- Germany

- /

- Renewable Energy

- /

- XTRA:RWE

Improved Revenues Required Before RWE Aktiengesellschaft (ETR:RWE) Shares Find Their Feet

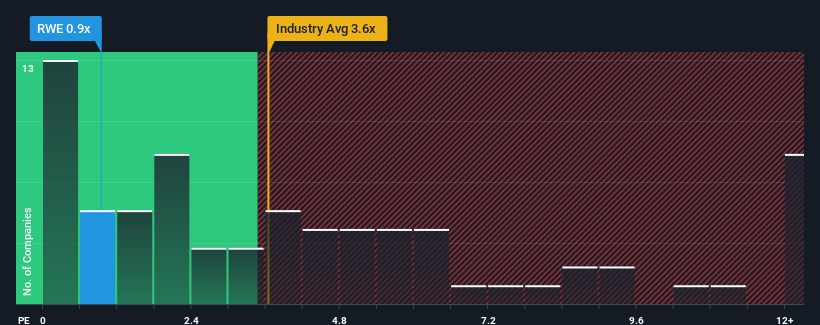

When close to half the companies in the Renewable Energy industry in Germany have price-to-sales ratios (or "P/S") above 3.2x, you may consider RWE Aktiengesellschaft (ETR:RWE) as a highly attractive investment with its 0.9x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for RWE

What Does RWE's Recent Performance Look Like?

With only a limited decrease in revenue compared to most other companies of late, RWE has been doing relatively well. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. You'd much rather the company continue improving its revenue if you still believe in the business. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on RWE.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like RWE's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. Still, the latest three year period has seen an excellent 138% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 8.2% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 18% per year, which is noticeably more attractive.

In light of this, it's understandable that RWE's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of RWE's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 4 warning signs for RWE (of which 2 are a bit concerning!) you should know about.

If these risks are making you reconsider your opinion on RWE, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:RWE

RWE

Generates and supplies electricity from renewable and conventional sources in Germany, the United Kingdom, rest of Europe, North America, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives