- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:E4C

Shareholders Can Be Confident That ecotel communication ag's (ETR:E4C) Earnings Are High Quality

The subdued stock price reaction suggests that ecotel communication ag's (ETR:E4C) strong earnings didn't offer any surprises. Our analysis suggests that investors might be missing some promising details.

View our latest analysis for ecotel communication ag

Zooming In On ecotel communication ag's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

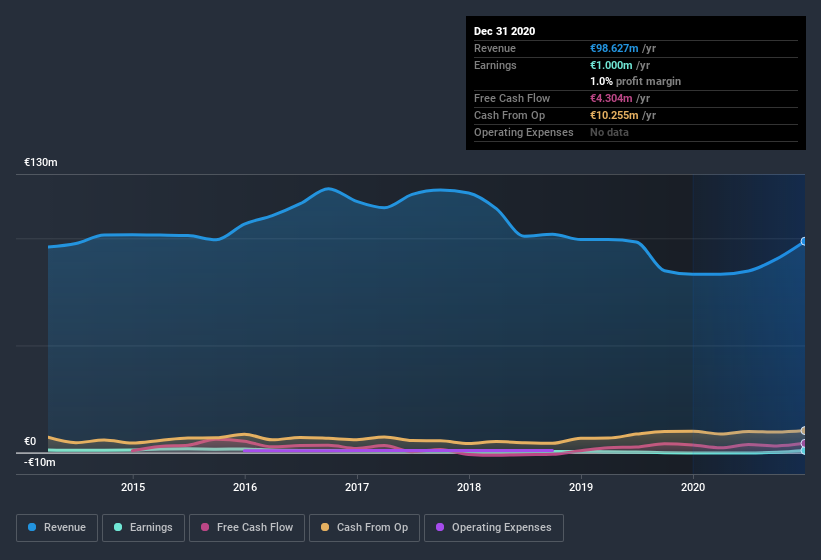

ecotel communication ag has an accrual ratio of -0.16 for the year to December 2020. Therefore, its statutory earnings were very significantly less than its free cashflow. In fact, it had free cash flow of €4.3m in the last year, which was a lot more than its statutory profit of €1.00m. ecotel communication ag's free cash flow improved over the last year, which is generally good to see.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of ecotel communication ag.

Our Take On ecotel communication ag's Profit Performance

As we discussed above, ecotel communication ag has perfectly satisfactory free cash flow relative to profit. Based on this observation, we consider it likely that ecotel communication ag's statutory profit actually understates its earnings potential! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Our analysis shows 4 warning signs for ecotel communication ag (1 is concerning!) and we strongly recommend you look at these before investing.

Today we've zoomed in on a single data point to better understand the nature of ecotel communication ag's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading ecotel communication ag or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:E4C

ecotel communication ag

Provides marketing information and telecommunication solutions in Germany.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026