- Germany

- /

- Wireless Telecom

- /

- XTRA:1U1

1&1 AG's (ETR:1U1) Price Is Right But Growth Is Lacking After Shares Rocket 26%

The 1&1 AG (ETR:1U1) share price has done very well over the last month, posting an excellent gain of 26%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 13% over that time.

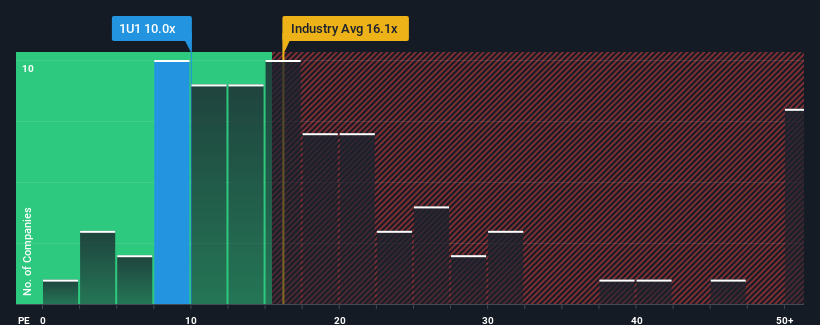

Even after such a large jump in price, 1&1's price-to-earnings (or "P/E") ratio of 10x might still make it look like a buy right now compared to the market in Germany, where around half of the companies have P/E ratios above 18x and even P/E's above 30x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, 1&1's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for 1&1

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as 1&1's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. The last three years don't look nice either as the company has shrunk EPS by 8.7% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 2.0% per annum as estimated by the eight analysts watching the company. That's not great when the rest of the market is expected to grow by 15% each year.

In light of this, it's understandable that 1&1's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From 1&1's P/E?

The latest share price surge wasn't enough to lift 1&1's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that 1&1 maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for 1&1 that you should be aware of.

If these risks are making you reconsider your opinion on 1&1, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:1U1

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion