- Germany

- /

- Wireless Telecom

- /

- XTRA:1U1

Can 1&1’s Steady 2025 Outlook Offset Weaker Earnings Momentum for XTRA:1U1 Investors?

Reviewed by Sasha Jovanovic

- 1&1 AG recently confirmed its full-year 2025 earnings and revenue guidance, anticipating stable service revenue and a steady contract base at the previous year’s level of €3.30 billion, despite reporting earnings for the first nine months of 2025 that showed little change in sales and a lower net income of €110.71 million.

- While the company projects stability going forward, the marked decline in net income and earnings per share compared to 2024 has drawn attention to ongoing operational pressures.

- With 1&1 maintaining its 2025 outlook despite a significant earnings dip, we'll assess how this interplay shapes the company's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

1&1 Investment Narrative Recap

To be a shareholder of 1&1 AG, you need to believe in the company's ability to manage execution risks and capital costs as it transitions toward independent network operations while contending with flat revenues and compressed margins. The recent confirmation of stable 2025 guidance, despite a sharp drop in year-on-year net income, provides little evidence that near-term operational pressures are easing. For now, this announcement does not materially change the short-term outlook: the main catalyst remains network rollout progress, and the biggest risk is persistent cost pressures from delays and dependence on roaming agreements.

Among recent announcements, the company’s reconfirmation of full-year 2025 guidance is the most relevant. By projecting service revenue and contract base stability at €3.30 billion, 1&1 is signaling confidence that contract migration and network investments are on track, even if recent sales and profit trends suggest margin headwinds remain a concern for investors focused on upcoming milestones.

But, while investors may appreciate the guidance, unresolved reliance on costly roaming could still create ripple effects that...

Read the full narrative on 1&1 (it's free!)

1&1's narrative projects €4.2 billion in revenue and €265.6 million in earnings by 2028. This requires a 1.3% yearly revenue growth and an earnings increase of €114.6 million from €151.0 million currently.

Uncover how 1&1's forecasts yield a €21.12 fair value, a 3% downside to its current price.

Exploring Other Perspectives

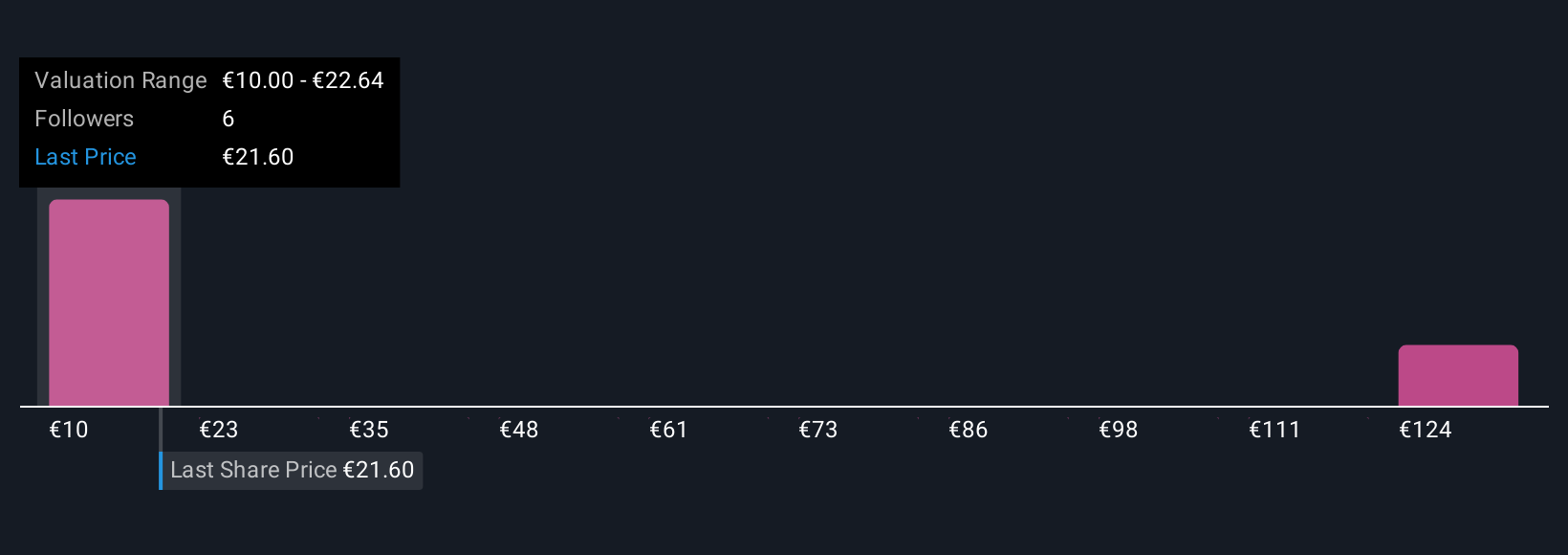

Four Simply Wall St Community members estimate fair value for 1&1 AG in a wide range from €10 to €136.37, with views clustered at various levels. With network rollout cited as the key potential catalyst, investor expectations for margin improvement could differ greatly depending on the pace and outcome of this transition.

Explore 4 other fair value estimates on 1&1 - why the stock might be worth less than half the current price!

Build Your Own 1&1 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 1&1 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free 1&1 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 1&1's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:1U1

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives