- Germany

- /

- Marine and Shipping

- /

- XTRA:HLAG

With EPS Growth And More, Hapag-Lloyd (ETR:HLAG) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Hapag-Lloyd (ETR:HLAG), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hapag-Lloyd with the means to add long-term value to shareholders.

Check out the opportunities and risks within the XX Shipping industry.

Hapag-Lloyd's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Hapag-Lloyd to have grown EPS from €19.16 to €85.35 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

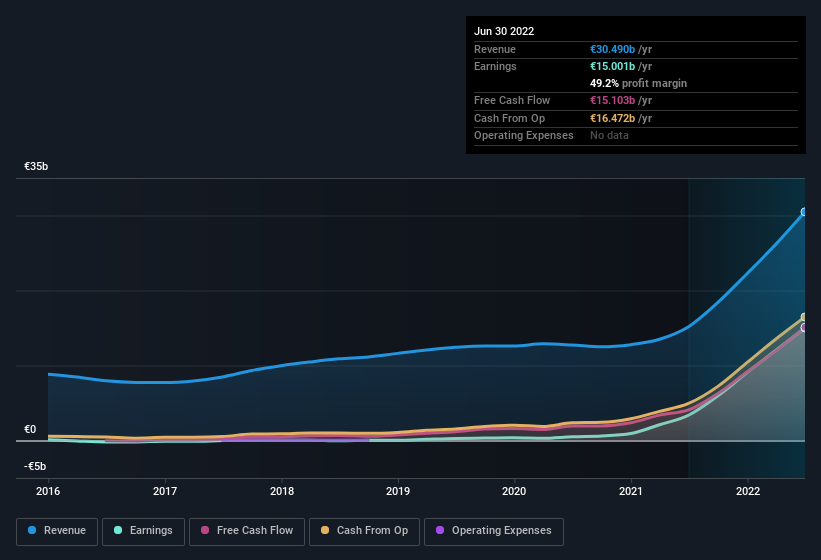

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Hapag-Lloyd shareholders can take confidence from the fact that EBIT margins are up from 25% to 51%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Hapag-Lloyd?

Are Hapag-Lloyd Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations over €7.9b, like Hapag-Lloyd, the median CEO pay is around €5.3m.

Hapag-Lloyd's CEO took home a total compensation package worth €2.9m in the year leading up to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Hapag-Lloyd To Your Watchlist?

Hapag-Lloyd's earnings per share growth have been climbing higher at an appreciable rate. This appreciable increase in earnings could be a sign of an upward trajectory for the company. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. It will definitely require further research to be sure, but it does seem that Hapag-Lloyd has the hallmarks of a quality business; and that would make it well worth watching. You should always think about risks though. Case in point, we've spotted 3 warning signs for Hapag-Lloyd you should be aware of, and 1 of them makes us a bit uncomfortable.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hapag-Lloyd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HLAG

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives