- Germany

- /

- Transportation

- /

- DB:R0C

Discovering Europe's Undiscovered Gems This November 2025

Reviewed by Simply Wall St

As Europe's major stock indexes show mixed performance, with the pan-European STOXX Europe 600 Index recently pulling back slightly after hitting a fresh high, investors are keenly watching for opportunities amid shifting economic conditions. With the European Central Bank holding interest rates steady and inflation near target, small-cap stocks may offer unique potential for growth in this environment. Identifying promising stocks often involves looking at companies with strong fundamentals and resilience to broader market fluctuations, making them potential gems in today’s dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Evergent Investments (BVB:EVER)

Simply Wall St Value Rating: ★★★★★☆

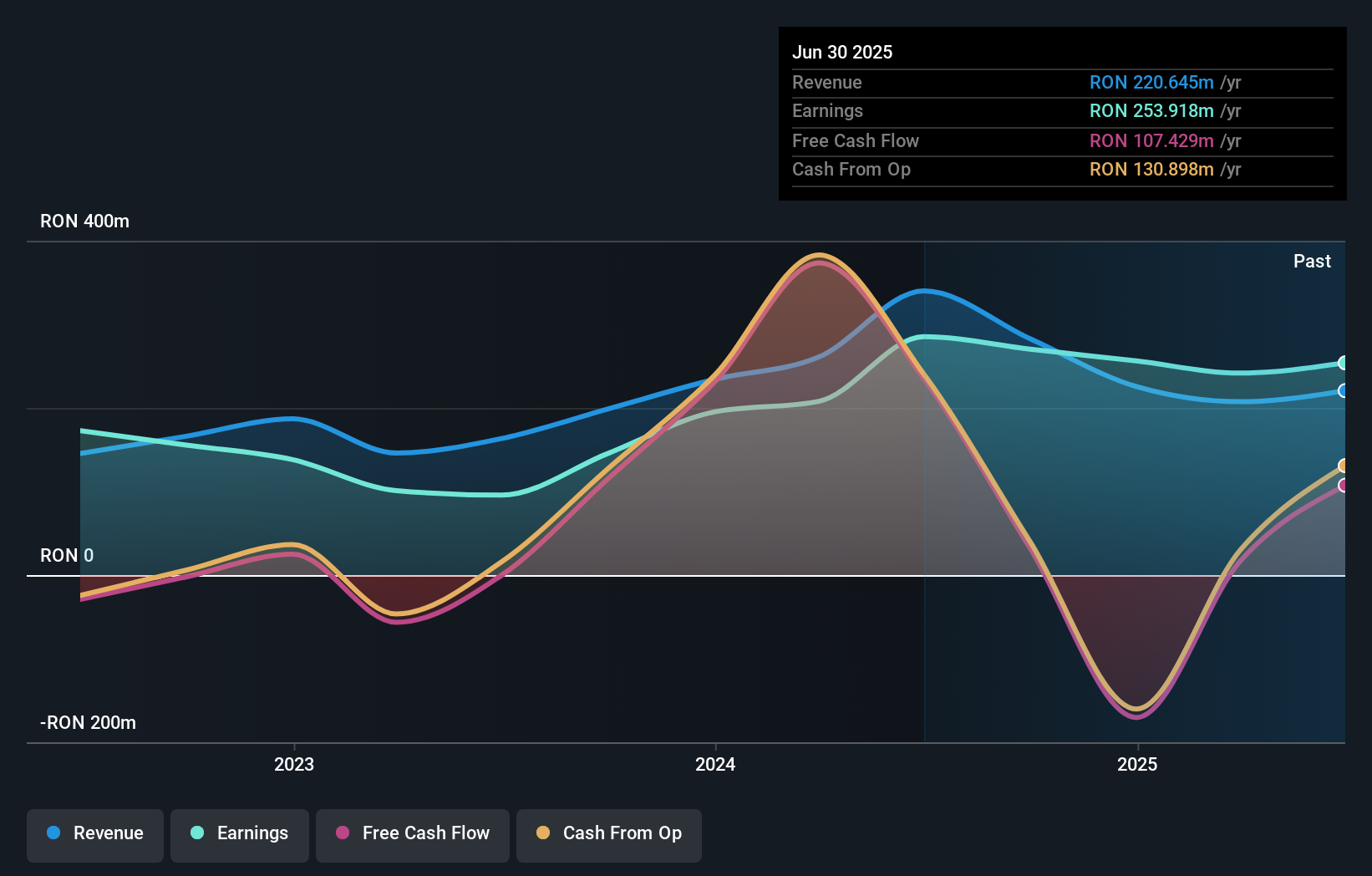

Overview: Evergent Investments SA is a publicly owned investment manager with a market capitalization of RON 2.11 billion.

Operations: Evergent Investments generates revenue primarily from Financial Investment Services, contributing RON 190.94 million, followed by the Manufacture of Agricultural Machinery and Equipment at RON 19.96 million.

Evergent Investments, a small yet intriguing player in the European market, showcases a robust financial position with more cash than total debt. Its net income for the first half of 2025 was RON 110.46 million, slightly lower than last year's RON 112.69 million, but earnings per share improved to RON 0.1265 from RON 0.1258. Despite an -11% earnings growth over the past year, it fares better compared to its industry peers' -57.5%. The company enjoys high-quality earnings and interest payments are well covered by EBIT at a solid 12.3x coverage, indicating strong operational efficiency and sound financial management strategies in place.

- Navigate through the intricacies of Evergent Investments with our comprehensive health report here.

Explore historical data to track Evergent Investments' performance over time in our Past section.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

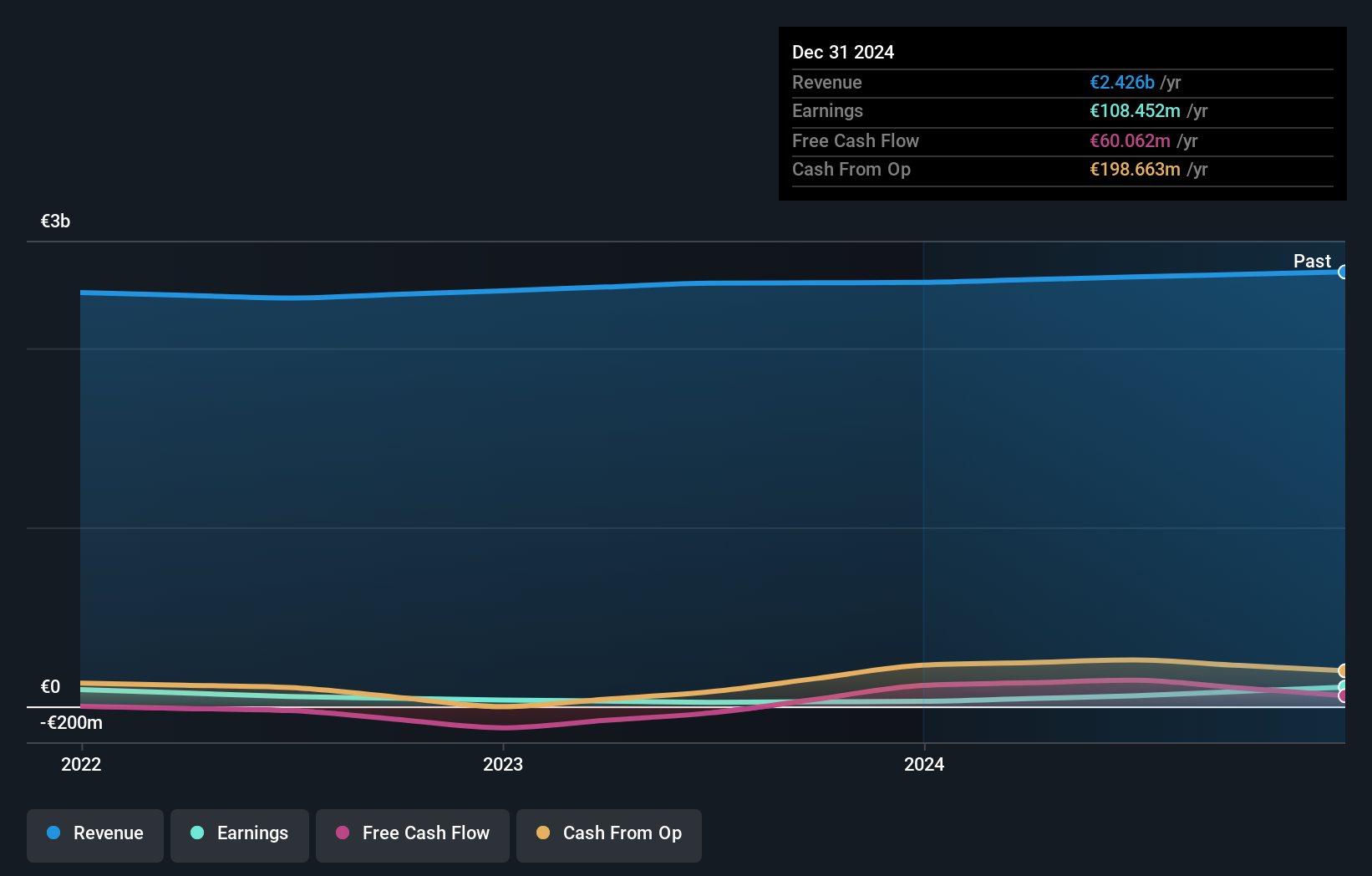

Overview: Paul Hartmann AG is a company that manufactures and sells medical and care products across various regions including Germany, Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market capitalization of approximately €813.35 million.

Operations: The company's revenue streams include Wound Care (€619.14 million), Infection Management (€523.34 million), Incontinence Management (€773.61 million), and Complementary divisions (€510.39 million).

Paul Hartmann, a notable player in the medical equipment industry, has shown mixed financial performance recently. Earnings have decreased by 9.5% annually over the last five years, while their net debt to equity ratio rose from 11.1% to 32.7%, indicating increased leverage but still within satisfactory levels at 19%. Despite this, the company reported a robust earnings growth of 36.9% last year, outpacing the industry's average of 13.3%. With a price-to-earnings ratio at an attractive level of 10x compared to Germany's market average of 17.9x, it offers potential value for investors seeking opportunities in smaller European stocks.

- Take a closer look at Paul Hartmann's potential here in our health report.

Gain insights into Paul Hartmann's past trends and performance with our Past report.

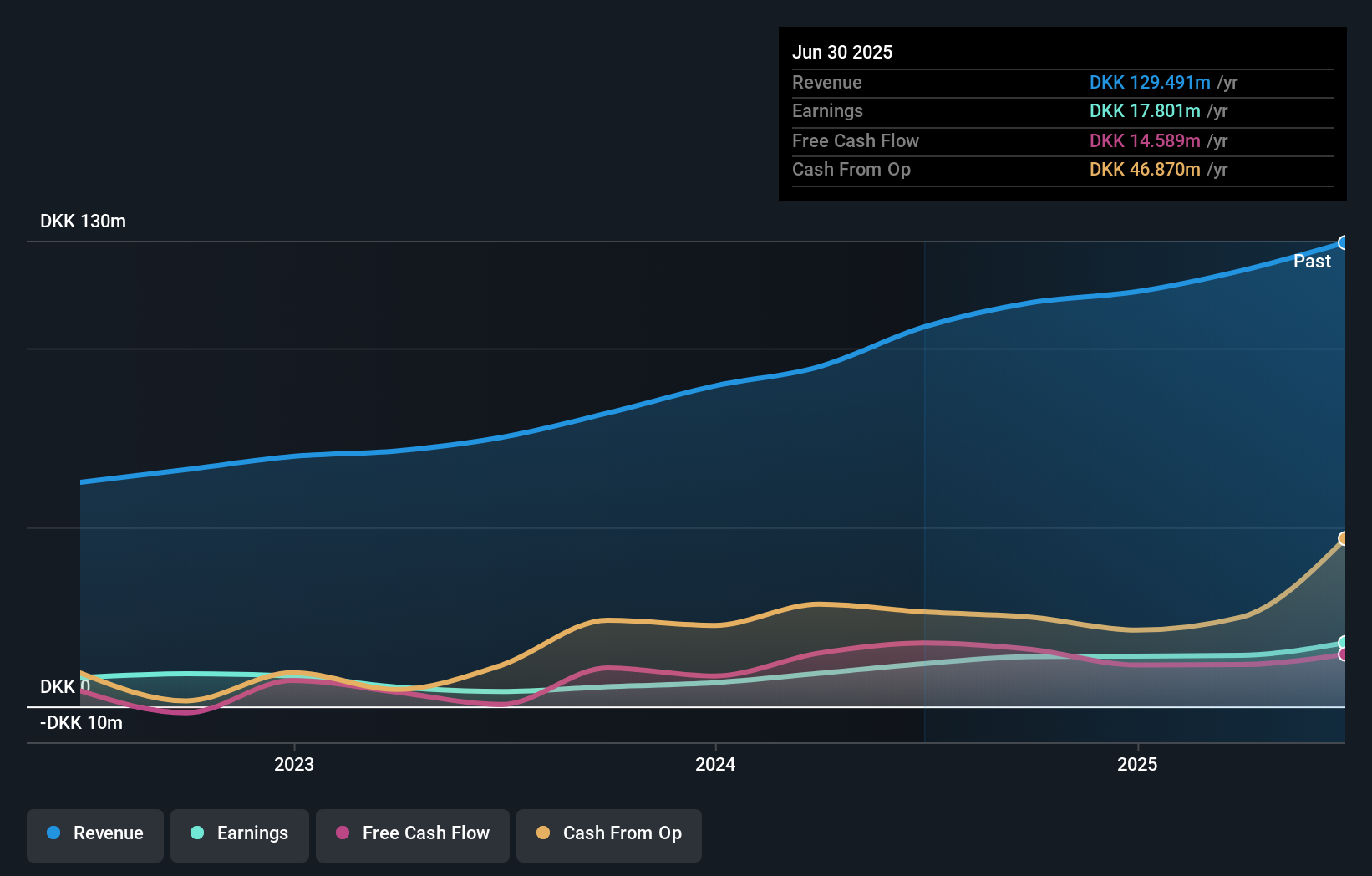

Freetrailer Group (DB:R0C)

Simply Wall St Value Rating: ★★★★★☆

Overview: Freetrailer Group A/S is a trailer rental company operating in Denmark, Sweden, Germany, and Norway with a market cap of €688.16 million.

Operations: Freetrailer Group generates revenue primarily from its Software & Programming segment, amounting to DKK 129.49 million.

Freetrailer Group, a nimble player in the European market, has shown impressive growth with earnings up 48.9% over the past year. The company is trading at a significant discount of 74.4% below its estimated fair value, offering potential upside for investors. Recent strategic agreements have bolstered its presence in the Netherlands and Sweden, enhancing its market footprint with partnerships like Het Goed and Mio stores. With a robust buyback program completed this year involving 248,498 shares for DKK 20 million and net income rising to DKK 17.8 million from DKK 11.96 million last year, Freetrailer is on an upward trajectory.

Seize The Opportunity

- Delve into our full catalog of 323 European Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:R0C

Freetrailer Group

Operates as a trailer rental company in Denmark, Sweden, Germany, and Norway.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives