The European market has recently shown resilience, with the STOXX Europe 600 Index rising by 1.77% as relief spread following the reopening of the U.S. federal government, although sentiment around artificial intelligence investments has tempered gains. In this environment, identifying high-growth tech stocks involves looking for companies that not only capitalize on technological advancements but also demonstrate adaptability to evolving economic conditions and investor sentiments.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 22.94% | 42.63% | ★★★★★★ |

| Hacksaw | 32.71% | 37.88% | ★★★★★★ |

| Pexip Holding | 10.67% | 22.75% | ★★★★★☆ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| Bonesupport Holding | 27.78% | 49.69% | ★★★★★★ |

| Comet Holding | 11.07% | 36.76% | ★★★★★☆ |

| CD Projekt | 35.69% | 51.01% | ★★★★★★ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 15.92% | 44.85% | ★★★★★☆ |

| Gapwaves | 41.49% | 89.60% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Stemmer Imaging (HMSE:S9I)

Simply Wall St Growth Rating: ★★★★☆☆

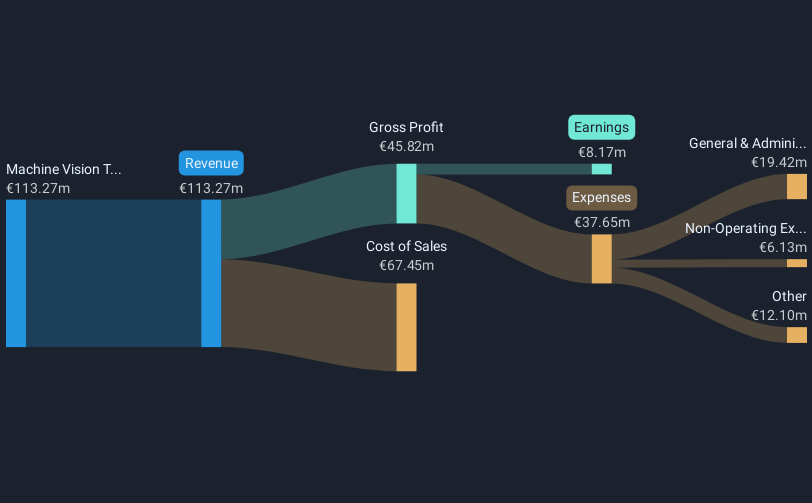

Overview: Stemmer Imaging AG specializes in providing machine vision technology for both industrial and non-industrial applications globally, with a market capitalization of €383.50 million.

Operations: Stemmer Imaging AG generates revenue primarily from its machine vision technology segment, which accounts for €102.14 million.

Stemmer Imaging, amid a challenging backdrop with a -73.4% dip in earnings last year, still projects an impressive 57.8% annual earnings growth, outpacing the German market's 16.8%. Despite this rebound, revenue growth at 16.4% annually is robust but lags behind the high-growth threshold of 20%. The firm's profit margins have contracted to 4.1% from last year’s 10.8%, reflecting operational pressures yet underscoring potential for recovery given strategic R&D investments and market positioning that aligns with evolving tech demands in Europe.

LINK Mobility Group Holding (OB:LINK)

Simply Wall St Growth Rating: ★★★★☆☆

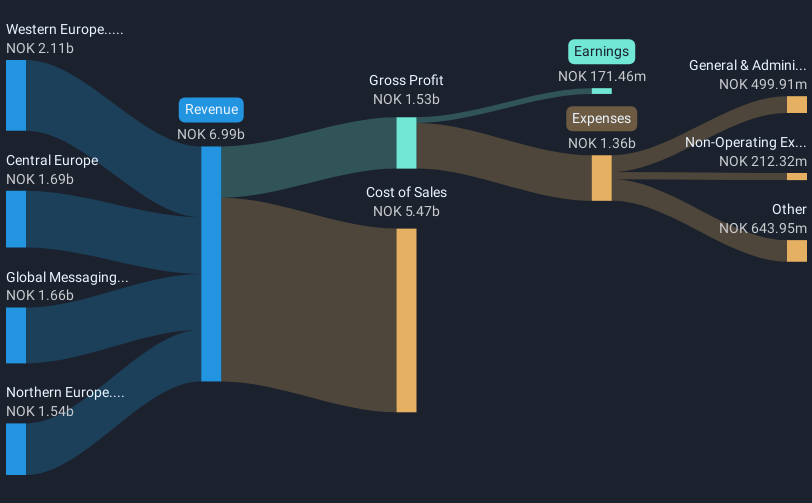

Overview: LINK Mobility Group Holding ASA, with a market cap of NOK7.86 billion, offers mobile and communication-platform-as-a-service solutions through its subsidiaries.

Operations: The company generates revenue primarily from its regional operations in Central Europe (NOK1.67 billion), Western Europe (NOK2.37 billion), and Northern Europe (NOK1.58 billion), as well as from Global Messaging services (NOK1.33 billion).

Amid a challenging landscape, LINK Mobility Group Holding ASA stands out with its strategic focus on mergers and acquisitions to bolster growth, as evidenced by recent pursuits to integrate SMSPortal's technology. This move is part of a broader strategy aimed at enhancing operational capabilities and market position in Europe. Despite recent fluctuations in financial performance, with a slight decrease in quarterly sales to NOK 1,694 million from NOK 1,657 million year-over-year and net income dropping to NOK 17.11 million from NOK 20.72 million, the company maintains an aggressive expansion posture. Notably, LINK's annual revenue growth forecast at 16.1% surpasses the Norwegian market average of 2.3%, reflecting robust sector dynamics despite current earnings challenges marked by a significant one-off loss of NOK 103.1 million affecting the last fiscal period's results.

