- Germany

- /

- Electric Utilities

- /

- XTRA:EBK

How Investors Are Reacting To EnBW Energie Baden-Württemberg (XTRA:EBK) Q3 Profit Drop Amid Rising Sales

Reviewed by Sasha Jovanovic

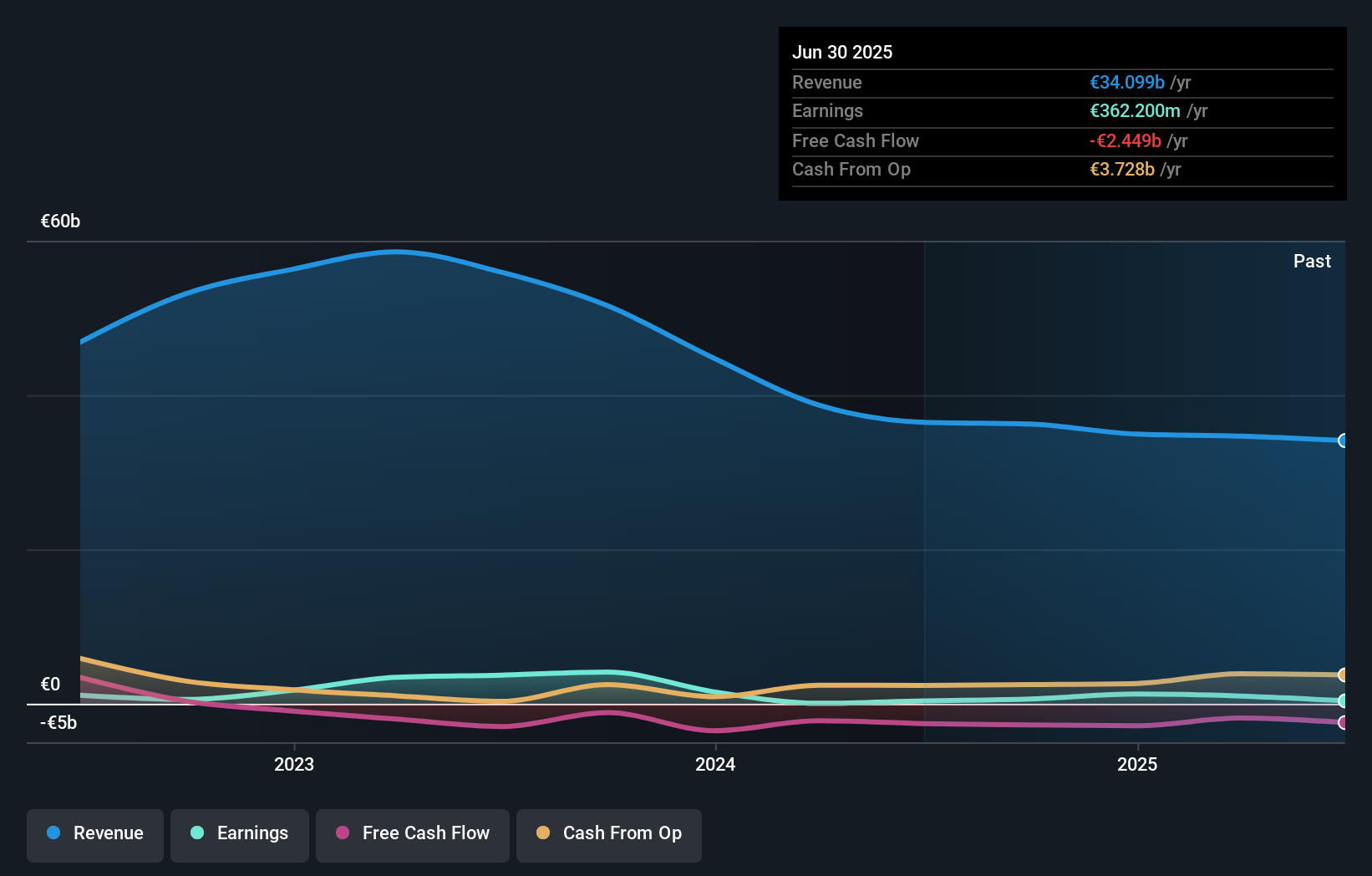

- On November 12, 2025, EnBW Energie Baden-Württemberg AG reported its third quarter and nine-month results, highlighting quarterly sales of €8.50 billion and net income of €126.2 million for Q3, both compared to the year-ago period.

- While quarterly sales increased year-over-year, the company experienced a sharp drop in both quarterly and nine-month net income, suggesting evolving profitability pressures despite stable overall revenue.

- We'll explore how this substantial decline in net income frames EnBW's current investment narrative and future performance considerations.

Find companies with promising cash flow potential yet trading below their fair value.

What Is EnBW Energie Baden-Württemberg's Investment Narrative?

The big picture for EnBW Energie Baden-Württemberg asks investors to trust in the company’s role as an established utility amid Germany’s evolving energy sector, even as financial challenges command attention. The sharp drop in both quarterly and nine-month net income in the latest report makes profitability pressures a major short-term risk, especially given a recent history of one-off charges and year-on-year earnings declines. While revenue trends have remained relatively steady, the sustained earnings weakness raises questions about cost management and the timing of any meaningful recovery. This earnings update could shift the focus away from near-term catalysts such as dividend growth or grid expansion, by elevating concerns surrounding earnings quality and cash flow coverage. As the market absorbs this report, the narrative around EnBW is likely to hinge more on addressing these profit headwinds than on previously anticipated triggers for upside.

But not all investors may fully appreciate the implications of EnBW’s current dividend coverage risks. EnBW Energie Baden-Württemberg's share price has been on the slide but might be up to 39% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 3 other fair value estimates on EnBW Energie Baden-Württemberg - why the stock might be worth 28% less than the current price!

Build Your Own EnBW Energie Baden-Württemberg Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EnBW Energie Baden-Württemberg research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free EnBW Energie Baden-Württemberg research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EnBW Energie Baden-Württemberg's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnBW Energie Baden-Württemberg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EBK

EnBW Energie Baden-Württemberg

Operates as an integrated energy company in Germany, Rest of Europe, and internationally.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives