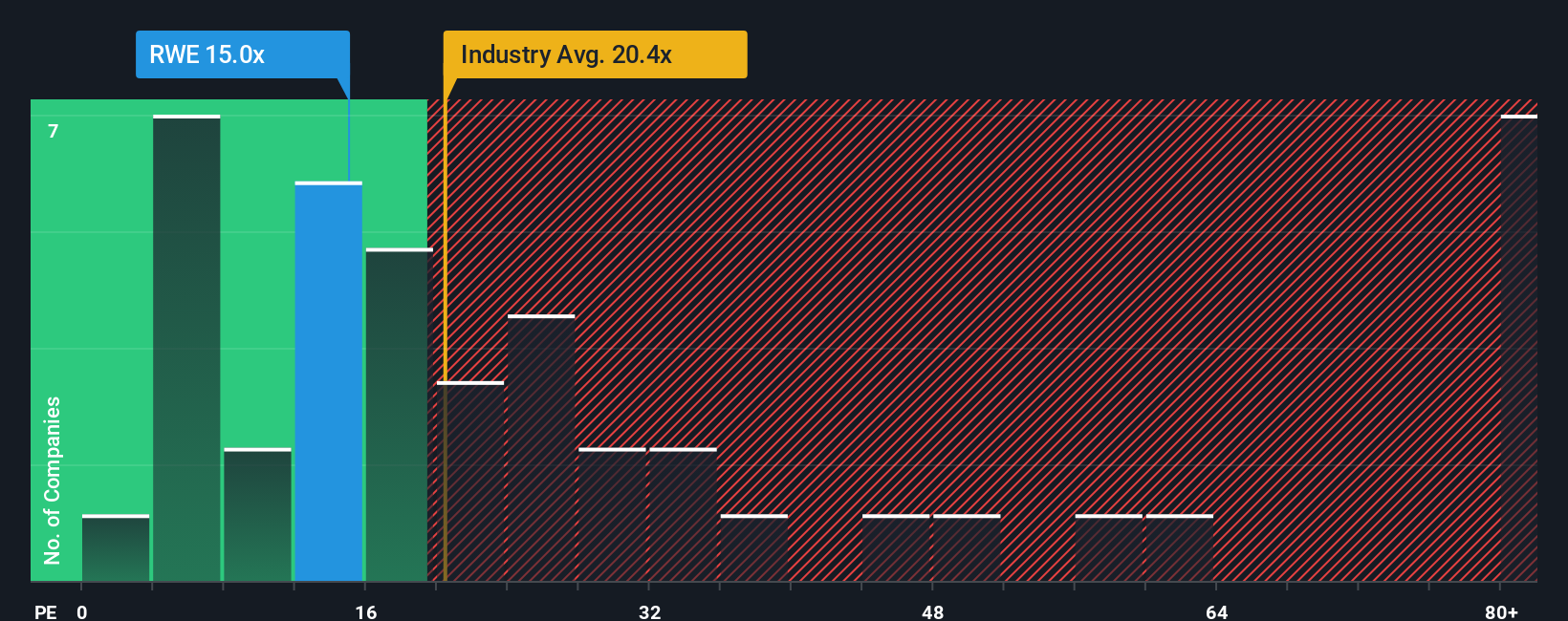

Looking through the lens of price-to-earnings ratios, RWE appears to be reasonably valued at 14.7x. This is lower than the German market average of 17.7x and well below peers at 31.7x. However, it stands above the “fair ratio” of 12.3x, which the market could eventually target. This gap hints at possible valuation risk if market sentiment shifts. Could this mean that optimism is already priced in, or is there more room to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RWE Narrative

If you see things differently or want to dig deeper into the data, you can craft your own narrative about RWE in just a few minutes. Do it your way

A great starting point for your RWE research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio with new opportunities and seize what others might miss. Take charge now and see what trends are powering the smartest next moves.

- Capitalize on the tech revolution by reviewing these 25 AI penny stocks that are transforming industries through artificial intelligence breakthroughs.

- Secure your income stream by evaluating these 15 dividend stocks with yields > 3% proven to generate yields above 3%, supporting resilient returns through all market cycles.

- Position yourself at the forefront of innovation by selecting these 27 quantum computing stocks fuelling progress in quantum computing and future-focused technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RWE

RWE

Generates and supplies electricity from renewable and conventional sources in Germany, the United Kingdom, rest of Europe, North America, and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success