Deutsche Post (ETR:DPW) Has A Somewhat Strained Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Deutsche Post AG (ETR:DPW) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View 2 warning signs we detected for Deutsche Post

What Is Deutsche Post's Net Debt?

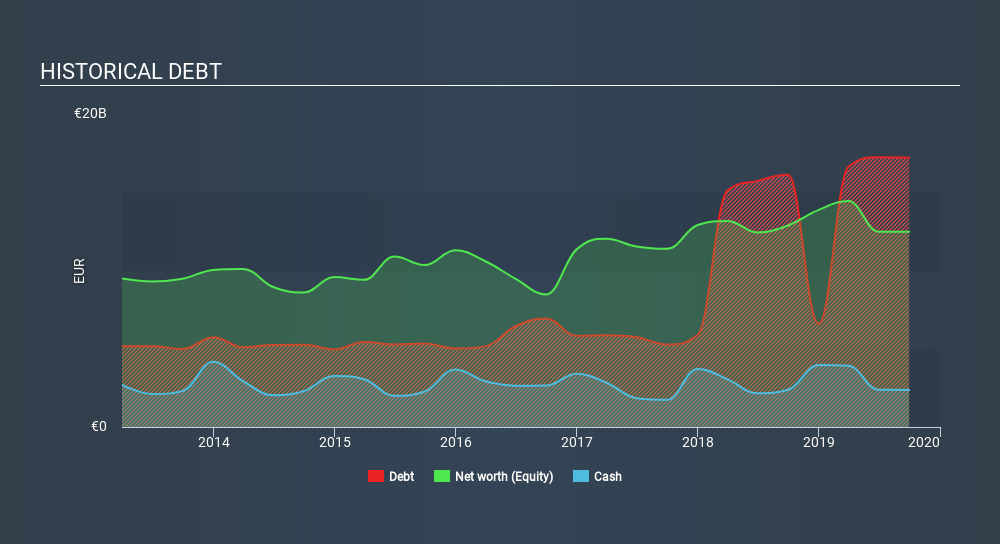

The image below, which you can click on for greater detail, shows that at September 2019 Deutsche Post had debt of €7.36b, up from €16.1k in one year. On the flip side, it has €2.37b in cash leading to net debt of about €4.99b.

How Strong Is Deutsche Post's Balance Sheet?

We can see from the most recent balance sheet that Deutsche Post had liabilities of €16.5b falling due within a year, and liabilities of €22.0b due beyond that. Offsetting these obligations, it had cash of €2.37b as well as receivables valued at €8.75b due within 12 months. So it has liabilities totalling €27.3b more than its cash and near-term receivables, combined.

This is a mountain of leverage even relative to its gargantuan market capitalization of €42.0b. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 1.1 and interest cover of 5.7 times, it seems to us that Deutsche Post is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Sadly, Deutsche Post's EBIT actually dropped 9.1% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Deutsche Post which any shareholder or potential investor should be aware of.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Deutsche Post produced sturdy free cash flow equating to 65% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Even if we have reservations about how easily Deutsche Post is capable of (not) growing its EBIT, its conversion of EBIT to free cash flow and net debt to EBITDA make us think feel relatively unconcerned. Looking at all the angles mentioned above, it does seem to us that Deutsche Post is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Deutsche Post's dividend history, without delay!

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:DHL

Deutsche Post

Operates as a mail and logistics company in Germany, rest of Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion