- Germany

- /

- Marine and Shipping

- /

- XTRA:HLAG

Investing in Hapag-Lloyd (ETR:HLAG) five years ago would have delivered you a 694% gain

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. To wit, the Hapag-Lloyd Aktiengesellschaft (ETR:HLAG) share price has soared 437% over five years. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 20% over the last quarter.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for Hapag-Lloyd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

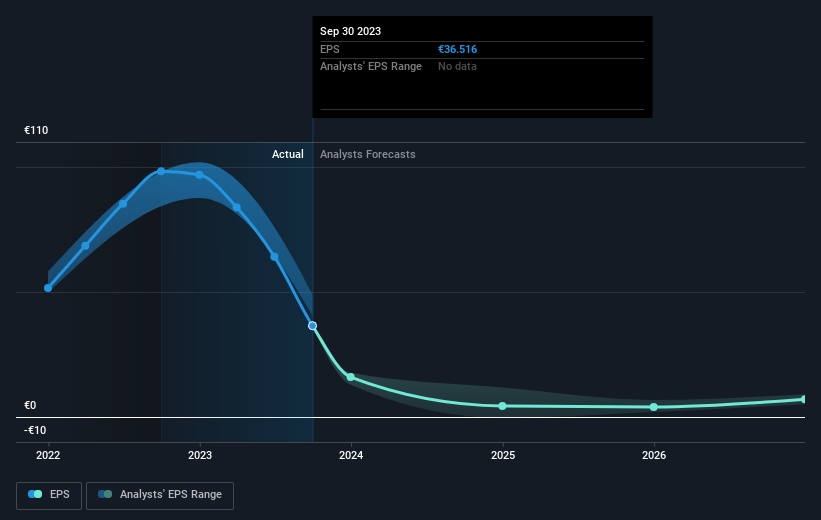

Over half a decade, Hapag-Lloyd managed to grow its earnings per share at 201% a year. This EPS growth is higher than the 40% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock. The reasonably low P/E ratio of 3.61 also suggests market apprehension.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Hapag-Lloyd has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Hapag-Lloyd's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Hapag-Lloyd, it has a TSR of 694% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Hapag-Lloyd had a tough year, with a total loss of 40% (including dividends), against a market gain of about 4.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 51%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Hapag-Lloyd (of which 2 are potentially serious!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hapag-Lloyd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HLAG

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026