Amidst a backdrop of shifting market dynamics, Germany's major indices, including the DAX, have experienced notable declines in recent weeks. This trend reflects broader European economic uncertainties and fluctuating industrial output which could influence investor strategies towards smaller-cap companies. In this environment, exploring undiscovered German stocks might offer unique opportunities as investors look for potential resilience or growth away from mainstream large-cap entities.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

| IVU Traffic Technologies | NA | 9.22% | 5.72% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Eisen- und Hüttenwerke | NA | -14.56% | 7.71% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

| HOMAG Group | NA | -27.42% | 22.33% | ★★★★★☆ |

| centrotherm international | 20.54% | 8.23% | 54.11% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| EUWAX | 4.67% | -5.08% | 433.28% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE operates globally, specializing in the manufacturing and distribution of isotope technology components used in medical, scientific, and industrial sectors, with a market capitalization of approximately €939.71 million.

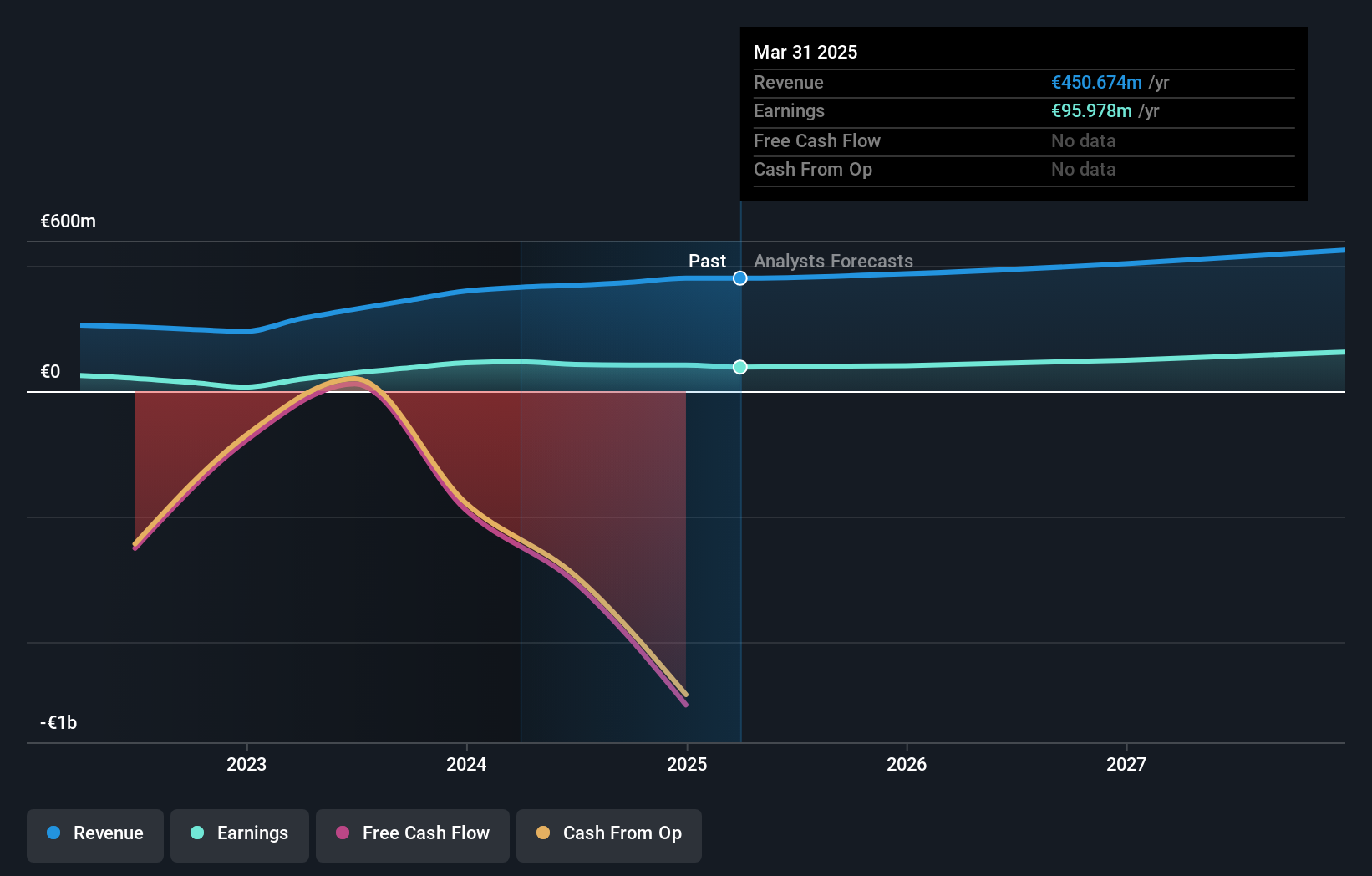

Operations: The company generates revenue through its Medical and Isotopes Products segments, with notable figures of €126.13 million and €140.75 million respectively. It achieves a net income margin of 13.24% as of the latest reporting period in 2024, reflecting its profitability from these operations.

Eckert & Ziegler, a notable player in the Medical Equipment sector, has demonstrated robust financial health and growth potential. With earnings growth of 14.7% this past year, surpassing the industry's decline of 6.1%, and a forecasted annual earnings increase of 6.7%, the company shows promise. Its debt-to-equity ratio improved from 14.9% to 10.6% over five years, indicating strong financial management. Additionally, its first-quarter sales surged to €67 million from €58 million year-over-year, coupled with a net income rise to €8 million from €5 million, underscoring its upward trajectory and operational efficiency.

- Click here and access our complete health analysis report to understand the dynamics of Eckert & Ziegler.

Understand Eckert & Ziegler's track record by examining our Past report.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: ProCredit Holding AG operates as a commercial bank offering services to small and medium enterprises and private customers across Europe, South America, and Germany, with a market cap of €518.31 million.

Operations: ProCredit Holding primarily operates in the banking sector, generating a consistent revenue stream through financial services as indicated by its latest reported revenue of €414.42 million. The company has maintained a high gross profit margin at 100%, reflecting efficient management of operational costs and effective revenue generation strategies.

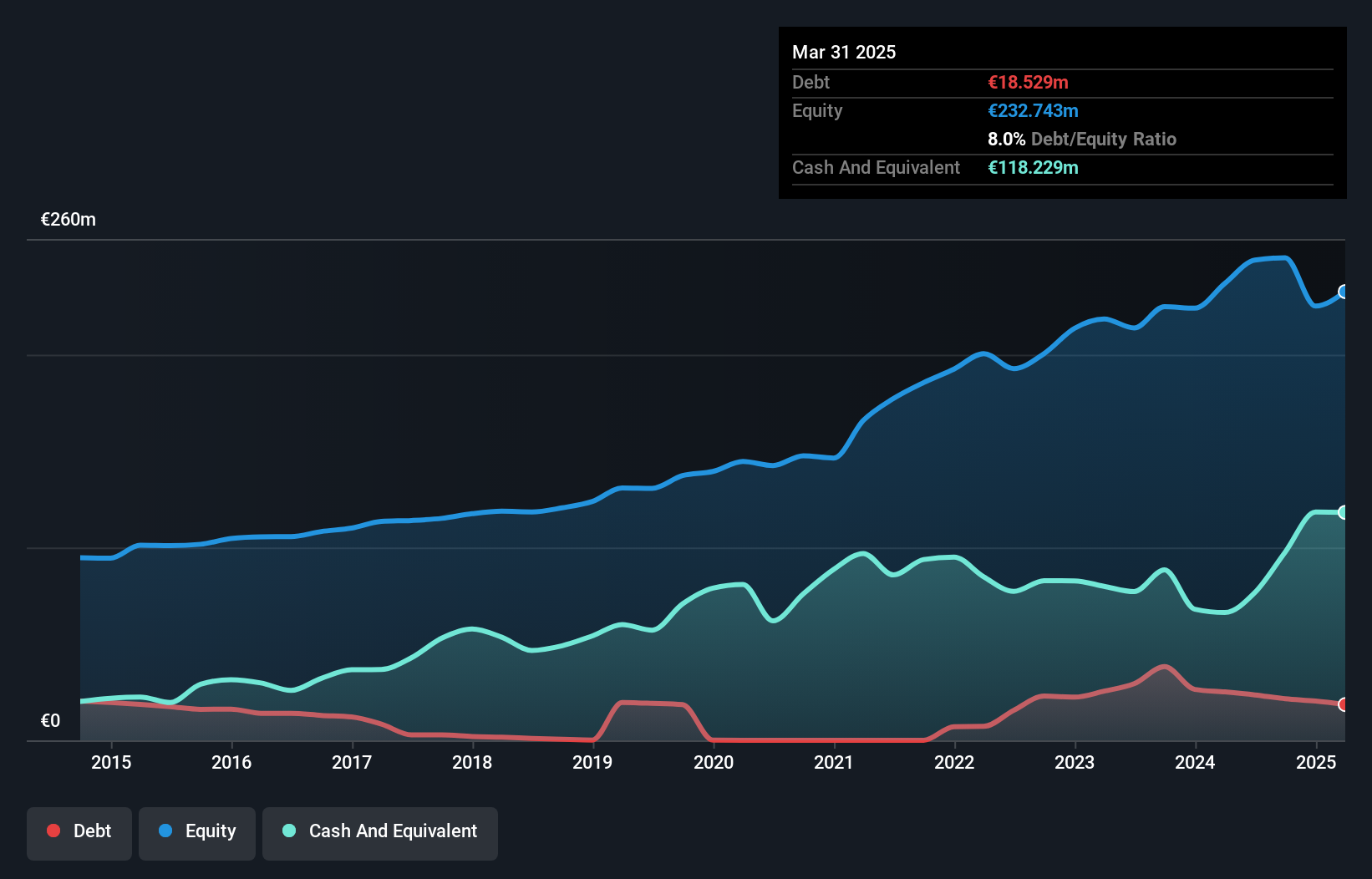

ProCredit Holding, a German financial gem, reported a robust net income of €33.5 million in Q1 2024, up from €29.5 million the previous year. With total assets of €10 billion and equity of €1 billion, this company stands out for its prudent risk management—evidenced by a bad loans ratio at 2.4% and a 119% coverage for these loans. Significantly undervalued by 65.9%, ProCredit has shown remarkable earnings growth of 146.4% over the past year, far surpassing its industry's average growth rate of 20.6%.

- Click to explore a detailed breakdown of our findings in ProCredit Holding's health report.

Assess ProCredit Holding's past performance with our detailed historical performance reports.

Logwin (XTRA:TGHN)

Simply Wall St Value Rating: ★★★★★★

Overview: Logwin AG is a global logistics and transport solutions provider operating in Germany, Austria, other European countries, Asia/Pacific, and internationally with a market capitalization of €754.35 million.

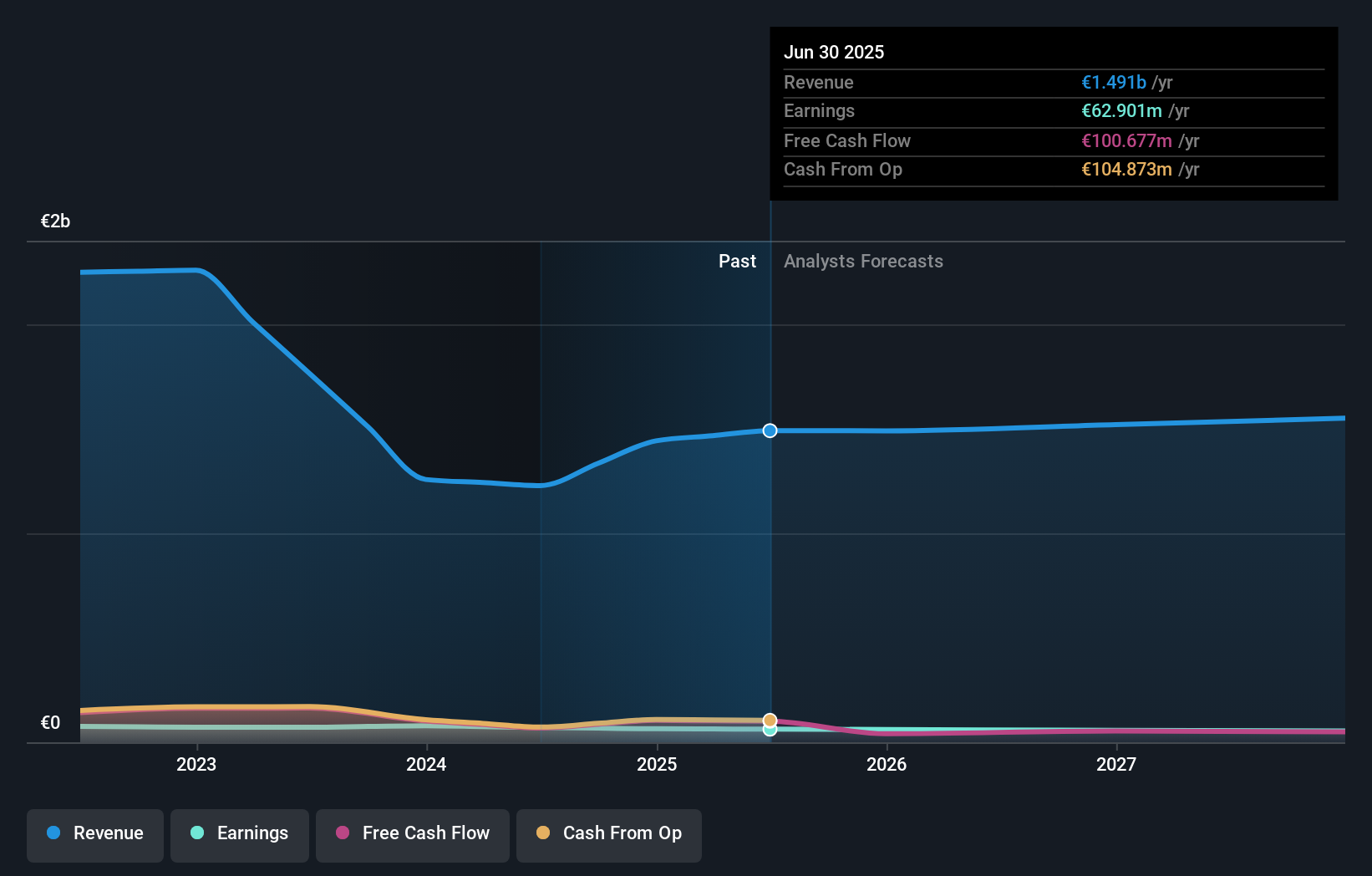

Operations: Logwin generates its revenue primarily through three segments: Solutions, Air + Ocean, and Consolidation. The company's largest revenue contributor is the Air + Ocean segment, which brought in €917.24 million, followed by the Solutions segment with €341.85 million. Despite fluctuations in net income over the years, Logwin has seen a recent upward trend in gross profit margins, reaching 13.11% as of the latest reported period in 2023.

Logwin, a lesser-discussed player in the logistics sector, has shown promising financial health with earnings growth of 9.7% last year, surpassing its industry's 9.4%. Despite a forecasted average earnings decline of 13.7% annually over the next three years, it remains appealing due to its positive free cash flow and reduced debt-to-equity ratio from 0.03% to just 0.01%. Investors should note Logwin's upcoming Q1 results on April 30, which could provide further insights into its operational dynamics and future trajectory.

- Unlock comprehensive insights into our analysis of Logwin stock in this health report.

Review our historical performance report to gain insights into Logwin's's past performance.

Key Takeaways

- Embark on your investment journey to our 40 German Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PCZ

ProCredit Holding

Provides commercial banking services for small and medium enterprises and private customers in Europe, South America, and Germany.

Very undervalued with solid track record and pays a dividend.