Stock Analysis

- Germany

- /

- Capital Markets

- /

- XTRA:MPCK

3 German Dividend Stocks With Yields Starting At 3.1%

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainties and fluctuating markets, Germany's DAX index recently experienced a notable decline, shedding 3.07% as investors grapple with rising U.S.-China trade tensions and mixed signals from the European Central Bank. In such an environment, dividend stocks can be appealing for their potential to provide investors with steady income streams. Understanding what makes a good dividend stock is crucial, especially in current market conditions where stability and reliable yield are prized attributes for weathering volatility.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

| INDUS Holding (XTRA:INH) | 5.38% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.79% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.35% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 7.46% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.41% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.27% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.21% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.31% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.17% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top German Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

FRoSTA (DB:NLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, specializes in developing, producing, and marketing frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market capitalization of approximately €429.19 million.

Operations: FRoSTA Aktiengesellschaft generates its revenue primarily through the development, production, and sale of frozen food products across key European markets including Germany, Poland, Austria, Italy, and Eastern Europe.

Dividend Yield: 3.2%

FRoSTA Aktiengesellschaft's dividends, with a yield of 3.17%, have shown consistency and growth over the last decade, supported by a sustainable payout ratio of 40% and a cash payout ratio of 19.3%. Despite earnings increasing by an average of 16% annually over five years, its dividend yield remains below the top quartile in the German market. The company maintains a competitive edge with a P/E ratio of 12.6x, lower than the market average. Recent financials indicate stable performance with slight fluctuations in sales and net income as of mid-2024.

- Click here to discover the nuances of FRoSTA with our detailed analytical dividend report.

- The analysis detailed in our FRoSTA valuation report hints at an inflated share price compared to its estimated value.

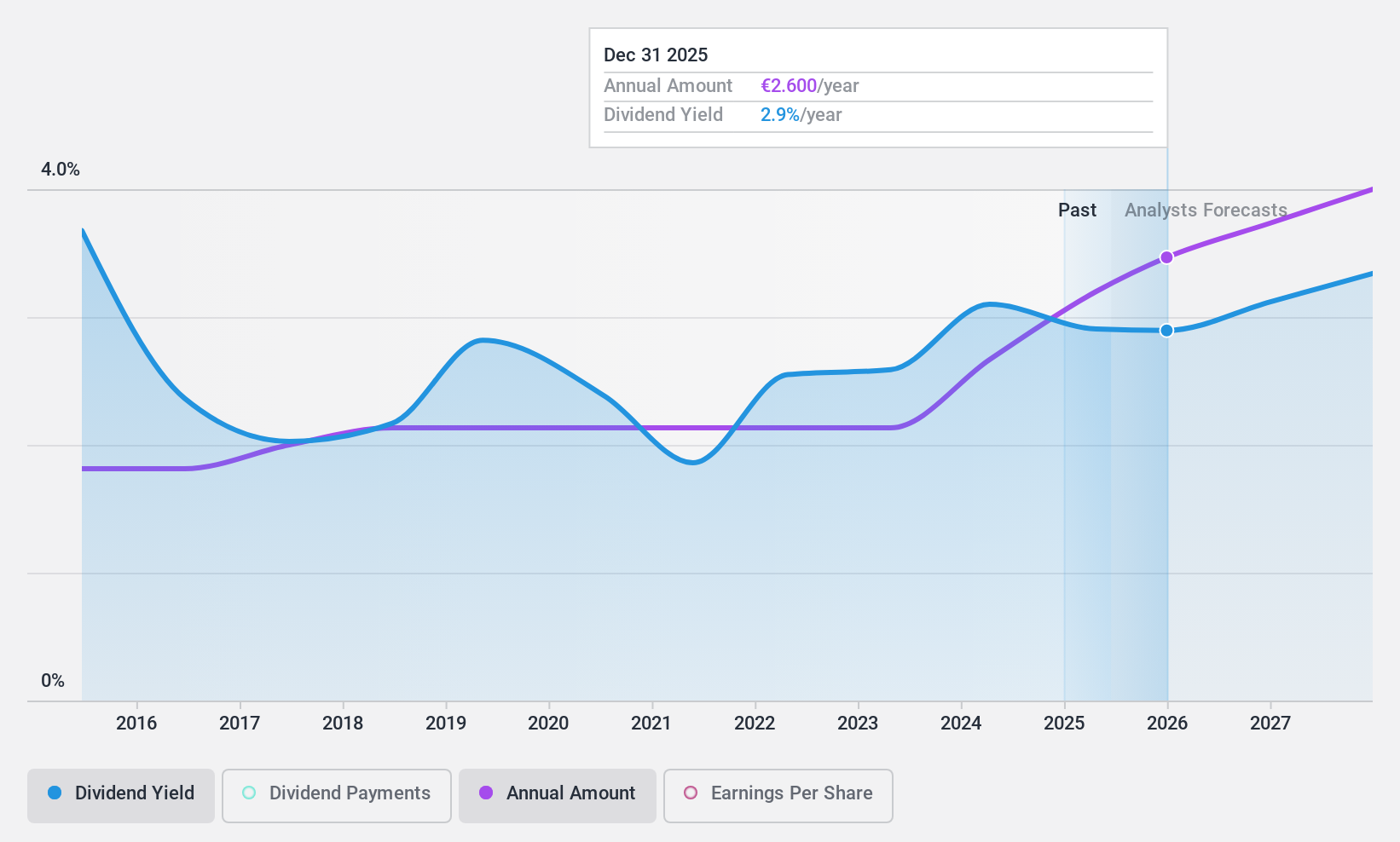

Deutsche Telekom (XTRA:DTE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Deutsche Telekom AG operates as a provider of integrated telecommunication services, with a market capitalization of approximately €118.48 billion.

Operations: Deutsche Telekom AG generates revenue primarily through its operations in the United States (€72.18 billion), Germany (€25.34 billion), Europe (€11.97 billion), along with contributions from Systems Solutions (€3.94 billion) and Group Headquarters & Group Services (€2.27 billion).

Dividend Yield: 3.2%

Deutsche Telekom has maintained stable dividends for the past decade, with a current yield of 3.21%. Despite being below the top quartile of German dividend payers, its dividends are well supported by both earnings and cash flows, with payout ratios at 87% and 19.3% respectively. Earnings are expected to grow by 21.69% annually. However, the company is trading significantly below estimated fair value and carries a high debt level, which could impact future financial flexibility. Recent activities include share buybacks totaling €700 million and presentations at major international conferences.

- Dive into the specifics of Deutsche Telekom here with our thorough dividend report.

- The analysis detailed in our Deutsche Telekom valuation report hints at an deflated share price compared to its estimated value.

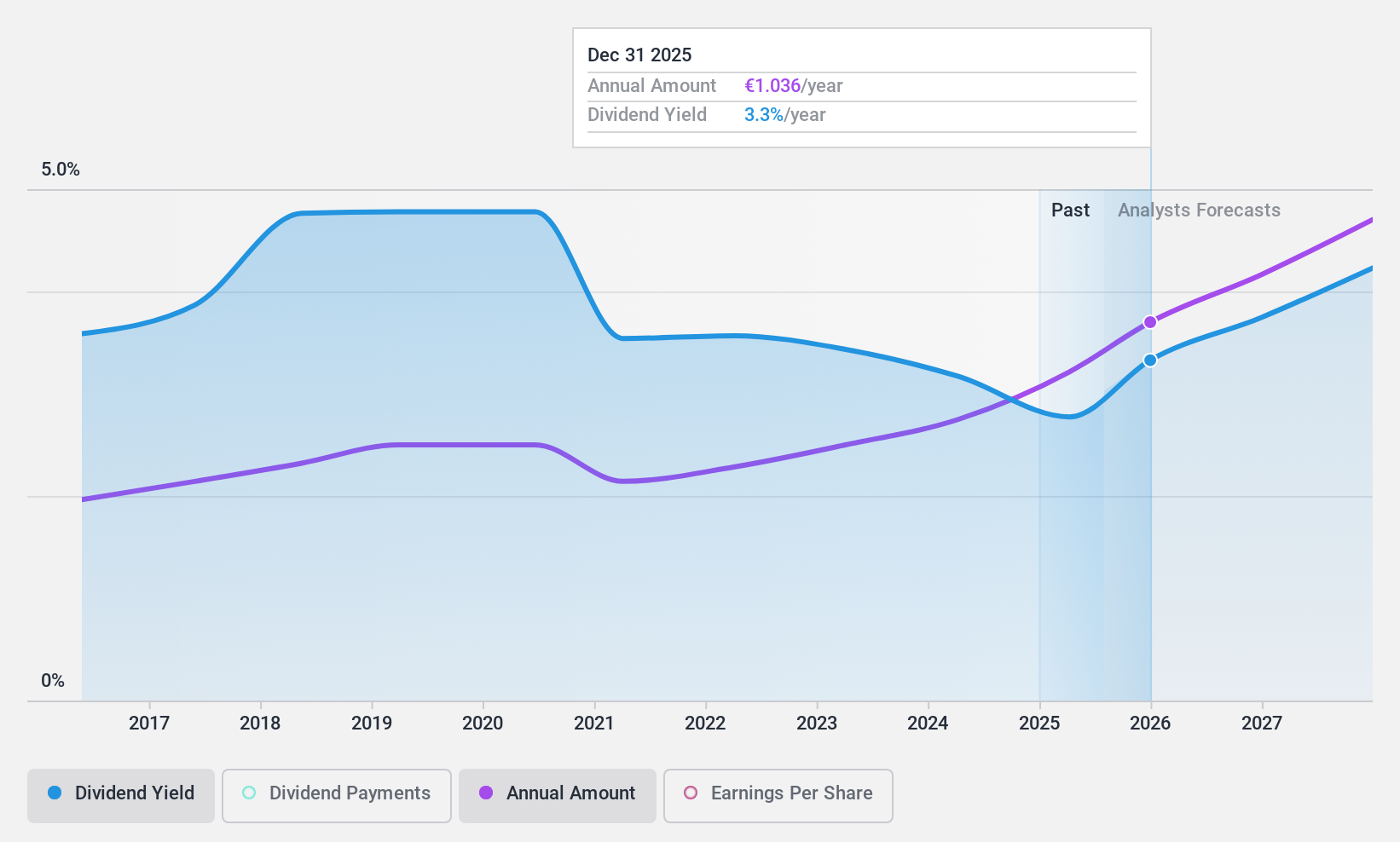

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager, operating with a market capitalization of approximately €138.88 million.

Operations: MPC Münchmeyer Petersen Capital AG generates its revenue primarily through Management Services (€30.83 million), followed by Transaction Services (€7.73 million).

Dividend Yield: 6.9%

MPC Münchmeyer Petersen Capital AG demonstrated robust growth with first-quarter sales rising to €9.6 million from €8.63 million year-over-year and net income increasing to €5.88 million from €3.72 million. Despite a short dividend history of only two years, the company's dividend yield stands at 6.85%, higher than the German market average of 4.67%. Dividends are well-supported by both earnings and cash flows with payout ratios at 72.6% and 73.6% respectively, indicating sustainability despite its relatively recent initiation into dividend payments.

- Take a closer look at MPC Münchmeyer Petersen Capital's potential here in our dividend report.

- Our valuation report here indicates MPC Münchmeyer Petersen Capital may be undervalued.

Make It Happen

- Discover the full array of 30 Top German Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MPCK

Flawless balance sheet, undervalued and pays a dividend.