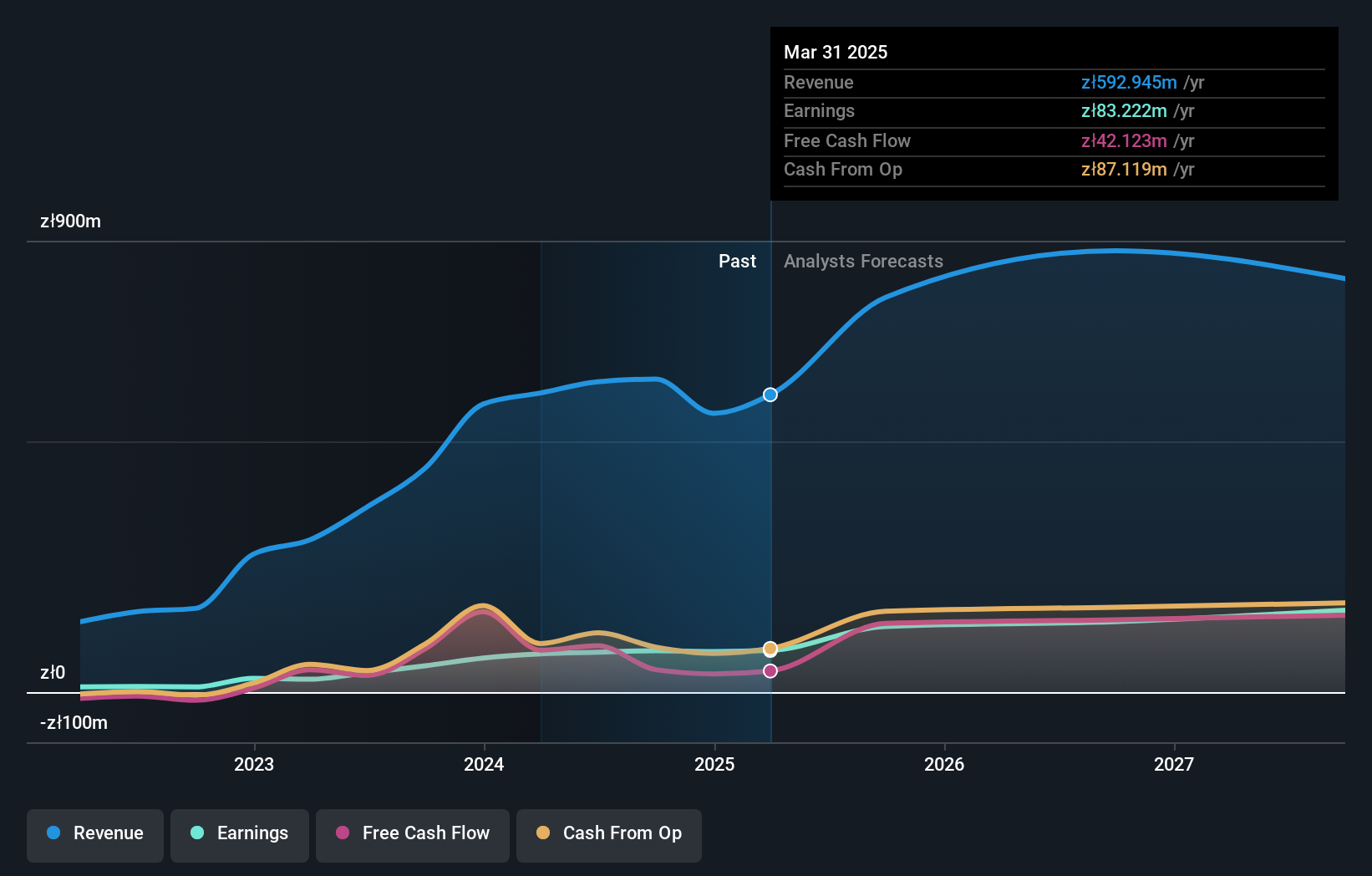

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Synektik Spólka Akcyjna is a Polish company offering products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications with a market cap of PLN2.17 billion.

Operations: Synektik Spólka Akcyjna generates revenue through its offerings in surgery, diagnostic imaging, and nuclear medicine sectors. The company focuses on providing specialized products and IT solutions tailored to medical applications in Poland.

Synektik Spólka Akcyjna, a European tech firm, recently showcased robust financial performance with full-year sales reaching PLN 681.3 million, marking a notable increase from PLN 624.12 million the previous year. This growth trajectory is complemented by an impressive surge in net income to PLN 102.19 million from PLN 82.57 million, reflecting an annualized earnings growth of approximately 25.5%. The company's commitment to innovation is evident in its R&D investments which are pivotal for maintaining its competitive edge in the high-tech sector. With earnings per share also climbing from PLN 9.68 to PLN 11.98, Synektik demonstrates not only resilience but also potential for sustained growth amidst dynamic market conditions.

- Take a closer look at Synektik Spólka Akcyjna's potential here in our health report.

Gain insights into Synektik Spólka Akcyjna's past trends and performance with our Past report.

Summing It All Up

- Discover the full array of 49 European High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HMSE:S9I

Stemmer Imaging

Provides machine vision technology for industry and non-industry applications worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives