- Germany

- /

- Infrastructure

- /

- XTRA:HHFA

Sentiment Still Eluding Hamburger Hafen und Logistik Aktiengesellschaft (ETR:HHFA)

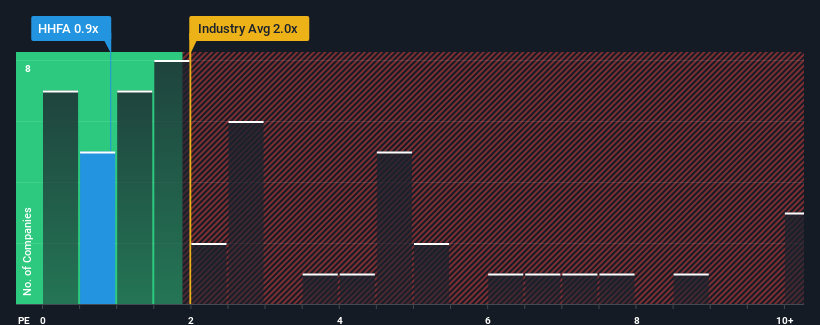

With a price-to-sales (or "P/S") ratio of 0.9x Hamburger Hafen und Logistik Aktiengesellschaft (ETR:HHFA) may be sending bullish signals at the moment, given that almost half of all the Infrastructure companies in Germany have P/S ratios greater than 2x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Hamburger Hafen und Logistik

How Has Hamburger Hafen und Logistik Performed Recently?

Hamburger Hafen und Logistik hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Hamburger Hafen und Logistik's future stacks up against the industry? In that case, our free report is a great place to start.How Is Hamburger Hafen und Logistik's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Hamburger Hafen und Logistik's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.7%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 5.4% each year as estimated by the dual analysts watching the company. With the industry predicted to deliver 3.8% growth per annum, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Hamburger Hafen und Logistik's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Hamburger Hafen und Logistik remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Hamburger Hafen und Logistik that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hamburger Hafen und Logistik might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HHFA

Hamburger Hafen und Logistik

Operates as a port and transport logistics company in Germany, rest of European Union, and internationally.

Proven track record with very low risk.

Market Insights

Community Narratives