- Germany

- /

- Marine and Shipping

- /

- XTRA:HLAG

Announcing: Hapag-Lloyd (ETR:HLAG) Stock Increased An Energizing 196% In The Last Year

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example Hapag-Lloyd Aktiengesellschaft (ETR:HLAG). Its share price is already up an impressive 196% in the last twelve months. Looking back further, the stock price is 143% higher than it was three years ago.

See our latest analysis for Hapag-Lloyd

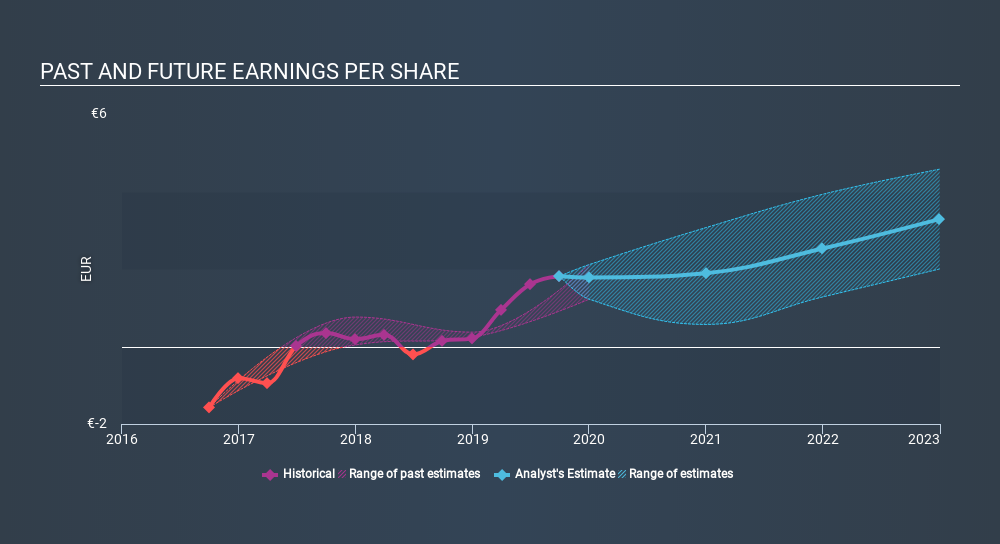

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Hapag-Lloyd saw its earnings per share (EPS) increase strongly. This remarkable growth rate may not be sustainable, but it is still impressive. We are not surprised the share price is up. To us, inflection points like this are the best time to take a close look at a stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Hapag-Lloyd's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Hapag-Lloyd's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Hapag-Lloyd's TSR of 198% for the year exceeded its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that Hapag-Lloyd shareholders have gained 198% (in total) over the last year. That includes the value of the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 36%. Given the track record of solid returns over varying time frames, it might be worth putting Hapag-Lloyd on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Hapag-Lloyd you should know about.

But note: Hapag-Lloyd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:HLAG

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives