- Germany

- /

- Telecom Services and Carriers

- /

- DB:UTDI

Some United Internet (FRA:UTDI) Shareholders Are Down 42%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by United Internet AG (FRA:UTDI) shareholders over the last year, as the share price declined 42%. That's disappointing when you consider the market returned -1.0%. However, the longer term returns haven't been so bad, with the stock down 23% in the last three years. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days.

Check out our latest analysis for United Internet

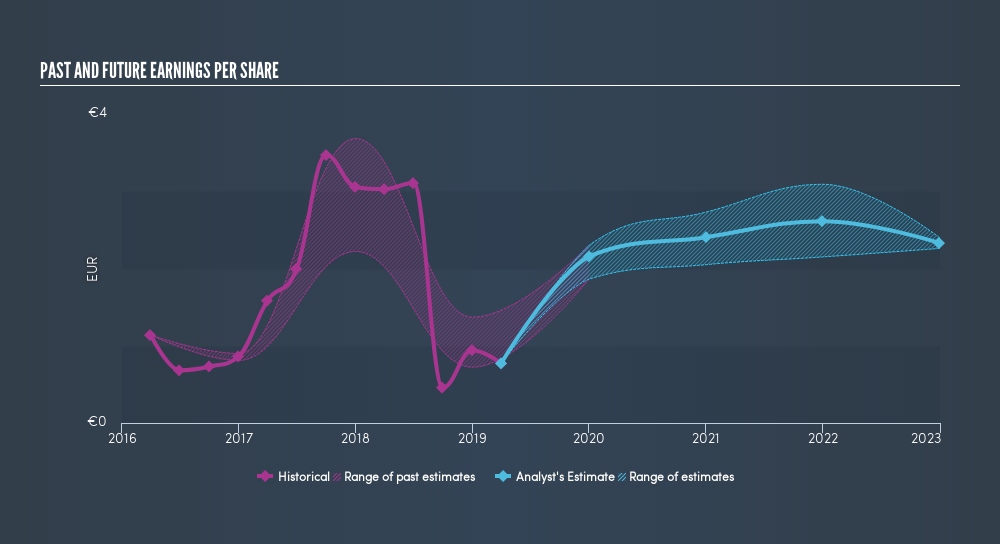

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately United Internet reported an EPS drop of 75% for the last year. The share price fall of 42% isn't as bad as the reduction in earnings per share. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

Dive deeper into United Internet's key metrics by checking this interactive graph of United Internet's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between United Internet's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that United Internet's TSR, which was a 42% drop over the last year, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 1.0% in the twelve months, United Internet shareholders did even worse, losing 42% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.8% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Importantly, we haven't analysed United Internet's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:UTDI

United Internet

Through its subsidiaries, operates as an Internet service provider worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives