- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:DTE

How Investors Are Reacting to Deutsche Telekom (XTRA:DTE) Expanding Whole-Home WiFi Through Comcast Partnership

Reviewed by Sasha Jovanovic

- Comcast Technology Solutions announced a major partnership with Deutsche Telekom to deploy advanced whole-home WiFi Mesh technology across Europe, leveraging Comcast’s cloud-based platform and Deutsche Telekom’s market presence for enhanced home connectivity.

- This collaboration enables Deutsche Telekom to deliver self-optimising WiFi, backward compatibility, and continuous software updates, directly integrating advanced connectivity features into its customer experience platforms and supporting both legacy and modern infrastructure.

- We'll examine how this expanded WiFi Mesh partnership could accelerate Deutsche Telekom's digital transformation and enhance its connectivity offerings.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Deutsche Telekom Investment Narrative Recap

To have confidence as a shareholder in Deutsche Telekom, you need to believe in its capacity to transform operations through digitalization, AI, and upgrades to core connectivity in Europe, all while managing the persistent margin pressures from competition and slow revenue growth in mature markets. The recent WiFi Mesh partnership with Comcast Technology Solutions is incremental in the near term, supporting digital transformation and network quality, but does not dramatically shift the biggest short-term catalyst, successful monetization of investment in high-speed networks, or address the most immediate risk, which remains competitive pricing and customer churn in German broadband.

The September 2025 announcement on Deutsche Telekom’s collaboration with Iridium to launch global NB-IoT direct-to-device connectivity also aligns with the catalyst of benefiting from demand growth in connected devices, but its impact will likely emerge after the WiFi Mesh upgrades help consolidate Deutsche Telekom’s footprint in European homes and enhance resilience against OTT and legacy service migration.

Yet, the ongoing concern investors should closely watch involves how intensifying price competition in the German broadband market could...

Read the full narrative on Deutsche Telekom (it's free!)

Deutsche Telekom's outlook anticipates €128.8 billion in revenue and €11.8 billion in earnings by 2028. This reflects a 2.2% annual revenue growth rate, but a decrease of €0.8 billion in earnings from the current €12.6 billion.

Uncover how Deutsche Telekom's forecasts yield a €37.58 fair value, a 26% upside to its current price.

Exploring Other Perspectives

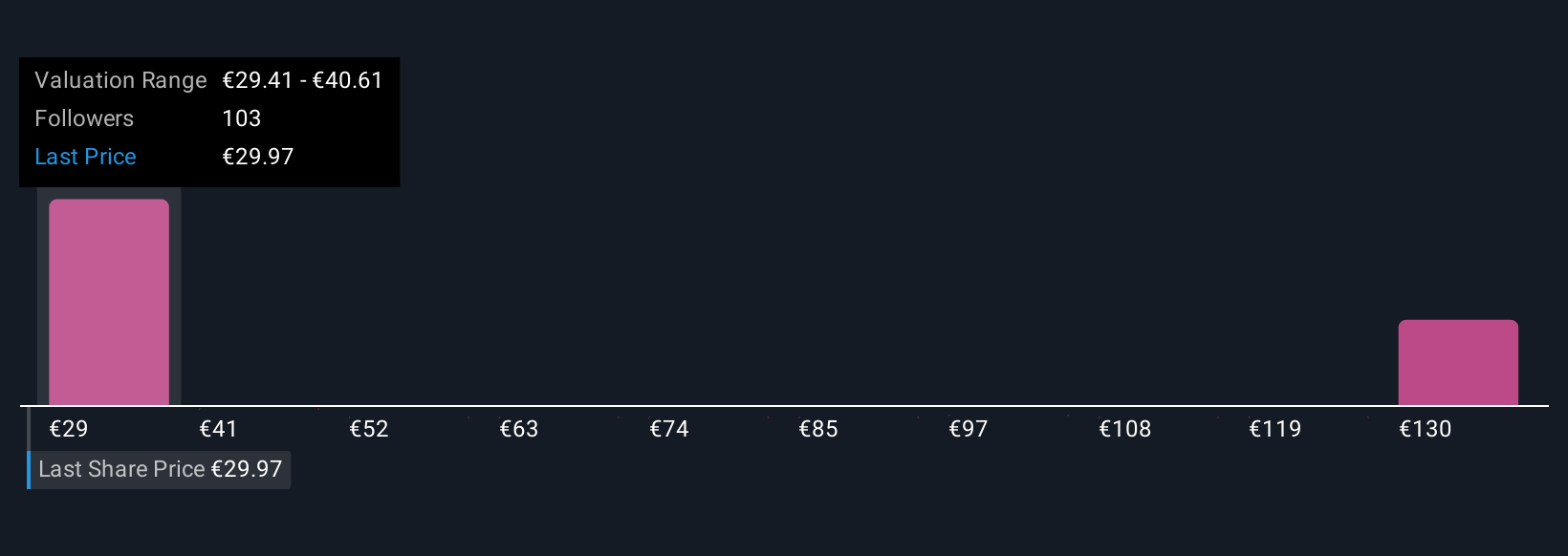

Simply Wall St Community members have published 13 unique fair value models for Deutsche Telekom, ranging from €29.26 to as high as €138.83 per share. While investor opinions span a wide margin, competitive pressure and slow revenue growth in Europe remain central issues that could influence whether the company's share price closes that gap or widens it further over time.

Explore 13 other fair value estimates on Deutsche Telekom - why the stock might be worth over 4x more than the current price!

Build Your Own Deutsche Telekom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deutsche Telekom research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deutsche Telekom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deutsche Telekom's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DTE

Deutsche Telekom

Provides integrated telecommunication services worldwide.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives