Stock Analysis

- Germany

- /

- Transportation

- /

- XTRA:SIX2

Even though Sixt (ETR:SIX2) has lost €183m market cap in last 7 days, shareholders are still up 31% over 3 years

Sixt SE (ETR:SIX2) shareholders might be concerned after seeing the share price drop 20% in the last quarter. But over three years, the returns would have left most investors smiling In fact, the company's share price bested the return of its market index in that time, posting a gain of 21%.

Although Sixt has shed €183m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Sixt

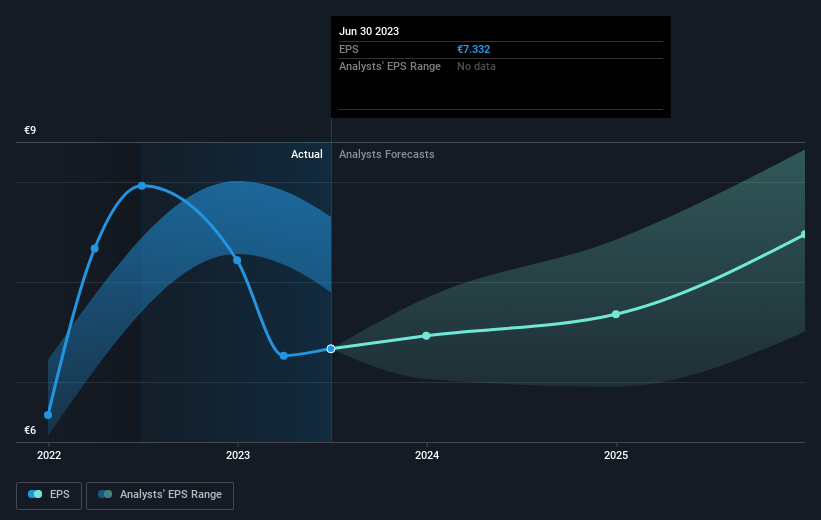

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Sixt became profitable within the last three years. So we would expect a higher share price over the period.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Sixt has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Sixt's TSR for the last 3 years was 31%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Sixt shareholders are up 2.3% for the year (even including dividends). But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 1.2% per year over five year. It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Sixt (including 2 which are a bit unpleasant) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Sixt is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SIX2

Sixt

Sixt SE, through its subsidiaries, provides mobility services through corporate and franchise station network for private and business customers worldwide.

Good value with adequate balance sheet.