- Germany

- /

- Marine and Shipping

- /

- XTRA:HLAG

Hapag-Lloyd (XTRA:HLAG): A Fresh Look at Valuation After 28.9% Year-to-Date Share Price Drop

Reviewed by Simply Wall St

See our latest analysis for Hapag-Lloyd.

Hapag-Lloyd's share price has slipped 28.9% year-to-date, reflecting recent pressure in shipping rates and investor sentiment. A 5-year total shareholder return of 213% highlights the company’s long-term ability to generate value. Momentum has softened for now as the market searches for fresh catalysts and sorts through sector volatility.

If you’re tracking trends in transport, this could be the perfect moment to branch out and discover fast growing stocks with high insider ownership

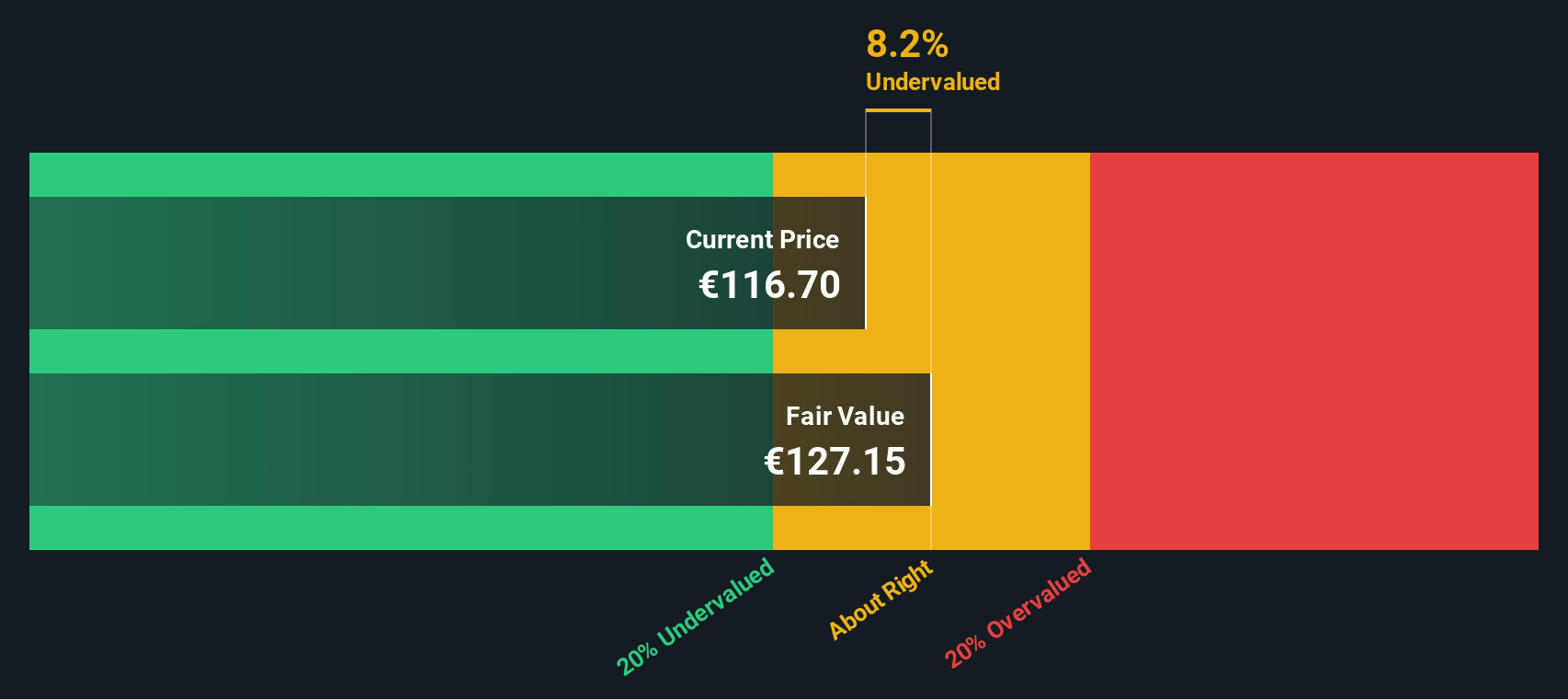

With the share price down this year but trading above analyst price targets, it raises the question: is Hapag-Lloyd undervalued right now, or is the market already factoring in the company’s growth outlook?

Most Popular Narrative: 10% Overvalued

With Hapag-Lloyd’s last close at €115.40 and the narrative’s fair value estimate landing at €104.91, this perspective suggests current prices are a stretch above analyst expectations for the business. This viewpoint is shaping sentiment among market watchers.

There is optimism around Hapag-Lloyd's fleet investments and efficiency gains, but the company's comments on transitional and inflation-driven cost increases, as well as the limits of their $1 billion cost savings program, suggest structurally higher unit costs from environmental compliance, fuel, and operational complexity. These factors may weigh on net margins in future periods.

What’s behind this valuation call? Unpack just how much future profitability rides on lower costs and operational upgrades. The most aggressive revenue and margin forecasts, along with bold assumptions about capital allocation, form the core of this narrative. Find out what could make or break analyst consensus by diving deeper.

Result: Fair Value of €104.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust global trade or rapid success with Hapag-Lloyd’s efficiency upgrades could quickly turn sentiment and challenge the current consensus.

Find out about the key risks to this Hapag-Lloyd narrative.

Another View: DCF Model Suggests Opportunity

While analysts see Hapag-Lloyd as overvalued based on consensus price targets, our SWS DCF model points in a different direction. According to this method, shares are trading about 17.7% below their estimated fair value of €140.13. Could the market be undervaluing longer-term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hapag-Lloyd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hapag-Lloyd Narrative

Keep in mind, if this perspective doesn't align with yours or you’re eager to dig into the numbers yourself, it’s simple and quick to shape your own narrative in just a few minutes. Do it your way

A great starting point for your Hapag-Lloyd research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stop at one stock? Unearth opportunities that match your strategy by checking out these hand-picked stock screens before the market moves ahead of you.

- Unlock growth with these 26 AI penny stocks shaping artificial intelligence across industries and setting the pace for tomorrow’s innovations.

- Benefit from steady income streams by targeting these 15 dividend stocks with yields > 3% offering yields above 3% for a reliable return on your investment.

- Capitalize on overlooked potential by targeting these 876 undervalued stocks based on cash flows primed for strong future cash flows and hidden value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hapag-Lloyd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HLAG

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives