Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, the ROCE of Logwin (ETR:TGHN) looks decent, right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Logwin is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = €48m ÷ (€574m - €249m) (Based on the trailing twelve months to December 2020).

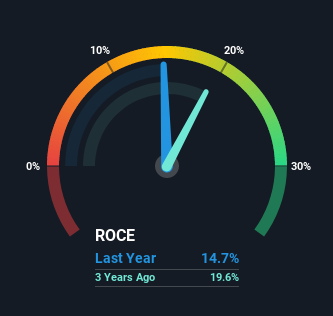

Thus, Logwin has an ROCE of 15%. On its own, that's a standard return, however it's much better than the 12% generated by the Logistics industry.

View our latest analysis for Logwin

In the above chart we have measured Logwin's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Logwin.

What Can We Tell From Logwin's ROCE Trend?

While the current returns on capital are decent, they haven't changed much. The company has employed 100% more capital in the last five years, and the returns on that capital have remained stable at 15%. 15% is a pretty standard return, and it provides some comfort knowing that Logwin has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 43% of total assets, is good to see from a business owner's perspective. Effectively suppliers now fund less of the business, which can lower some elements of risk. Although because current liabilities are still 43%, some of that risk is still prevalent.

The Bottom Line

To sum it up, Logwin has simply been reinvesting capital steadily, at those decent rates of return. And the stock has followed suit returning a meaningful 85% to shareholders over the last three years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

On a final note, we've found 2 warning signs for Logwin that we think you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade Logwin, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:TGHN

Logwin

Provides logistics and transport solutions in Germany, Austria, other European countries, Asia/Pacific, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success